Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Facebook has finally filed for an IPO last evening and is looking to raise five billion Dollars. Page four of the document sums up a lot of the stuff we know about Facebook, but they told us anyhow. "We had 845 million MAUs as of December 31, 2011, an increase of 39% as compared to 608 million MAUs as of December 31, 2010." MAU stands for Monthly Active User. "Our users generated an average of 2.7 billion Likes and Comments per day during the three months ended December 31, 2011." 250 million photos uploaded every day. And wait for it, 100 billion friendships. So each user has on average 110 friends or so. Nice. And there I thought that nobody had any friends.

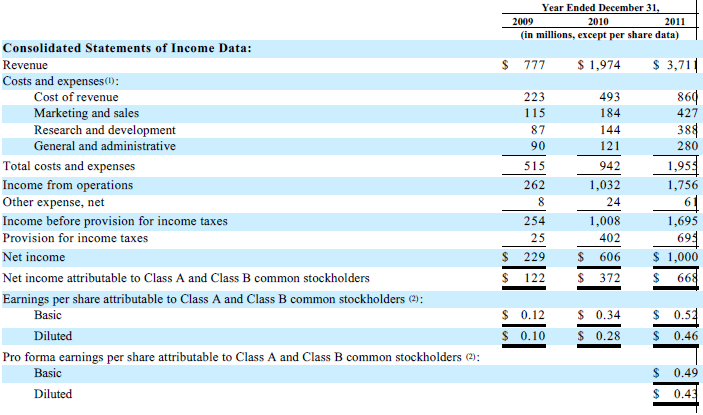

Their mission statement: "To make the world more open and connected." I like that too. OK, the important stuff. Revenue of 3.7 billion Dollars last year and net income of around 1 billion Dollars. So, it is quite a profitable business. But what is it actually worth? Is a like or a comment worth something? Is loading a photo up to your profile worth something? Well, here goes, have a look for yourself:

In fact, have a look at the whole IPO document yourself -> Facebook, Inc. It is huge. OK, 43 cents worth of earnings per share. On the OTC platform that existed for trading of Facebook stock the price was around 38 Dollars per share. So, Mr. Market already has given the company a very lofty valuation. Very lofty. So revenue has increased by a factor of five in just two years. Profits up four fold. As are costs though, the hiring has been pretty aggressive, but the company has said that they are not going to be hiring so much in the short term.

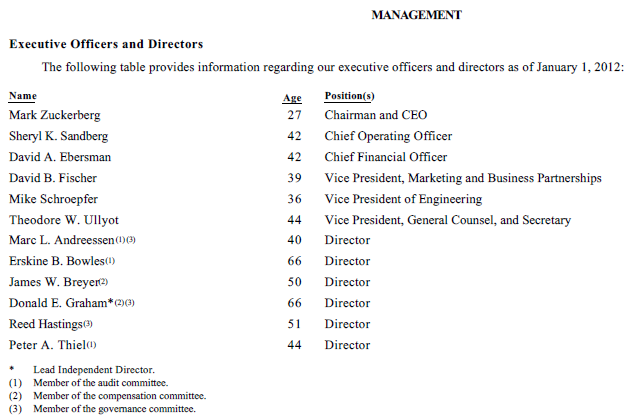

But this means nothing. Because all you care about is "the Zuck". Mark Zuckerberg. The richest young man in the world. Who earned 1,487,362 Dollars last year. And will only earn 1 Dollar a year from January 2013. It is going to be a tough year next year for the Zuck. Sound familiar? Do not feel sorry for him however. He gets 120 million extra shares at listing at a mere 6 cents a share, which he can choose to exercise before the 7th of November 2015. Nice. So he will own more or less 28 percent of the business, valuing him at between 21 to 28 billion Dollars, according to the WSJ. 9th on the Forbes list is what the WSJ is telling me.

Do not worry too much about the Zuck's age, check this out about the rest of the management team, not his roommate but the execs. Do not let that worry you. In fact reset your own reality if age matters. Sachin Tendulkar is a good example:

Not finished this Facebook "thingie" at all. Byron's beats continues with this exciting company, sharing his own thoughts.

There are hundreds of articles being written about Facebook, its potential as an investment and its potential to change the world more than it already has. Of all the articles I have read, this one seemed to make the most sense. The article attempts to compare Google with Facebook and is based on a debate between the Author, Jeff Matthews who backs Facebook and Henry Blodget, the CEO of Business Insider, who argues for Google.

Here is what Blodget had to say about Google which makes a lot of sense. "And why is search such a better business than social networking? Because search is the best advertising product in the history of the world….it is advertising space that can capture the consumer's attention at the exact moment that the consumer is looking for something to buy." Exactly, you use search to find things to buy, what more could an advertiser want?

Blodget's argument continues to compare Facebook to a social party with adverts hanging on the walls. Its effective but limited because people are there to socialise. I tend to disagree however and like what Matthews has to say. Facebook has a different dimension. It can convince people to buy goods when they are not looking to consume the product. They may not even know they want it yet. And to me that is the essence of advertising, especially when you are launching a new product. This piece by Matthews was the final straw that convinced me this company is going to explode.

"But the magic of Facebook's targeting doesn't stop with countries or education. If I wanted to, I could advertise to all 10,141,480 Facebook users with birthdays that happen in a week or less. Think about that. And if you really want your head to spin, think about this: according to a friend in retailing, the average Facebook woman updates her relationship status to "Engaged" within two hours of the guy actually proposing…so Facebook sells that relationship status information to retailers who have bridal registries."

As a South African consumer I had a look at the adverts on my page. I was offered a student loan from Standard Bank and some Springbok memorabilia. Personally I have never clicked on a Facebook ad but I think we underestimate the culture of online retail in the developed world. We are still far behind in that department and even our advertisers have not taken advantage of Facebook yet. I would definitely click on an ad if it tickled my fancy, that has just not happened yet. But it will, as local companies pick up on this trend.

Ok so we know the company is going to make a lot of money but what about these valuations? There is no point buying shares in a good company if the price has already factored in its profits for the next ten years. Personally I think the company's potential is still underrated. I remember when the company was valued at $10bn and people said that that was absolutely ridiculous when you looked at the earnings. Well now, a few years later, that valuation would give the company a PE of 10. Yes $100bn sounds like a lot for $1bn in earnings but some companies need to be valued in different ways. Social networking is very new to Wall Street. Maybe a valuation per user is more accurate. In Facebook's case that would value each user at around $120. We'll have to see what happens on the day it lists but I'll bet my bottom dollar it will fly beyond all expectations.