Let us crunch the Apple inc. quarterly numbers, which were released after the bell. I am trying to care less and less about what the expectations are, because that is not what we do here, we DO NOT want to contract quarteritis. Quarteritis is not a disease, but rather an affliction of sorts, where you measure the performance of a company on a quarter to quarter basis. It is the wrong way to go about investing! Having said that, hah-hah, let us have a look at these quarterlies. Record quarterly revenues and records sales across their iPhones and iPads, and their Macs too, iPods are so last decade. Check it out:

"The Company sold 37.04 million iPhones in the quarter, representing 128 percent unit growth over the year-ago quarter. Apple sold 15.43 million iPads during the quarter, a 111 percent unit increase over the year-ago quarter. The Company sold 5.2 million Macs during the quarter, a 26 percent unit increase over the year-ago quarter. Apple sold 15.4 million iPods, a 21 percent unit decline from the year-ago quarter."

This translated into sales of 46.33 billion Dollars for the quarter (58 percent of sales outside of the USA), record profits of 13.06 billion Dollars. And 13.87 Dollars per share. Wow. And gross margins widened to 44.7 percent, when compared to 38.5 percent in the corresponding quarter. Now that is one of the metrics that in our world (and most, to be fair) is very important. Growing revenues and margins at the same time.

The iPhone segment recorded revenues of 24.417 billion Dollars, the iPad 9.153 Dollars, with the Mac 6.598 billion Dollars. It is unbelievable to think that the iPhone sales are three and a half times Mac sales. What people forget is that the iPhone was only released on the 29th of June 2009. That was less than 1000 days ago. 941 to be exact. That is only 134 weeks. Or almost 31 months. That is right, the iPhone, a product that sold over 37 million units last quarter, was released less than three years ago. Amazing, and to think that we are currently on version five, the iPhone 4S, I have seen them, Byron has one as has my wife. Neither of them have let go of them long enough to let me have a look, that tells you all you need to know. But think about it. You hear folks say, ah well they have not released a new phone for a while. Nonsense, at this run rate there is a release of a new iPhone every 200 days or so. Even that is not enough to satisfy our credit card hyperactive consumer society. That is a point worth making.

The iPad, that turns two years old on Friday. That is right, that is when we first saw it. And we asked questions like, well it is not a phone, it is not a computer, seemingly it was not for me. Wrong! The release date in 2010 in the US was 3 April, the international release date was 28 May 2010. 94 weeks ago we saw the iPad "in the flesh" for the first time.

Amazing.

Products that everybody wants, packaged absolutely beautifully, this is not an out and out tech stock. There is an element of luxury in the company, their products are not cheap. There are long queues associated with the release of a new product, even if it does not wow initially, the consumer is stilled amazed. It is still perhaps the most

wow mainstream consumer electronic device(s) that I have ever seen. The critical question for us however is, are there long queues that still remain for the stock of the company? Is the stock cheap, even if the products are not? Are folks wow for the stock?

The short answer is yes. The stock in the post market of these blow out numbers bid the stock up heavily. After hours the stock is trading at 451 Dollars a share, an increase of over seven percent. Which means that the company should be the most valuable, by market capitalisation in America. When the market opens, don't jump the gun. So clearly all the market participants think that this is the case. The one criticism that I did hear is that their cash management is just poor. I have taken their balance sheet from the release to emphasise the point that some folks are making.

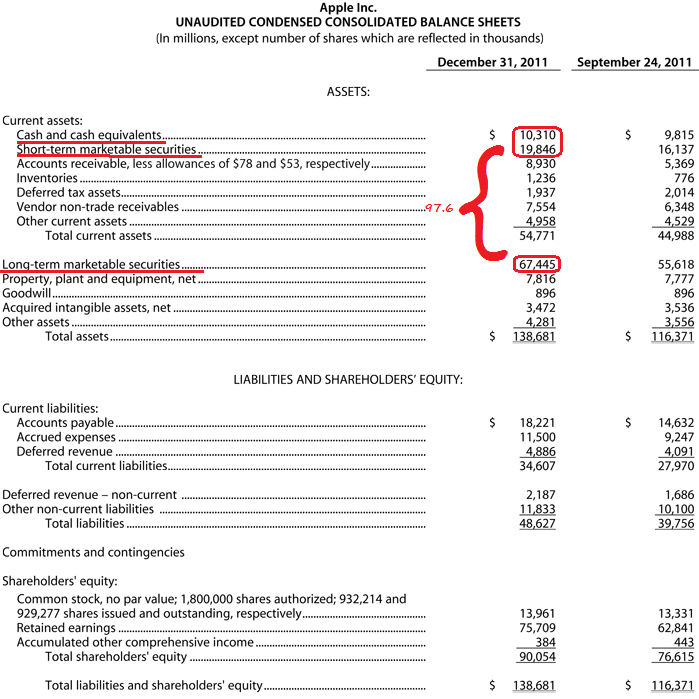

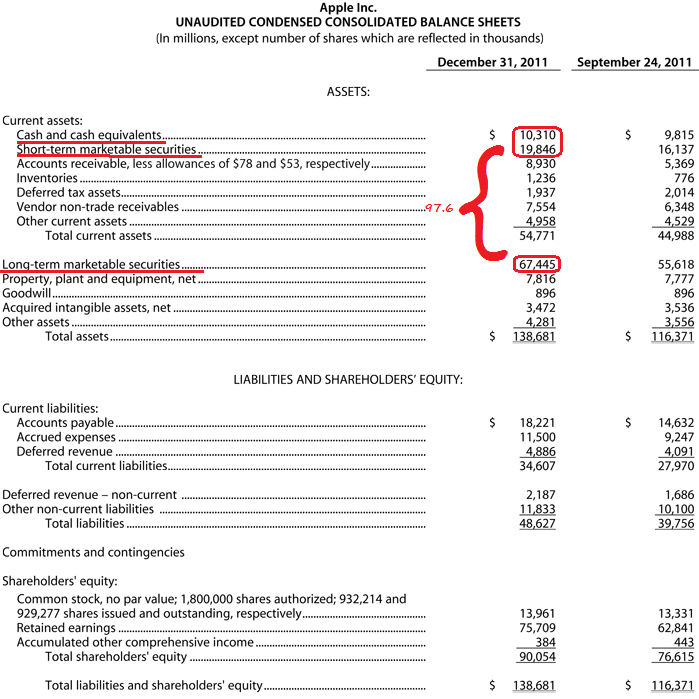

The company has 97.601 billion Dollars worth of cash. Did you hear that line or did you faint? It is not all cash, but rather made up as follows:

Shouldn't shareholders be entitled to this money? The main problem is that because the company earns a lot of money outside of the US, that cash does not return to the US, because of the high corporate tax rates. But also, because loop holes exists in which US domiciled corporations are able to get away with very low rates. Think GE for example. This needs to change. And must, fast. Because as you can imagine, companies will eventually find more favourable places to operate. Just back to that cash quickly, 97.6 billion Dollars. That is 104.81 Dollars per share of cash. At the suggested opening price of 451 Dollars a share that is 23.2 percent cash. So I am guessing, even with the guidance of around 8.50 Dollars of earnings per share for the current quarter, the company looks real cheap. Real cheap. There will come a time when Samsung perhaps has a wow product, but for the time being everyone wants an Apple product. So watch it, stay in the stock, even buy the stock on these cheap valuations. But watch it a whole lot closer than you would anything else.