Market scorecard

US markets closed higher yesterday, with the S&P 500 inching up, but staying just shy of its February highs. Tesla led the charge, rising 4.5% after Donald Trump extended an olive branch to Elon Musk, saying he wants to keep Starlink at the White House, and wished Musk "very well." Remember, the latter funds candidates in elections.

In company news, Qualcomm is dropping $2.4 billion to snap up UK-based Alphawave, beefing up its chip tech for the AI boom. Elsewhere, Meta is eyeing a multibillion-dollar investment in Scale AI. Finally, Robinhood (-1.98%) and AppLovin (-8.21%) fell after S&P Dow Jones Indices decided not to include them in the S&P 500.

At the close, the JSE All-share inched up by 0.05%, the S&P 500 rose 0.09%, and the Nasdaq ended 0.31% higher.

Our 10c worth

One thing, from Paul

Eli Lilly is the stock we've bought most actively in the last year, but its share price has been very choppy. Sales of their world-leading weight-loss drugs have been rising fast, but the market has not yet fully grasped their revenue potential.

As a result, we've been watching the news closely for any Eli Lilly updates. I was pleased to see that they've teamed up with a Swedish company, Camurus, to exploit the latter's FluidCrystal technology in a deal worth up to $870 million.

The FluidCrystal system slowly delivers drugs through prefilled autoinjector pens that contain a lipid solution that turns into a liquid crystalline gel upon contact with a patient's bodily fluids. Then, it breaks down over time, releasing the encapsulated active ingredient in the paired drug, allowing for sustained benefits "from days to months".

Eli Lilly has licenced the Camurus technology for the delivery of its obesity and diabetes drugs. The deal includes an upfront payment of $290 million and a further $580 million in sales-based milestone payments and royalties. Sounds good.

Byron's beats

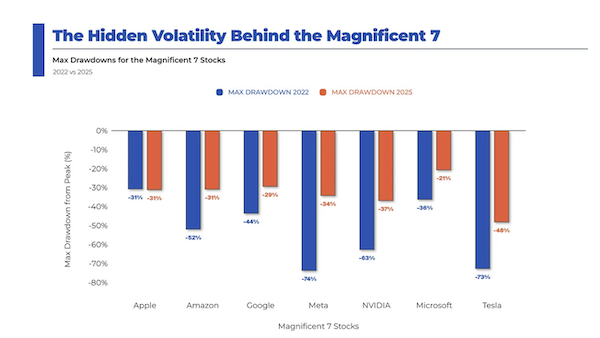

Yesterday, Paul wrote about the Magnificent 7 stocks and how well they have served us. A successful story often sounds easy and obvious in hindsight. But in reality, it has been far from plain sailing.

The team at Ritholtz Wealth put this image together which shows the biggest drawdowns for each stock in 2022 (blue) and so far this year (red).

Do you remember Meta crashing 74% in 2022? Stocks were in the doldrums because of high inflation and increasing interest rates. At that time, Meta was ploughing many billions into creating the Metaverse, which the market did not like. Nvidia collapsed 63% that year and Amazon was down 52%. Tesla is in a league of its own when it comes to drawdowns.

This year has also required strong resolve. Again, as Paul mentioned yesterday, it is not just about what stocks to own, it's vital to have the composure to stay the course when times get tough.

Michael's musings

There is an old joke in finance: one year investment bankers will be pitching a CEO amazing merger deals and then the next year, the same banker will advise the CEO to split up his company. The joke pokes fun at the advisory industry on several fronts.

The first insinuation is that investment bankers don't really create much value for society because financial engineering isn't creating anything, it is just moving figures around on a spreadsheet. The second is that bankers are only interested in deal flow because that is how they get paid. Third, it illustrates that the investment world swings between different trends.

The latest company to live up to that joke is Warner Bros. Discovery, created through a merger in 2022. Since then, the combined company's share price has more than halved, partly due to too much debt and partly because consumers are changing the way that they watch content. Yesterday, the company announced that it will be splitting into two separately listed entities, namely streaming and studios, and TV networks.

The streaming and studios company will include Warner Bros. Television, Warner Bros. Motion Picture Group, DC Studios, HBO, and HBO Max as well as the film and television libraries, and will be run by Chief Executive Officer David Zaslav. The TV networks will include brands like CNN, Discovery and TNT Sports, and will also be lumped with a lot of the debt of the current company.

Interestingly, CEO David Zaslav comes from Discovery and will be leaving with the new streaming service - the merger and demerger has allowed him to move from a legacy asset to an emerging one. I suppose that you need to give credit to Zaslav and the investment bankers for not sitting still in the fast-changing world of content creation and distribution.

Bright's banter

A few publications have covered Apple's current AI efforts, including Siri's big AI upgrade taking longer than expected, and the market's growing impatience.

Some former employees say the integration of large language models hasn't been smooth, especially since Apple is trying to layer new tech onto legacy infrastructure. It's a classic Apple challenge: evolve without compromising what's already deeply embedded across hundreds of millions of devices.

Yes, competitors like OpenAI, Google, and Perplexity have stormed ahead with flashy voice assistants, and Apple's stock has lagged the Magnificent 7 this year. But Apple rarely goes first, they go second (or third), and then do it better, cleaner, and at scale.

Remember the iPod, iPhone, and even Apple Watch? They weren't the first, but they became the standard. Apple's delay likely means they're still polishing the user experience, figuring out how to deliver powerful AI on-device without compromising privacy which, in fairness, is a harder problem than cloud-based LLMs.

They've also been quietly integrating OpenAI's tech into Siri as a bridge, which shows they're pragmatic while building their own AI muscle. Last night at their Worldwide Developers Conference (WWDC) conference, Apple said Siri's upgrades will need more time. So if they finally do crack it, the upside surprise could be meaningful.

Linkfest, lap it up

The Williams F1 team used to track over 14 000 car parts on a spreadsheet. Now they're a top-five team thanks to James Vowles, ex-Mercedes chief strategist - Inside the $200 million gamble that's turning heads.

Countries will need electricity to power AI growth. China produces more electricity than the US, EU, and India combined - Top countries by annual electricity production.

Signing off

Asian markets climbed after US officials struck an upbeat tone following the first day of trade talks with China. The MSCI Asia-Pacific index rose, building on gains to reach its highest level since late 2021. Meanwhile, China's exports to the US tumbled 35% in May, the steepest drop since the early days of the pandemic, highlighting the stakes of the negotiations in London.

In local company news, Alexforbes posted solid numbers for the year to end-March, with operating income up 13% to R4.4 billion and HEPS rising 15%. They also declared a special dividend, thanks to proceeds from a successful legal case.

The Rand is idling at around R17.78 to the US Dollar.

US equity futures are in the green pre-market, despite wild scenes of rioting in Los Angeles.

Keep calm and keep going.