Market scorecard

US markets opened up yesterday but slid lower and retreated from record highs as the day wore on. The negative close broke a six day winning streak for the S&P 500. A cautious mood spread ahead of the Fed's interest rate decision this afternoon, and some major tech earnings updates tonight.

In company news, Novo Nordisk shareholders went home hungry yesterday; it dropped 22% after posting weaker GLP-1 guidance, mostly due to being bested by rival Eli Lilly. UnitedHealth fell another 7.46% on poor numbers; that share price is down 48% for the year. Lastly, appliance maker Whirlpool got washed, down 13.4% after raising concerns about fiercer competition from Asian rivals.

In summary, the JSE All-share closed up 0.47%, but the S&P 500 slipped by 0.30%, and the Nasdaq ended 0.38% lower. As Saffas like to say when something unfortunate happens: "shame".

Our 10c worth

One thing, from Paul

Here at Vestact we don't approve of people borrowing money to buy shares. Just save up cash, then convert it into long-term investments by accumulating high-quality companies in your portfolio, and that's all.

We are also dead against margin trading, which means entering into geared derivative positions, both long and short. Honestly, if you get involved with that crap, you will just blow up your life savings. It's gambling, you have no edge, trust me.

I was not impressed to see the chart below, for the last decade, which shows aggregate debit balances in US customers securities accounts just hit $1 Trillion. That's from data compiled by the industry regulator, FINRA.

That's a ton of money owed, in aggregate, by retail clients to their brokerage firms. It reflects the extent to which trading stocks has become a popular pastime in a bull market. In my opinion, that's not good. These people are crazy.

Byron's beats

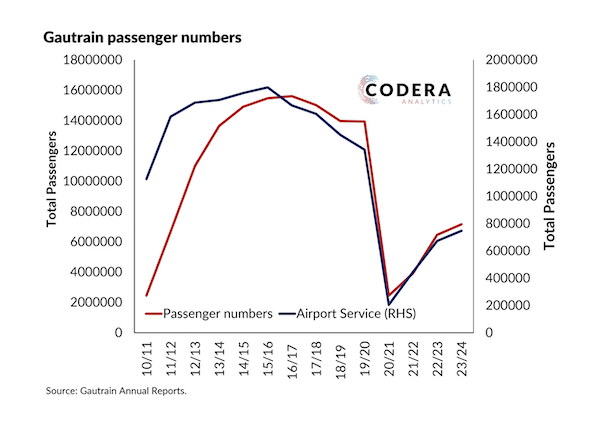

I am a big fan of using the Gautrain to get to and from the airport. So, I was disappointed to see how badly their passenger numbers have dropped since Covid, courtesy of data supplied by Codera.

Naturally, there was a huge dip due to the lockdowns but the recovery levels are nowhere near where they used to be. Passenger numbers are around half pre-pandemic levels. Sad.

Any ideas why? I would assume that many commuters are still able to work from home. Or they only need to be in the office a few times a week which makes driving your car more tolerable. Hours are also flexible so driving during rush hour is not always necessary. It could also be a price issue and an indication that our middle class has shrunk since Covid.

It is probably a combination of all those factors and a few other reasons I may have missed. I hope the Gautrain continues to operate efficiently and more people start using its great service.

Michael's musings

With tax season opening last week, I decided to run to the Gupta compound, also known as the Saxonwold Shebeen, to say "hi" to my tax payer money from yesteryear. If you haven't been before, the compound has an intimidating wall around a few separate properties. Now, paint is flaking off the walls, the steel gates are rusting, cameras are cracked and there aren't any guards. It's still quite a sight, and I can imagine back in the day it was creepy to see armed goons at the exits.

In large letters, on a prominent part of the wall, is a sign for the IT brand Sahara, which was one of the Gupta companies. I love the South African sense of humour, someone has added to the sign, so it now reads, "Jou Ma Sahara". LOL.

On my run home I was thinking about how much we learnt from the Zondo commission. It cost taxpayers a billion Rand and a lot of dirt was revealed, but there has been so little done with that information. Implicated ministers are still ministers, and tainted business people still have contracts with the government. There's just no will from our leaders to change, and if things don't change, don't expect much to happen with out GDP growth rate.

Another succession line came to mind when I think of our political masters - "You are not serious people".

Linkfest, lap it up

Art sales have fallen to a decade low, even though global wealth has been rising - Why billionaires aren't bidding.

Would you want to work in the hospitality industry? It has low pay and nasty working hours - Which industries are struggling to hire globally?

Signing off

Asian shares are mostly higher this morning as Trump is expected to announce an extension to a trade truce with China.

In local company news, Kumba Iron Ore jumped 4.8% after reporting slightly lower revenue of R34.5 billion, but stable profits of R7.1 billion. During the period, Transnet paid them R942 million due to logistics penalties. Ouch. The own goals from state-owned entities are so frustrating.

US futures are slightly higher this morning. Tonight, Microsoft, Meta, Qualcomm and ARM report numbers, which will have a significant impact on overall market sentiment for the next few weeks. The Rand is at $/R17.88.

Be well.