Market scorecard

US markets kept the momentum going yesterday, with the Nasdaq turning positive for the year. Tech and energy sectors topped the S&P 500's leaderboard. Broadcom rallied 3.3% to close at a record high. Nvidia also gained 2.8% and is back on top as the world's most valuable company.

In company news, discount retailer Dollar General surged 16% after raising its outlook. Somehow they are less affected by tariffs. Bumble tumbled 6.5% on a report that the dating app is losing market share to Hinge. That might be useful information to some of you?

In short, the JSE All-share closed down 0.29%, but the S&P 500 rose 0.58%, and the Nasdaq cruised 0.81% higher. Lovely!

Our 10c worth

Bright's banter

Meta is doubling down on AI, rolling out tools by the end of next year that will allow advertisers to create and target entire ad campaigns, text, video, imagery, and all, using just a product image and a budget.

The move has sent ripples through the traditional marketing industry, as it threatens to bypass the creative, planning, and media-buying roles traditionally filled by ad agencies. While Meta says it's not trying to kill off agencies, investors clearly got the message; shares in WPP, Publicis Groupe, and Havas all took a knock.

The new AI tools aim to "level the playing field" for small businesses that can't afford agency support, allowing them to produce and distribute tailored campaigns at scale, that are location-specific.

Meta already generates $160 billion in ad revenue annually, is looking to swell that figure as it ramps up AI infrastructure spending to as much as $72 billion next year. Ad agencies probably still have a future, particularly in cross-platform strategy and measurement, but automation is clearly coming for the bulk of the heavy lifting.

Michael's musings

Yesterday was a busy day for Meta, as they also announced a 1.1 gigawatt power deal with Constellation Energy. The tech-giant has committed to buying all the power for 20 years from one nuclear reactor. In December, Meta announced that it was seeking to sign power supply agreements for between 1 and 4 gigawatts. This deal is at the lower end of that scale.

At the moment, tech giants are spending hundreds of billions building data centres which are electric power-sucking monsters. Electrical grids around the world might reach a point of limited supply.

Former Google CEO, Eric Schmidt, forecasts 10 gigawatt data centres being built in the near future. That means consuming 10 times the power of the deal that Meta just signed. The energy space is going to be very interesting over the next decade.

One thing, from Paul

It's become quite normal to be anti-immigrant. Xenophobia used to be frowned upon, but now people seem to feel quite comfortable making rude comments about foreigners. Populist political parties around the world are winning votes by demonising people from other countries.

My own view is that national borders are a waste of time. I support the free movement of money, goods and people around the planet. We invest in global multinationals, and would like to see them operating in every country in the world.

So, I was pleased to see that Spain is bucking global trends with an ambitious migration push, including the "mass regularisation" of undocumented foreign workers.

Spanish officials say it's a way to enrich society, boost a collapsing birthrate and keep the economy growing, and are set to add close to 1 million new residents in the next three years.

Byron's beats

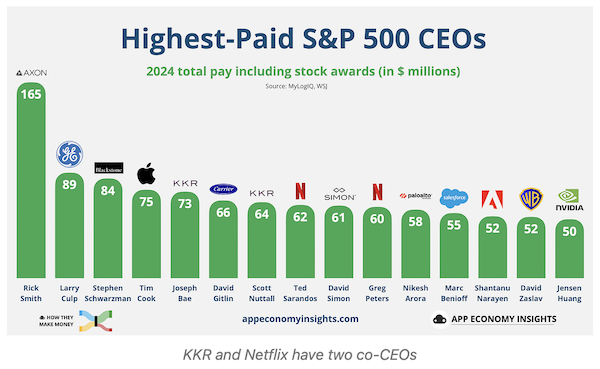

CEO pay is a highly debated topic and I'm torn on the issue. Corporate leaders get paid huge amounts of shareholder money which can be hard to justify. On the other hand, if you don't pay up for quality, the best talent moves to other companies.

The following infographic shows the highest-paid CEOs in the S&P 500. Interestingly, Rick Smith is a co-founder of Axon and all of that compensation came from performance-based stock awards tied to long-term share price goals. That's fair enough. Axon sells security equipment like Tasers, drones and even cloud security.

I quite like the performance-based schemes, because shareholder and management interests are aligned.

Linkfest, lap it up

A lower inflation target isn't only good for your pocket. It is good for government finances too - 3% inflation target could save South Africa R870 billion.

Streaming has changed how we consume entertainment. We don't have to pay per movie or per song - Almost half of streaming subs are from plans with ads.

Signing off

Asian markets are mostly in the green this morning. In South Korea, stocks surged after left-wing opposition leader Lee Jae-myung clinched the presidency. The Kospi jumped 2.46%, hitting its highest level since August last year.

In local company news, Prosus announced an unexpected shake-up in its senior management team. Ervin Tu, the group's president and chief investment officer, has stepped down. No reasons were given for his resignation.

US equity futures are unchanged pre-market. The Rand is steady at R17.85 to the greenback.

Have a solid day. Be sensible.