Market scorecard

Wall Street scraped through another green close. The market started in a cheery mood following the EU/US trade deal, but that faded as attention turned to major economic and company news which comes later this week. With 5 minutes to go the S&P 500 shot up, squeaking into positive territory as the closing bell rang.

In company news, Nike's fortunes finally seem to be turning. JP Morgan upgraded the company to 'overweight', pushing the share price 3.8% higher. In AI news, AMD raised the prices of its chips, boosting the entire sector, with notable increases for AMD (4.3%), Super Micro Computer (10.2%), ASML (2.6%), and Nvidia (1.9%).

Elsewhere, the new European trade agreement resulted in a hangover for beer manufacturers; Anheuser-Busch Inbev (-5.5%), Heineken (-9.4%), and Molson Coors (-2.5%).

In summary, the JSE All-share closed down 0.22%, but the S&P 500 rose by 0.02%, and the Nasdaq ended 0.33% higher. Ok then.

Our 10c worth

One thing, from Paul

The founder and CEO of LVMH, Bernard Arnault (pictured below), was recently interviewed about the state of the luxury goods market. He was making a lot of excuses, because it's not good, at all.

He made some predictable comments about consumer uncertainty in major markets like the US, China and Europe. Top of the list of concerns were tariffs, inflation, interest rates, political polarisation, etc, etc.

I was more intrigued by this observation:

"In 50 years, will the iPhone still be used? But I believe, that in 50 years, we'll still be drinking Dom Pérignon."

I'm not sure he's thinking straight. Personally I'd be quite happy to be denied champagne for a whole year. I'd be horrified to have to part with my iPhone for more than a few hours.

Sure, humans probably won't be using iPhones in 50 years' time, because our principal personal electronic devices will have evolved into a new shape. Those will be even more convenient to use, whereas, expensive booze will be just the same, and drinking it at a party will still serve much the same purpose. Luxury brands are timeless, and demand for their products is durable, but they are not transformative technologies.

Byron's beats

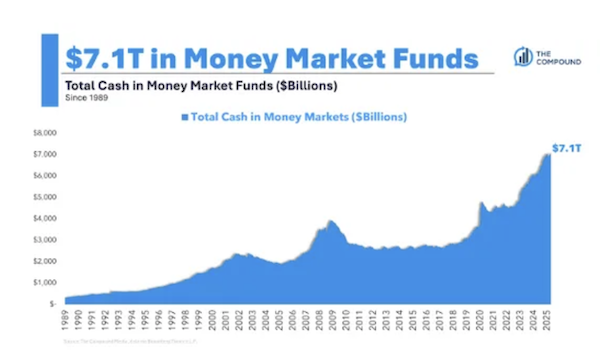

US stocks are currently at all-time highs, which is great. What I find interesting is that cash sitting in money market funds is also at an all-time high, around $7.1 trillion. Not so long ago, in 2022, that number was below $5 trillion.

Investors are still getting around a 4% yield on money market funds which explains the big leap from 2022 when interest rates were much lower. A risk free 4% return with inflation sitting at around 2.5% is an attractive deal for some people, particularly older folks.

This does mean that there's still a lot of money on the sidelines that may start looking for a new home should interest rates come down. Money markets compete with equities for capital. Rates coming down is a matter of when, not if. And when they do, it should be a solid tailwind for equities.

Michael's musings

I just learnt about a phenomenon called 'corn sweat', where maize releases water vapour as it grows. The vapour becomes a problem in vast maize fields when there is a heat wave. In some US farming states this month, corn sweat is pushing up temperatures and causing unpleasant levels of humidity.

It's ironic that maize production is causing higher temperatures. In the US, large amounts of corn is turned into biofuel to be mixed with regular gasoline to make it more environmentally friendly and to combat climate change. The theory is that corn sucks CO2 out of the atmosphere when it grows, making it net-neutral when used as fuel in a car, which emits CO2. This all sounds good on paper, but farming has negative environmental impacts too.

This sounds like ESG box-ticking gone wrong, where some supposedly eco-friendly concepts have unintended consequences.

Linkfest, lap it up

Big software upgrades are coming to your iPhone. Apple plans to release iOS26 in September - This might be the biggest update to the core apps in forever.

Would you pay $80 for a limited edition popcorn bucket? There is a growing trend for blockbuster movies to come with unique popcorn holders - The new Fantastic Four 9-litre bucket with LED lights.

Signing off

The MSCI Asia-Pacific index is on track for its third down day. Oil prices have moved higher as Trump warned Russia to speed up negotiations with Ukraine to reach a truce.

In local company news, Sea Harvest announced that its profits are expected to increase by 60% to 65%, with final results due on 1 September. Even with this jump in profits, the share price is down 9% over the last year. Fishing is a tough industry. Not much fun for the fish either.

US futures are higher this morning. Earnings out tonight include Visa, Booking, Spotify, Boeing and UnitedHealth. The Rand is at $/R 17.91, with July set to be the first month this year where the Dollar strengthened against a basket of international currencies.

Have a good one.