Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

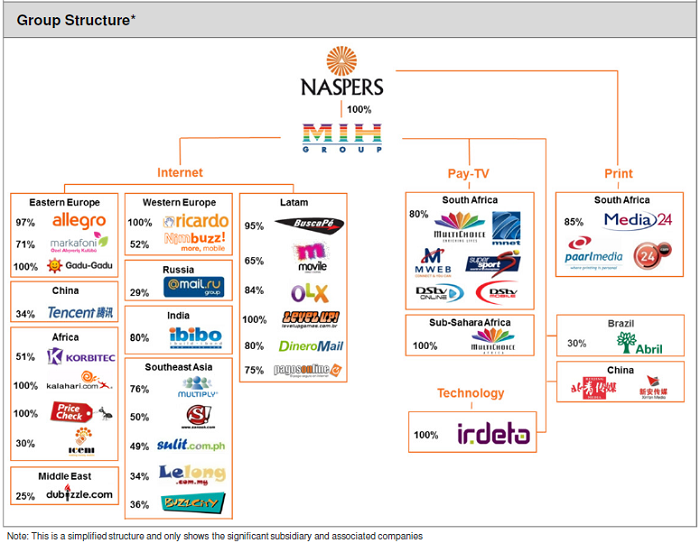

And this morning we have results from Naspers, we will immediately jump into those results. These are for the first six months of their financial year. Consolidated revenues increased 17 percent to nearly 18.5 billion Rands, with "core headline earnings" clocking 3.458 billion Rands. Earnings per share for the six months came in at 921 cents, which is a modest improvement on the 860 cents reported this time last year. Someone once described this business and stock as part NAV, part earnings. Before we start on what the right price is for the business, check out the group structure:

We often do the math on this sort of valuation, as per above, and we have done exactly that this morning. First TenCent, which is listed in Hong Kong. It (TenCent) has NOT had a good time of it lately, the share price, not the business. Over the last calendar year the share price of TenCent is down 16 percent. And TenCent trades on an earnings multiple of 22 times. And a very, very modest dividend. 34 percent of the market value of TenCent (that is what Naspers owns) at 1.0745 ZAR to the Hong Kong Dollar of 256 billion HKD, that equates to a little over 93 billion ZAR. The current market capitalisation of Naspers (at last close) is 144 billion ZAR. So the local market is doing two things, one, it does not believe that the stake in TenCent is nearly worth 100 billion Rands as the Hong Kong market values it, or two, the rest of the assets are not worth 50 billion ZAR. Take your pick!

Here is the commentary on the TenCent business from Naspers in the official release: "In China, Tencent achieved solid growth in an increasingly competitive market. Our share of revenues grew by 46% to R4,9bn and trading profits were up 27% to R2,1bn. The QQ IM platforms now manage 145 million peak simultaneous users. QZone services and online games also grew well." 145 million users all at the same time? My observations about TenCent users and Facebook (see below) are one and the same, how much are you willing to pay for all these users?

So what are the rest of the assets? Pay TV and print, and their other internet businesses, that is the way that I see it. So first, Pay TV grew revenues for the half by 14 percent to 11.6 billion Rands with trading profits of 3.414 billion Rands for the half year. I would not be surprised to see the Pay TV business make just less than 6 billion of profits for the full year. So what would you pay for a business that in a tough year grew profitability nearly ten percent? Ten times earnings? 7 times earnings? At seven times earnings, a very, very modest valuation, that would value the business at around 40 billion ZAR. If you value the business on ten times earnings you get to 60 billion Rands.

But wait, for example, Comcast trades on 15 times earnings, in a developed market. If you apply that valuation to the pay TV business you get to around 90 billion Rands. And more importantly access to an African market that is football hungry, do you remember Paul interviewing my old mate Luyanda Peter, Marketing Manager for Supersport? I kid you not, I played cricket and rugby in junior (and senior) school with him. He could swing the ball both ways and he was tricky to face, quite tall. He should have bowled more.

And then the print business, what people call old media. For the first half that part of the business made (trading profit) 247 million Rands. Which was 31 percent less than the first six months last year, not good, but that is the nature of the business. So what would you pay for these old media businesses? Let us presume that the business makes 500 million for the full year. The New York Times company is making a loss. Gannett (which owns USA today) trades on a whole five times earnings!!!! So I would guess, when making your overall analysis of this business, don't afford more than that. 2.5 billion ZAR???? Ironically at that valuation the print media assets of Naspers would be more than that of Avusa. In case you missed Byron's beats on Avusa last week -> Avusa results.

I guess for the purposes of this valuation, ignore the print media assets.

Onto the next set of assets, which are tricky to value. In fact, no, let me rephrase, those assets, the other internet assets make a modest profit. Mail.ru for instance for the half, the Naspers stake returned a mere 178 million Rands. Which might not sound like much, but I can bet you that this time next year, the contribution in their stake in Mail.ru will be more than that of the local print business. Phew, there, I said it. Remember that Naspers own around 29 percent of Mail.ru. Mail.ru trades at 30 Dollars per share. Valuing the company on some alternative platform in London at 4.4 billion Pounds, which is around 57 billion Rands. This is important, because their (Naspers) shareholding in Mail.ru at around 12.9 ZAR to the Pound Sterling is valued currently by the market at a little less than 16.5 billion ZAR. But that seems a little expensive, don't you think? I suspect that is what the local market is telling you.

They are investing heavily in their business, with development costs as percentage of revenue over six percent. Total development costs for the six months is high, 1.125 billion Rands, which is 78 percent more than this time last year. 55 percent of that is in the development of their internet businesses, 35 percent in their Pay TV businesses and the balance (10 percent) in other!! So you know where all their resources are being deployed, definitely not in the old businesses.

There are a whole host of really good internet business in early growth stage, that will become increasingly important over time. Buscape in Brazil seems like a mix of old and new business, The ibibo business (a JV with TenCent) in India could in future replicate the successes of TenCent in China. Do not underestimate the Markafoni business in Turkey, as the Financial results presentation points out, the country has the 12th biggest internet population. Pay TV is growing nicely too, adding loads of new subscribers, not just here in South Africa (thanks Super Diski) but also through the rest of Africa. Also, around one in four PVR users (571 thousand in South Africa alone) have signed up for BoxOffice. Goodbye local DVD store, yip, it is happening already.

OK, that is all very nice, you can add up all those stakes (trying to do a sum of the parts calculation) in the main parts and say, well that is worth a lot more than the market affords Naspers here locally. Why do you think that is? Well, there are many a holding company who trade at a discount to their NAV. So do not fight the collective wisdom of the market and say, well they should know better. The price of the stock is currently 350 ZAR, and has been much higher, in fact it has topped 400 ZAR a share this year. This year the performance has been less than stellar. Pretty weak actually, but that is what is up this year for most of the market!!

The outlook, well, cautious: "Indications are that overall revenue growth should remain fairly robust over the next six months. By contrast, and as previously warned, growth of the profit line will be affected by an acceleration of organic development spend in several of our businesses. We continue to believe that this strategy is sound and will stimulate long-term growth."

A strange way to end off, but what is Naspers? Or rather, how should you classify this business? I think once who have seen through the haze, you would see that it is an emerging market (Russia, China, Turkey, Brazil, India, South Africa, amongst others) internet business with a solid and growing pay TV business across the African continent! And those markets are set to grow far faster than developed market. Happy to be owners of the stock, there might be some time until there is any "real action", but we would continue to advise that one remains in accumulate mode!