Market scorecard

Yesterday was uneventful on Wall Street. Some soft economic data gave weight to the idea that the Fed could deliver at least two rate cuts this year. The S&P 500 closed flat while the Nasdaq rose, but defensives like health care and communications moved quietly higher.

In company news, Wells Fargo just got out of the Fed's naughty corner, the asset cap that's been limiting its growth since 2018 has finally been lifted. Meanwhile, CrowdStrike is in the spotlight after US officials asked for details on how it books some of its customer deals. The cybersecurity firm says it is cooperating fully. Shares wobbled a bit but that could also be due to guidance released the day before, more on that below.

In summary, the JSE All-share closed up 0.81%, the S&P 500 rose a tiny 0.01%, and the Nasdaq was 0.32% higher.

Our 10c worth

Byron's beats

On Tuesday, CrowdStrike released another solid set of numbers. Sales grew by 20% while earnings declined slightly, which was expected. The consequences of last year's blackout are still filtering through the system. The highly-followed Annual Recurring Revenue (ARR) number came in 22% higher.

Their reaction to the infamous cyber shutdown of July 2024 has been commended by both clients and analysts. They cleverly offered clients new products at discounted rates as a form of apology. This resulted in slower revenue growth and lower margins today, but numbers will jump next year once the discounts expire. Upselling to existing clients who will most likely continue with the new product even after the discount lapses is genius.

Their pay-as-you-go product called Falcon Flex has been incredibly well-received. Clients can add modules as they need them instead of being forced to buy a package with software that is not required. Despite that, the average Flex client uses 9 product modules while the overall client base uses an average of 7. Again, very clever.

AI is making all of CrowdStrike's products more effective, and they have some world-class chatbots that focus on cybersecurity troubleshooting. AI itself has also put so much more data online which now needs cyber protection from CrowdStrike software.

The stock is trading near all-time highs. Uncertain geopolitical times are good for a company like CrowdStrike. This management team has proven itself and their tech is world-class.

CrowdStrike is one of our "future hero" stocks and we are happy so far.

One thing, from Paul

Current affairs, market drama and business news is interesting, but people's feelings are what counts most. By way of an example, I read this comment in The Economist a few weeks ago:

"I once asked my grandmother how she felt when the Second World War ended. 'Devastated', she said. The American soldiers left her English town before she was old enough to date them and 'their uniforms were far sexier.'"

What's the relevance of this observation about "feelings", to stock market investing?

Each individual that puts their savings to work in the market will have a unique experience. They will enjoy gains in bull markets, and suffer losses in bear markets. Their timing will differ.

We invest money in direct equity portfolios for our clients, and they all have varying entry prices into (mostly) the same shares. For some, it's a breeze from the start, for others some patience is required.

Michael's musings

According to The Bloomberg Billionaires Index, Elon Musk, Mark Zuckerberg and Jeff Bezos are worth a combined $839 billion. That's a big number!

An opinion article I read recently criticised the US because these three individuals have the same combined wealth as roughly the bottom 50% of Americans. They argued that as wealth inequality goes up, society as a whole is worse off. Also, the usual argument that these billionaires don't pay enough tax.

Imagine if one of those founders went to another country and said to the government: I'll create a trillion-dollar company in your country, but in exchange, I don't want to pay any personal taxes. I think every country offered that deal would jump at it. Imagine how much better off South Africa would be if Musk had set up shop here.

Tesla, SpaceX, Meta, Amazon and Blue Origin employ many people directly in the US, and significantly more people indirectly - all those people pay tax. They have also spent hundreds of billions on infrastructure development. Then there is all the money spent on R&D, which has kept the US ahead in key technologies.

I think those individuals having so much self-made wealth is a sign of success, not failure. The US has many shortcomings, but hosting world-leading organisations is not one of them.

Bright's banter

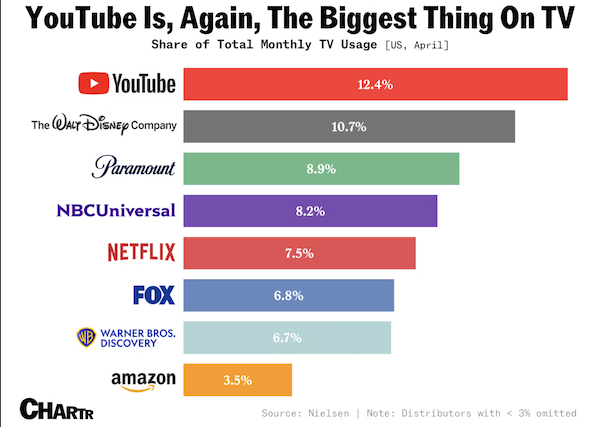

YouTube is officially the biggest thing on American TV, again. For the third consecutive month, the platform topped Nielsen's TV usage rankings, securing a record 12.4% share in April. That's ahead of legacy giants like Disney and Paramount, and well above Netflix's 7.5%.

With more viewers turning to creator-led content over traditional programming, YouTube is now the main character in the living room and TV screens have now overtaken phones as its primary viewing platform. They are rolling out new AI-powered ad tools to cash in on its dominance and fuel further growth in its advertising business.

Linkfest, lap it up

Have you tried hot yoga? Your next workout will be heated - More sweat at fitness classes.

Travel broadens our horizons. Here are some places to add to your bucket list - The 10 happiest cities in the world.

Signing off

Asian markets are muted this morning. Japanese indices are lower after a soft 30-year government bond auction, where demand came in weaker than expected.

In local company news, Ninety One eked out a 4% rise in assets under management to GBP130.8 billion for the year ended March. Profits came in 1% lower at GBP187.9 million. Not too bad, all things considered.

US equity futures are slightly lower pre-market. The Rand is at R17.85 to the US Dollar.

Have a top day. Stay away from culture wars.