Market scorecard

US markets ended the week on a downbeat note, wrapping up what turned out to be the worst week since 2022. The tech-heavy Nasdaq took the biggest hit, with a 5.5% decline over 5 days, while the broader S&P 500 dropped by 3.1%. Notably, Nvidia experienced a significant setback, tumbling by 10% on Friday, marking its largest one-day loss in four years.

In company news, American Express rose 6.2% after reporting good earnings as new card sign-ups accelerated. United Health climbed 1.6%, finishing the week up 14% after its quarterly numbers beat Wall Street's expectations. Lastly, TikTok plans to challenge in court any US law mandating a ban or divestiture of the Chinese-owned app, if the proposed US bills are implemented.

On Friday, the JSE All-share was up 0.13%, the S&P 500 fell 0.88%, and the Nasdaq was 2.05% lower.

Our 10c worth

Michael's musings

On Thursday night, Netflix released a solid set of quarterly results, beating the street's revenue, profit and subscriber number expectations. Revenue increased 15% to $9.37 billion for the quarter. More importantly, operating income grew 54% to $2.63 billion thanks to their operating margins expanding from 21% to 28%.

Netflix's ad-tier plan is a year old, and its subscriber numbers increased 65%. In regions where the ad-tier membership is offered, 40% of new sign-ups came from that option.

Despite these good numbers, the main talking point from the results is that from next year, Netflix won't publish subscriber data. In years gone by, subscriber growth numbers were almost the only metric that financial analysts cared about. The theory was that profitability didn't matter, as long as subscriber numbers were growing, because when the business matured, costs would stabilise, but streaming revenue would continue to increase.

Now that the growth in the streaming market is slowing, Netflix doesn't want investors to get distracted by subscriber numbers, but rather judge it on the more important metrics of revenue growth and operating profit. Investment analysts don't seem to agree, pushing the share price lower on the day. Not knowing subscriber numbers makes it significantly more difficult to forecast sales and profit numbers.

Netflix has a large and established customer base, and even though new sign-ups are slowing, it is able to grow profits through price increases and by drawing more advertisers into its ecosystem. Is it safe to say that Netflix has won the streaming wars? I think so.

One thing, from Paul

Markets were rotten last week. Vestact clients would not have had a pleasant Saturday morning, waking up to receive their weekly mini-statements and noticing a nasty fall from the prior weekend.

As you know, we own volatile securities, whose prices are set in the market, not set in stone. We have to take the rough with the smooth.

The most significant recent shift in the general market narrative has been the sense that US inflation is stuck at 3% per annum, so the Fed won't cut interest rates any time soon. They want it at 2% before making a move.

In my opinion, a breakthrough to lower shelter inflation in the US is imminent. Let's be patient.

Higher interest rates are not really a problem for healthy companies, but they do lower the current value that investors place on earnings expected more than two years hence.

If that doesn't make sense, go to Google and search "discount rate."

Byron's beats

The largest solar plant in South Africa was officially opened recently near Keinhardt in the Northern Cape. The panels can produce 540MW, while the backup battery system can support 1 140MWH of storage, according to energy expert Anton Eberhard.

The plant, which consists of nearly 1 million panels, spans 9km from one end to the other and cost around R18 billion to build. Norwegian renewable energy company Scatec built the project as part of the Renewable Energy Independent Power Producer Programme launched by the government in 2011.

This is all good news of course but the procurement process to the grid is a bit of a mess. At this stage, the site only delivers 150MW, far below its potential. The rest is going to waste it seems.

Below is what the plant looks like, very impressive. Gwede, get the rest of that energy into the grid ASAP!

Bright's banter

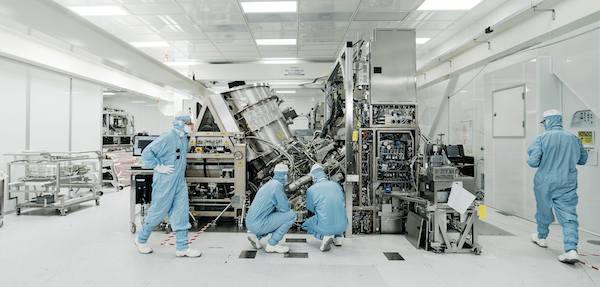

ASML, a key player in chip manufacturing equipment, remains confident in the semiconductor industry's future, despite disappointing first-quarter results. The Netherlands-based company saw a big drop in net bookings to EUR 3.6 billion, below analysts' expectations of over EUR 5 billion.

Factors such as restrictions on China buying advanced chip technology and lower demand from less complicated chip manufacturing facilities affected ASML's performance. However, outgoing CEO Peter Wennink emphasised that 2024 is a "transition year," with expectations of improvement in the second half.

ASML's shares took a hit, dropping 7% on the day. The company's first-quarter sales fell to EUR 5.3 billion, down from EUR6.7 billion a year earlier. Profits also declined by 37% to EUR 1.2 billion year-on-year.

Nearly half of ASML's system sales were to China, notwithstanding US efforts to restrict shipments of high-end machines. ASML's lithography machines, which use extreme ultraviolet (EUV) light, play a crucial role in etching circuits onto silicon wafers, enabling the creation of more powerful chips.

Linkfest, lap it up

How can your financial success benefit others? Leave the children enough so that they can do anything but not so much that they can do nothing - How to think about your money, charity, and death.

Cocoa prices are about 5x higher than usual. A mixture of late ordering and a smaller crop size pushed prices vertical - Cocoa prices are now the highest they've ever been.

Signing off

Asian markets rebounded this morning, recouping some of those big losses we saw last week. Benchmarks rose in India, Hong Kong, Japan, and South Korea, while mainland China pulled back slightly.

Locally, Old Mutual announced that the Reserve Bank's Prudential Authority had given them the green light to establish a new bank. This doesn't make much sense considering they offloaded their stake in Nedbank not so long ago. The macro conditions aren't exactly favourable either.

US equity futures are sharply higher pre-market. The Rand is trading at around R19.10 to the US Dollar.

This week, SAP, Visa, Tesla, Pepsico, Meta, ServiceNow, Microsoft, Alphabet, Intel, and Exxon Mobil are some of the companies that will report their first-quarter earnings.

Have a good week. Enjoy the warm weather across the country.