Market scorecard

US markets rose again yesterday, with the S&P 500 hitting its 12th all-time high for the year. Trading got off to a good start on news of a US trade deal with Japan, and maintained its momentum on reports that the US and EU are close to a deal, setting a 15% tariff on most goods. The Nasdaq Composite also made history, closing above the 21 000 mark for the first time.

In company news, elevator manufacturer Otis Worldwide is going down (-12.4%) after weak earnings. Elsewhere, Google is up 1.8% after hours following pleasing second-quarter results that included a surge in revenue from their cloud hosting division and a big hike in future capital spending. Elsewhere, Tesla fell 4.4% overnight after reporting a 16% drop in net income and another dip in automotive sales.

In summary, the JSE All-share closed up 0.86%, the S&P 500 rose 0.78%, and the Nasdaq was 0.61% higher. You have to be in it to win it.

Our 10c worth

One thing, from Paul

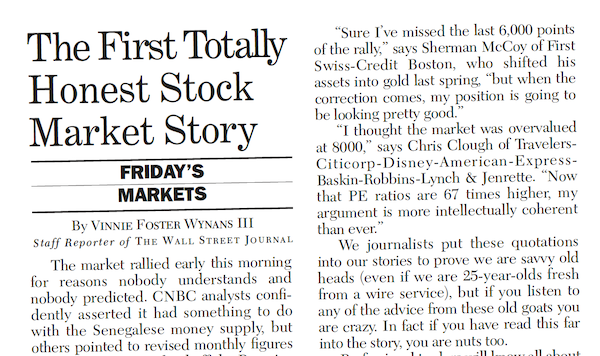

Back in 1998, a publication called the Weekly Standard ran a parody article called The first totally honest stock market story.

It opened with this line: "The market rallied early this morning for reasons nobody understands and nobody predicted."

It continued: "The Dow turned down in late morning trading due to profit-taking, which is a meaningless phrase we journalists use when we don't know what we are talking about. Around noontime, tech stocks rallied, perhaps a result of profit giving?"

I liked this line too: "Professional traders will know all about yesterday's markets from their computer terminals. Normal investors shouldn't read day-to-day market reports because it will only cause them to churn their accounts."

Of course, we face the same challenges when writing these Vestact daily market reports. We don't know what's going on either, we just try to keep the facts straight, the opinions honest, and the whole letter brief and humorous.

Byron's beats

When I visited Thailand in December 2016, I got a cap made that said 'ALSI 100 000'. I was inspired by the hats that were given out on the floor on Wall Street when that market went through big milestones.

At the time, the JSE All Share was at around 50 000 points. I thought that 100 000 could be hit within the next 5 years, based on the kind of returns South African stocks had delivered during the previous decade.

I was off by 4 years but I am happy to report that after 9 years, the JSE All Share has finally hit 100 000, thanks in part to a good 18% showing so far in 2025. Over the full period, it's managed an annual return of 8.4%, slightly higher than the average inflation rate of 5%.

Unfortunately, that's not a great return, especially if you keep in mind that the Rand has weakened from around 14.00 then to 17.50 to the USD now. Considering the state of the South African economy over that period, I suppose it could have been worse?

Over the comparable timeframe the S&P 500 has nearly tripled, delivering an annual return of 11.21% in USD. Our Vestact US model portfolio is up closer to 18% per annum since then. Much better!

In the picture here, that's me on the left, wearing the hat yesterday, and on the right, me in 2016 in Bangkok. Luckily, the hat is covering all the hard-earned grey hairs accumulated over the last 8 years.

Michael's musings

A week or two ago when the PowerBall Jackpot was R77 million, friends and I were chatting around the braai about the idea of putting money into a pot, buying a whole bunch of tickets and then splitting the prize money 4 ways if one of them won.

The conversation moved on to the question of how $1 million could change your life. One person argued that they wouldn't notice any difference in their lifestyle. That sum wasn't enough to retire on, so they would carry on as usual. At the other end of the spectrum, another person said they would pay off their house, quit their job, travel the world and only do odd jobs as needed.

Everyone's definition of wealth and 'what is rich' is relative. It made me think of this great scene from the hit series Succession - 5 Million is a nightmare. The closing line is a classic "you will be the poorest rich person in America."

Bright's banter

Rich people are living large. Flexjet just pulled in $800 million in new capital, led by L Catterton, the private equity firm 40% owned by luxury giant LVMH. The deal lifts Flexjet's valuation to $4 billion, up from $3.1 billion during its scrapped attempt to reverse list into a SPAC in 2022.

The fresh funding gives the Cleveland-based operator room to expand its fleet of long-range jets for international trips without public market headaches.

Flexjet has already signed a $7 billion deal with Embraer for 182 Phenom and Praetor jets, a move that could boost the Brazilian planemaker's backlog by over 25%.

Linkfest, lap it up

The British Grand Prix is a signature event. There is no shortage of drama - This F1 outing is like a soap opera.

Over 10 years, is the S&P risk-free? Share price volatility is unpleasant and is the definition of market risk - Over the past 100 years you would have made money in 95% of rolling decades.

Signing off

Asian markets are rallying again this morning, taking their lead from Wall Street's upbeat session. It would seem that while tariffs are annoying, the global economy is very large and very resilient, and major companies can work around them.

In local company news, Indian pharma group Natco has made a move to take local drugmaker Adcock Ingram private with a R75 per share offer to minorities. If the deal goes through, Bidvest will hang onto its controlling 64.25% stake, while Natco takes the rest.

US equity futures are slightly lower pre-market; Union Pacific, Blackstone and Intel are set to report earnings today. The Rand has strengthened to around R17.52 to the US Dollar.

Have a pleasant day, stay positive.