Market scorecard

US markets were mixed yesterday, but the S&P 500 managed to close at another record high. Trade-related drama continued, with some comments about US deals with the Philippines and Indonesia, but confusion about China. Tech mega-caps were soft, but Tesla and Google pushed higher ahead of their earnings reports tonight.

In company news, OpenAI and Oracle announced plans to add a massive 4.5 gigawatts of new US data centre capacity, which is enough to power a small country. Defence contractors were in the news, with Northrop Grumman up 9.4% on good numbers and strong demand for new-generation missiles and B-21 bombers. Lockheed Martin dropped 10.8% after reporting big losses which it couldn't explain because the details are "classified". This is not good.

In summary, the JSE All-share closed down 0.33%, the S&P 500 rose just 0.06%, and the Nasdaq was 0.39% lower. No worries.

Our 10c worth

One thing, from Paul

I spent the last 10 days away, on a family holiday in Greece. That's me in the picture, not finishing the Olympic Marathon in the Panathenaic Stadium. It was just a 5 km jog, if you must know. During the trip, I completed my 11th year of running every day.

By the time you read this, I will be back in Johannesburg and on the way to the office.

I have not been submitting contributions to this newsletter, but I've been online daily, staying in touch with market developments, company news and client activities. I prefer to do that. Some people like a "full disconnect" from time to time, but not me. You can't have "burnout" if you love your work, in my humble opinion.

Of course, Vestact has an excellent team, so everything went very smoothly.

Byron's beats

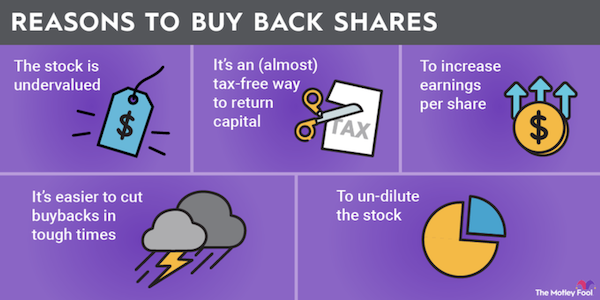

Most of the stocks in our US portfolios do not have a good dividend yield. I would guesstimate that the average yield on client accounts is around 0.4%. This is not because the companies we own cannot afford to pay dividends, in fact, most of them have bucket loads of cash. It's because share buybacks are more tax-efficient.

Over the past 12 months, S&P 500 companies have returned an incredible $1.6 trillion to shareholders; 57% of that was through buybacks and 43% was through dividends. It's not just Vestact-recommended stocks that prefer buying back shares, it is a broad-based method to reward shareholders.

All things being equal, share buybacks result in the share price going up because earnings per share increase. We are more than happy to watch our portfolios grow as an alternative to higher yields.

Michael's musings

Netflix has officially utilised AI in one of its shows, demonstrating another use case for this emerging technology. AI video tools were used to create a scene of a building collapsing in an Argentinian science fiction series called El Eternauta.

According to Netflix, they didn't have the budget to use conventional tools, so they went with the cheaper option of AI. The company says that using normal visual effects would have taken them 10 times longer. I haven't seen the scene, despite my best efforts, so I can't comment on its quality.

If it's as good as current-generation visual effects, at a fraction of the cost, then there is about to be a major shift in Hollywood. I suspect that AI isn't there just yet, or Netflix would have used it for more than just one scene.

Ted Sarandos, Netflix co-CEO, said: "This is real people doing real work with better tools. Our creators are already seeing the benefits in production through pre-visualisation and shot planning work, and certainly visual effects. I think these tools are helping creators expand the possibilities of storytelling on screen, and that is endlessly exciting."

AI is firmly entrenching itself in modern society. This is why the likes of Meta, Amazon, Google and Microsoft plan to spend tens of billions a year, for many years, to provide the computing power needed to run the technology effectively.

Bright's banter

Universal Music Group (UMG) has quietly filed for a US listing, giving in to pressure from one of its heavyweight shareholders, Bill Ackman's Pershing Square. The company won't raise fresh capital in the process; the offering will come from existing shareholders.

UMG has been trading in Amsterdam since 2021, where it's up about 10% this year and valued at around EUR50 billion. But Pershing Square has been nudging it toward a US listing for months, arguing that an American stage could command a higher valuation. Ackman recently stepped down from the board, but it seems his influence lingered just long enough to get this over the line.

No word yet on how big the US float will be or when it's coming, but with a roster that includes Taylor Swift and Drake, music industry investors will be watching this one closely.

Linkfest, lap it up

Following the crowd might be a smart way to travel. Tourist traps are optimised cultural hubs - These places are busy, but also safe and enjoyable.

Weak password allowed hackers to sink a 158-year-old company. Protecting data is hugely important - Businesses need to wake up to security risks.

Signing off

Asian markets are mostly in the green this morning, led by Japan's Nikkei, which jumped over 3% after President Trump announced a "massive" trade deal with Tokyo late last night.

In local company news, the JSE is flirting with the idea of 24-hour trading, a concept the US embraced years ago and will fully implement next year. It seems like everyone is waiting for the Nasdaq to take the lead, iron out the wrinkles, and set the global playbook.

US equity futures are in the green pre-market. The Rand has strengthened to around R17.54 to the greenback. It's a great time to move money offshore if you've got capital waiting to be put to work. The Rand has held up nicely, global markets are humming, and opportunities outside our borders remain rich and diverse.

We have a big earnings day ahead with Google, Tesla, IBM, ServiceNow, T-Mobile, and Boston Scientific all reporting.

Have a good Wednesday.