Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Do not freak out when you see the Apple share price down 85 percent today, until of course everyone figures out that the company today does their 7 for 1 split. Why seven for one, I am not exactly sure. In the original announcement, in April this year, no reason was given: Board of Directors also Approves Seven-for-One Stock Split. The only people who really care whether or not your share price is "high" or "low" relative to one another are the folks who manufacture the index. If you read the DJ indices website Overview section, I notice something strange about the inclusion mechanism. The 30 stocks now in the Dow Jones Industrial Average are all major factors in their industries, and their stocks are widely held by individuals and institutional investors.

So why would Apple, with their nearly 580 billion Dollar market cap not get a look in? The last reshuffle was done in September last year, with Nike, Goldman Sachs and Visa coming in. But the folks creating the index, that is supposed to represent industrial America, have not included Apple because of their "high" share price. There is a divisor, which takes all 30 share prices, adds them together, and then multiplies by that number by 0.125552709. I don't know about you, but this seems like a made up index that was good a number of years ago, but perhaps not as relevant today. I expect Apple to be included in the index soon, but that may mean nothing but bragging rights.

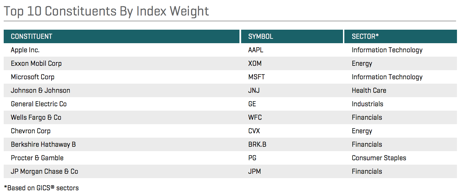

More important for the average investor is to follow the broader market, the S&P 500. As per the fact sheet, which you download from there, then find Methodology Construction, the quick facts represent something easier, from a level point of view. Biggest company, Apple. Check it out, from the fact sheet.

So. Of all of those companies, Apple (the biggest by market cap) through to JP Morgan, only Apple and Wells Fargo are not Dow Jones Industrial Average components. Wells Fargo I can understand, the definition of Industrial companies is non financial, and whilst Apple might well be considered by some as the largest hedge fund in the world (all that cash 150 billion Dollars of it), the company is a hardware and software one. I suspect that in a matter of months we will see a review and Apple will replace one of the other companies in the Dow, the question is, which one? Intel or IBM? Or Cisco? Or will another non-industry related company exit? Coca-Cola? United Technologies? We will see sooner than one thinks.