Market scorecard

US markets ended Thursday little changed, after a nasty rise in factory-gate inflation muddied the interest rate outlook. Even so, CME Group's FedWatch Tool still prices in a 92.6% chance of a quarter-point Fed rate cut next month. Amongst the big-caps (our favourite part of the market), Amazon, Eli Lilly and Netflix stood out.

In company news, Applied Materials, the maker of chipmaking equipment, tumbled 14% in after-hours trade after issuing a downbeat sales and profit outlook. Meanwhile, Warren Buffett's Berkshire Hathaway disclosed a new stake in UnitedHealth in Q2, sending the depressed health insurer's shares surging 10.7% post-market. The old man probably signed off on the deal, even though he's in the process of stepping down.

Izolo, the JSE All-share closed down 0.28%, the S&P 500 rose a tiny 0.03%, and the Nasdaq was dead flat.

Our 10c worth

One thing, from Paul

Ok, time for a piece of Friday advice. Here goes: you can relax about the end of the world, and just live your life.

The two most likely ways that the planet and its 8.14 billion occupants would be destroyed are an all-out nuclear war, or an asteroid strike.

The first threat can be dismissed, because although 9 countries currently have nuclear weapons, no one is going to use them, because of what they call the doctrine of "mutually assured destruction". For example, Putin knows that if he launches all the Russian ICBMs, then Moscow, St Petersburg, him, and his house in the Kremlin will all be turned into dust.

The second risk, of Earth getting hit by a giant asteroid, is a more pressing concern. The dinosaurs were wiped out 66 million years ago, when a lump of rock about 16km wide landed on the Yucatan Peninsula in Mexico.

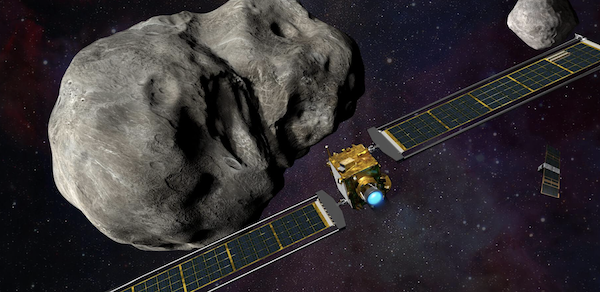

On that score, you can also relax, because there are astronomers that scan the night skies from observatories in Chile and South Africa, looking for asteroids heading our way. If any has a trajectory that puts us at risk, the plan is to send up a spacecraft to crash into it, knocking it off its course. That was already tested in 2022, when a NASA mission successfully impacted the asteroid Dimorphos.

Byron's beats

A client sent me an article this week that was published in The Economist, titled 'Palantir might be the most over-valued firm of all time'. Palantir is an interesting company but not a Vestact-recommended stock and the client does not own it, but he wanted my opinion on the article.

My immediate response was that headlines like that are aimed at getting lots of clicks. I remember about 2 years back when Nvidia was "the most expensive share ever". Then it wasn't because the earnings grew into the share price.

To be honest, I don't really take publications like The Economist seriously anymore. Journalists are usually not investors, they are professional attention seekers. I prefer Substack blogs written by people who have real skin in the game.

Sometimes the market is wrong but most of the time it is right. Who are we to say that a company is overvalued?

Fun fact. The name Palantir comes from the powerful stone that is used by the wizard Saruman in The Lord of the Rings.

Michael's musings

The weather this morning in Joburg is the best it has been in months, so I'll keep my Musings short. There is an old market saying, "insiders sell for many reasons, but they only buy for one".

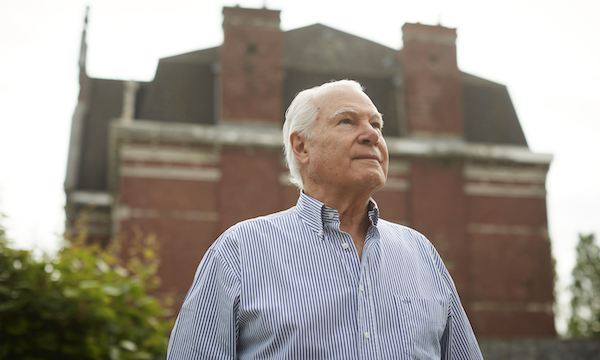

Last week, Eli Lilly released an impressive set of numbers, but disappointing drug trial data led to a tumble in the share price. The reaction from company insiders was to load up on shares worth millions, including the CEO, David Ricks (pictured below), who bought $1 million worth for himself.

When insiders are buying, it is usually worth paying attention. To us, this also looks like a good buying opportunity.

Bright's banter

In the late 1980s, Paul van Zuydam (a South African) got wind of a French cookware company called Le Creuset that was in trouble. Debt-ridden, plagued by family infighting, and facing an uncertain future, it wasn't exactly the kind of business you'd expect to become an $850 million-a-year powerhouse.

But Van Zuydam saw something others missed: a hand-crafted product with colour baked into its DNA (literally) and a production process that was as much art as it is engineering. When a deal via his then-employer fell through, he didn't walk away. He walked straight in, left his job, secured French government approval, and bought the company himself.

Today, production capacity has more than doubled, the product range has exploded, and the cast-iron pots are still made in the same French factory, now supported by a ceramics plant in Thailand. Paul is 87 years old, and he's still involved in day-to-day operations and has no plans to retire.

Business opportunities rarely come gift-wrapped. You often have to spot them, fight for them, and bet on yourself to make them happen.

Linkfest, lap it up

Weekend warriors were ahead of the game. Studies show that cramming all your weekly exercise into two days can reduce risk of heart disease by 33% - All activity is good activity.

Jobs safe from AI disruption are those needing a human touch. Fashion models are at risk - The uproar over Vogue's AI-generated ad.

Signing off

Asian equities are mostly in the green this morning. Gains came through in Australia, mainland China, Japan, and Taiwan, while Hong Kong lagged. Markets in India are closed for Independence Day celebrations, and South Korea is shut for National Liberation Day.

In local company news, Standard Bank posted a 10% rise in earnings for the first half, powered by strong fee income and a solid jump in trading revenue. Both the South African and broader African operations are pulling their weight.

US equity futures edged higher pre-market. The Rand has strengthened to around R17.58 to the US Dollar.

Have a lekker weekend. Let's hope the Boks give the Wallabies a solid hiding at Ellis Park tomorrow.