Market scorecard

US markets wrapped up the week on a high note, with strong earnings and cooling inflation data propelling both major indices to new records. The S&P 500 broke 6 800 for the first time with contributions broadening beyond AI favourites to include companies like Ford (+12.2%) and Albemarle (+8.6%).

In company news, Eli Lilly is expanding its gene therapy ambitions by acquiring Adverum Biotechnologies, a biotech developing treatments for blindness. Elsewhere, Porsche posted its first quarterly loss since listing, taking a $3.6 billion hit after trimming its EV plans and due to the impact US tariffs. Lastly, Ford shares jumped the most in over five years after saying that production of its best-selling F-150 pickup will rebound next year, recovering from a supplier fire that temporarily halted output.

On Friday, the JSE All-share closed down 0.27%, but the S&P 500 rallied 0.79%, and the Nasdaq trotted 1.15% higher. Super!

Our 10c worth

One thing, from Paul

AI is so advanced that it can now lose money just like a human trader. Someone gave ChatGPT $10 000 of real money to trade crypto, and it made 42 losing trades out of 44 and ended up down $7 200 in one week.

Even more amusing was the explanations it gave for its next steps: "Despite a significant overall loss of -72.12%, I'm holding steady with my ETH, SOL, XRP, BTC, DOGE and BNB positions, using leverage to try and claw back ground".

Short-term share price movements are random and unpredictable. The prospect of making money with your bottom planted in a comfy office chair is very alluring; no wonder so many people want to give day trading a go. It's all been tried - charts, formulas, computers, resulting in varying degrees of failure.

Insider trading on material non-public information from company executives still works (sometimes) but that's illegal.

What's the point of my Monday missive? Just accumulate quality holdings and never trade. Over longer time periods, stocks go up or down based on earnings, sectoral developments and general economic conditions, so it's easier to have a workable theory about what may happen, and buy some company shares and avoid some others.

Byron's beats

There's a lot of talk about investing in developing markets at the moment because many of those exchanges have done very well this year. Some are even suggesting that this is the beginning of the end for US market dominance.

This is a classic case of recency bias. The S&P 500 has outperformed the MSCI world index ex-USA for the last 16 years. A few years of underperformance here and there is perfectly normal. Remember that many markets around the world are growing off a much lower base. Ours here in South Africa was a serial under-performer since 2016, but has had a good run lately.

So far this year, international stocks are up 27.5% and US stocks are up 15.5%. But US stocks were up 24% in 2024 and international stocks were only up 4.7%. A 15.5% gain after such a strong year is a huge win. So don't get developing-market FOMO, just keep your eyes on the prize.

Michael's musings

Last week, another Chinese car brand announced that it's launching in South Africa. State-owned carmaker Changan plans to open 25 dealerships by the end of the year, with a further 20 to follow over the next two years.

The success of other Chinese car brands has shown that South Africans are open to buying cars from these newcomers, so it makes sense that more brands want to get a foothold. Recent results from JSE-listed CMH noted that nearly 50% of their sales are of Indian and Chinese cars.

Buying a car is only a small part of vehicle ownership. After-sales service is arguably the most important aspect. The new brands are untested, and some of the longstanding brands in decline are running out of money to offer decent service levels.

If we fast-forward ten years, I doubt that all the car brands currently in South Africa will still be here. Some of these newly-launched ones won't get the required critical mass of customers and will need to head home. Some longstanding brands might need to pack up too.

Bright's banter

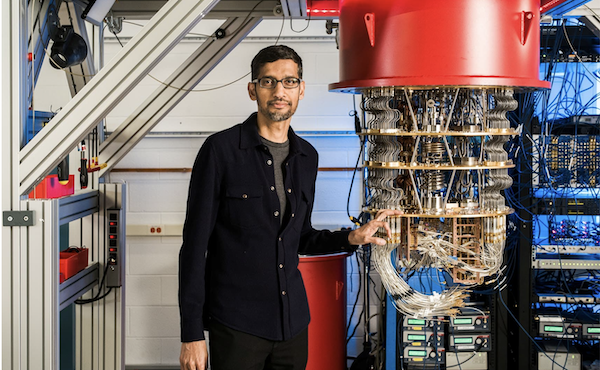

A client recently asked about quantum computing after watching an interview with Google's Sundar Pichai. The promise of quantum computing is simple, as it refers to machines that process information using quantum bits rather than binary ones, which could eventually redefine computing power, cybersecurity, and even medicine.

The likely winners are the same companies already leading the digital era:

Google has its own quantum processor, Sycamore, and has already demonstrated "quantum supremacy".

Microsoft is developing Azure Quantum, an entire software ecosystem for developers.

Amazon's AWS Braket lets researchers experiment with quantum hardware in the cloud.

Nvidia, meanwhile, isn't building quantum chips yet but will power the hybrid systems that run them through its GPUs and CUDA Quantum platform.

Quantum computing isn't an investable theme yet, it's still in the research phase, but by owning the world's dominant platforms, our model portfolio is already positioned to benefit when the technology matures. That's what makes our strategy future-proof, as we don't need to chase the next big thing; we already own the companies that are building it.

Linkfest, lap it up

Wall Street bonuses are setting records. The average bonus size is expected to be above $250 000 for the employees of 130 New York firms - Volatility has been good for profits.

In America, armadillos are moving north. These curious creatures pose a danger to native wildlife similar to past invasive species - Armoured, hungry and hard to stop.

Signing off

Late yesterday, the US and China agreed to a framework of a trade deal ahead of the Trump-Xi meeting. As a result, Asian markets are mostly in the green this morning, with strong gains in Japan, South Korea, China, and Hong Kong.

Elsewhere, reports suggest that Xavier Milei has won a fresh mandate for the free-market policies he's pursued in Argentina, with some assistance from the US Treasury.

In local company news, Quantum Foods' shares jumped 13.6% after the poultry producer projected annual earnings up as much as 78%, driven by a rebound in its layer flock, and stronger feed and livestock sales. Cluck-cluck.

S equity futures are up strongly pre-market, so we are set for a green Monday, not a black one. The Rand is trading at around R17.22 to the US Dollar.

Lots of big companies report numbers this week. Our portfolio holdings are clustered together on Wednesday and Thursday. What fun!

Have a good week.