Market scorecard

Earnings season is going swimmingly, and US markets remained upbeat on Wednesday. Tesla surged 12%, propelling the tech-heavy Nasdaq Composite to its third consecutive session of gains. It's refreshing to see market moves influenced by tangible factors like earnings rather than elusive elements one can't quite grasp. We are so tired of the stop-start motions caused by "interest rate expectations".

After hours, things took a turn for the worse with Meta tumbling 15% as it projected second-quarter sales below Wall Street's expectations. South Korean memory chip maker SK Hynix declined 4% despite reporting its fastest revenue growth since 2010. Lastly, BHP Group has initiated a takeover bid for Anglo American, triggering the most significant upheaval in the global mining sector in over a decade.

In short, the JSE All-share was up 0.68%, the S&P 500 rose a tiny 0.02%, and the Nasdaq crawled 0.10% higher.

Our 10c worth

Byron's beats

The first Vestact client bought Visa in November 2008 for $12.85 per share, it now trades at $275. That person has a sweet 2 033% return and has never sold a single share. Visa is the longest-standing position in our current portfolio and I do not see that changing anytime soon, especially after another solid earnings release on Tuesday.

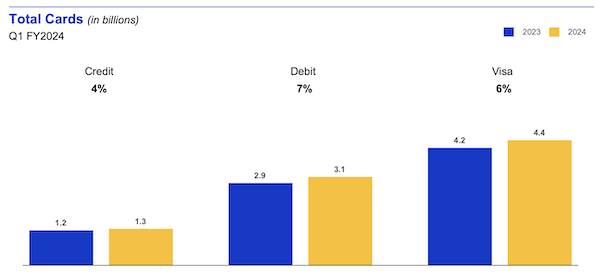

Sales grew by 10%, net income grew by 10%, and earnings per share moved 20% higher to $2.51. The stock currently trades at about 24 times forward earnings with a dividend yield of 0.8%. All very solid. Visa does well when people are swiping their cards. Processed transactions grew by 11%, but more importantly, the high-margin cross-border volume increased by 16%.

Visa currently has 4.4 billion cards in issue. Take a look at the image below which shows the year-on-year growth of credit cards and debit cards. That number is incredible. I wonder if that includes virtual cards too? Those have been growing fast lately, in my life anyhow.

There is not much to fault about this business, growing steadily, huge moat, the sector is robust and they benefit from network effects. We recommend Visa in all portfolios, whether you are young, retired, risk-averse or gung-ho. Just own it.

One thing, from Paul

Our elections are just over a month away, so we each have to make a political choice at the ballot box. Broadly speaking, you get to pick between left (progressive) and right (conservative) options.

When I was younger, I automatically supported the people who wanted to change the world. In South Africa in the 1980s, it was a rather obvious choice, to reject racism and campaign for the end of Apartheid. But now that we live in a 30-year-old democracy, I find myself drifting more right of centre.

The Australian singer-songwriter Nick Cave (pictured below) said: "a conservative temperament understands the world's vulnerable and precarious nature. It is suspicious of the impulse to tear things down, dismantle things, burn things to the ground, rather it's more naturally inclined towards cautious, incremental change."

Leftists pretend that they are advancing the interests of the poor, but most just want power for themselves. If you want to have a nightmare, read the MK Party's manifesto.

Evolutionary psychologist Geoffrey Miller adds: "Most policy interventions have worse side effects than benefits. Most political revolutions reduce well-being. In complex adaptive systems, it's easier to mess them up than to improve them."

Michael's musings

How's this for a catchy headline - Swapping red meat for anchovies and sardines 'could save 750 000 lives by 2050'. I like a good steak and I'm not a fan of sardines, so I took the bait and clicked.

Bloomberg reports that researchers in the UK found that reducing red meat intake by 8% and replacing it with sardines could prevent 10% of heart disease deaths in the next 26 years. They forecast that deaths from stroke, diabetes and bowel cancer could also be reduced by 1 to 2%. Reducing red meat consumption has the indirect benefit of reducing greenhouse gas emissions generated from farming activities, which I think saves lives too?

I won't be giving up my steaks though; my general view is 'all things in moderation'. Warren Buffett's theory is that happiness plays a large role in longevity. That's why he eats McDonald's for breakfast, drinks litres of Coke during the day and has a massive steak for supper, and is still strong at 93.

Bright's banter

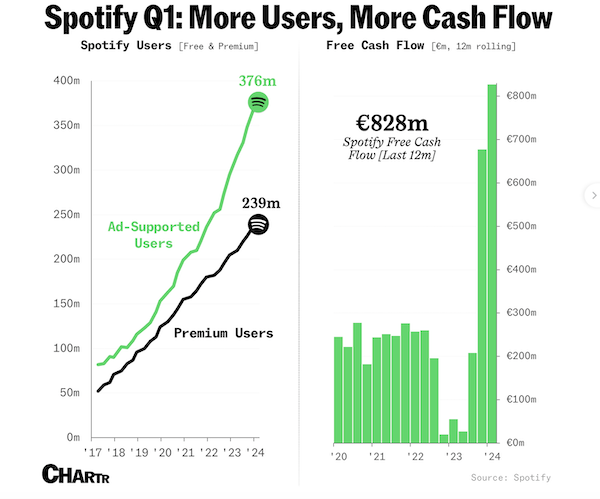

Spotify shares popped on Tuesday, the most in almost two years, after the audio-streaming company announced a healthy profit in the first quarter. The boost came as Spotify increased subscribers and rolled out new features.

Paid subscribers rose 14% year-on-year to 239 million, in line with analysts' expectations. However, total active users, including free plan users with ads, reached 615 million, up a cool 23%.

Revenue jumped 20% to EUR 3.6 billion ($3.8 billion), with a net income of EUR 197 million. Adjusted operating profit hit a record high of EUR 168 million. The music is finally doing all the talking!

Spotify has been trying to diversify its business model beyond music streaming into other audio entertainment areas like audiobooks and podcasts. After implementing its first price hike in over a decade last year, the company plans another increase by the end of the month. The company is also introducing new plan tiers, including one without audiobooks for a lower monthly fee and a music-only option.

Spotify introduced audiobooks to its subscription plans last year and expanded into six markets. Around 25% of users with access to audiobooks have engaged with the offering. While Spotify has scaled back on its podcast staff and programming, it renewed its distribution deal with Joe Rogan in February and broadened his show's availability on YouTube and Apple Podcasts.

CEO Daniel Ek celebrated Spotify's 18th anniversary by highlighting its newfound profitability. Shares soared as much as 16% to $314.80 in New York, marking the largest intraday gain since July 2022. I'm just happy to see Spotify turn its user growth into cash flow.

Linkfest, lap it up

Being a new parent is tough, because your baby can't talk to tell you what is wrong. A new app claims to be able to interpret a baby's cry (if you have used it please let us know if it worked) - Nanni AI.

YouTube rules supreme. It's the most popular music services platform across ages - It's also the "data fuel" for AI systems.

Signing off

Asian markets are mixed this morning. Paul says it's cloudy in Taipei. Benchmarks rose in India, Hong Kong, and mainland China, but slid in Japan and South Korea.

Locally, Copper 360 shares jumped 19.2% higher after announcing the first copper concentrate deliveries from the Northern Cape in over two decades. Record concentrate grades exceeding 30% are coming out of its Nama Copper plant, acquired in November 2023 from Mazule Resources for R200 million.

US equity futures are moving lower in pre-market trading, probably due to the Meta sell off. The Rand is at R19.22 to the greenback.

There are more big earnings releases this evening from Microsoft and Google. Those will set the tone in our office tomorrow, given our hefty investments in both. Other well-known companies to report are Intel, Airbus, and Caterpillar.

All the best.