Market scorecard

US stocks edged higher again yesterday. Treasury Secretary Scott Bessent added fuel to trader optimism, saying that there's a decent chance the Fed could go big, and cut rates by 50 basis points come September. Nearly 400 of the S&P 500 constituents rose, with Apple and Amazon leading the charge.

In company news. AI startup CoreWeave dropped 20.8% as it spooked investors with a softer-than-expected outlook. Elsewhere, Paramount Skydance blasted 36.7% higher after the recently merged entertainment company became the latest meme stock. Finally, Oracle fell 3.8% after saying it was trimming staff in its high-profile cloud division.

At the closing bell, the JSE All-share was up 0.99%, the S&P 500 tacked on 0.32%, and the Nasdaq was only 0.14% higher. A decent day.

Our 10c worth

Michael's musings

Uber recently released a good set of trading numbers. For the quarter, revenue was $12.7 billion (up 18%), translating into net profit of $1.3 billion (up 33%). Perhaps more impressive is the 44% increase in free cash flow, which enabled the company to announce a $20 billion share buyback program, roughly 10% of its market capitalisation.

Looking forward a few years, the future of mobility is in self-driving vehicles. We are heading to a place where ride-hailing will be so cheap that most people won't have their own cars. Uber estimates that ride-hailing could grow by 25x if prices drop to under $1/mile. The only way to do that is to remove expensive human drivers.

Under former CEO Travis Kalanick, Uber had its own self-driving research unit, but it was shut down due to massive R&D costs and a death during testing. Now, with improved self-driving technology, Uber has partnered with a number of different companies in many different cities. It appears that their plan is to test a variety of approaches to determine what works best.

Consumer fear of having a robot drive them around town has disappeared too. In San Francisco, Waymo's self-driving cars now have a bigger market share than rival Lyft. Waymo (owned by Google) is about 25% more expensive than Lyft, indicating that customers are willing to pay extra to avoid having a human driver.

Tesla is another big player in this emerging industry. Tesla's self-driving cars only have cameras for analysing their environments. This is significantly cheaper than many competitors who use cameras and lidar, so Tesla's cost per mile is lower than everyone else, which could give them a big chunk of the market in the future. Tesla bulls will argue that the AI behind their cars is superior, so there is no need for lidar. Regulators might take a different view.

This industry is still very young and in a testing phase. Once the technology settles, and regulators have given the thumbs up, companies will adapt. Uber is well-positioned for any changes, given that they have a broad network of different service providers. They also have a valuable brand, and their app is already installed on a couple hundred million phones.

Uber is a "future hero" stock given how huge the self-driving market could be in the next decade. It currently trades on a P/E of only 15, so it's extremely cheap for a tech company. We have 34 clients who already own Uber, and it may be one to consider in your portfolio.

One thing, from Paul

August 8th, 2011, was one of the worst days in recent stock market history. Do you remember it? Can you recall what caused the crash? Probably not.

It was the first trading day after Standard & Poor's cut its rating on American debt. They said that United States sovereign bonds were no longer AAA-rated, or "risk free". It was the first time in history that the United States was downgraded. The main reasons were government overspending and the problems with raising the debt ceiling in Congress.

According to Morningbrew, that was the only day in the last 25 years that the entire S&P 500 dropped into the red. Not the index, the stocks themselves. Every single one of the 500 or so companies listed on the S&P 500 sank by the end of the day for the first time since the dot-com crash.

Anyway, this is all just ancient history. The closing value on that day was 1 119 points, after a gut-wrenching 6.7% decline.

The S&P 500 is now above 6 400 points, making new highs. Stay long and strong my friends, and don't overreact to news headlines.

Byron's beats

If you have Googled anything lately you would have noticed the AI mode at the top which gives a summarised answer for what you have searched. I find it very useful.

I am not surprised to see that Google is preparing to place ads inside the AI mode block. These ads will be based on the entire context of the AI conversation, which will be different from the traditional keyword-based targeting. In other words, it is moving from static to conversational search.

I would imagine that these adverts will prove to be highly effective.

Bright's banter

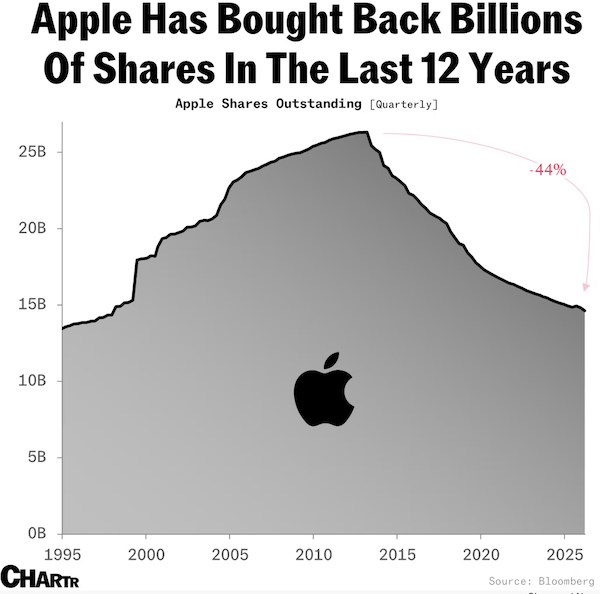

Apple has quietly pulled off one of the most impressive moves in corporate history. Since the early 2010s, Apple has reduced its outstanding share count by roughly 44% through aggressive share buybacks.

Fewer shares means that each remaining slice of the pie gets bigger without you lifting a finger, earnings per share go up, dividends stretch further, and your ownership stake quietly grows.

This isn't financial engineering for the sake of optics but a deliberate, disciplined capital allocation strategy. Apple isn't hoarding cash or making questionable acquisitions; it's buying back its own stock when it believes it offers the best return for shareholders.

As Charlie Munger put it, "If you're repurchasing shares below intrinsic value, you're doing your shareholders a favour." Apple has been doing us a solid for over a decade, and as long-term investors and shareholders, we should enjoy every minute of it.

Linkfest, lap it up

Matcha is having its moment. The finely-ground powder made from green tea leaves is said to have plenty of health benefits - Why matcha supplies are running dry.

AI is revolutionising business. Some countries don't trust the technology - Where ChatGPT is banned in 2025.

Signing off

Asian markets are mostly in the green this morning, with Australia leading the rebound after yesterday's dip. Japan bucked the trend, sliding sharply and ending a seven-day winning streak. Elsewhere in Asia, New Zealand, China, Hong Kong, Malaysia, and Indonesia traded higher.

In local company news, Nedbank is buying iKhokha outright for R1.65 billion in cash. Founders Matt Putman, Ramsay Daly, Clive Putman, and Lesaka (early backers) will be throwing the house out the window when they celebrate this deal.

US equity futures are as flat as a pancake in early pre-market trade. The Rand has strengthened to around R17.53 to the US Dollar.

Have a good Thursday; the weekend is almost here.