Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

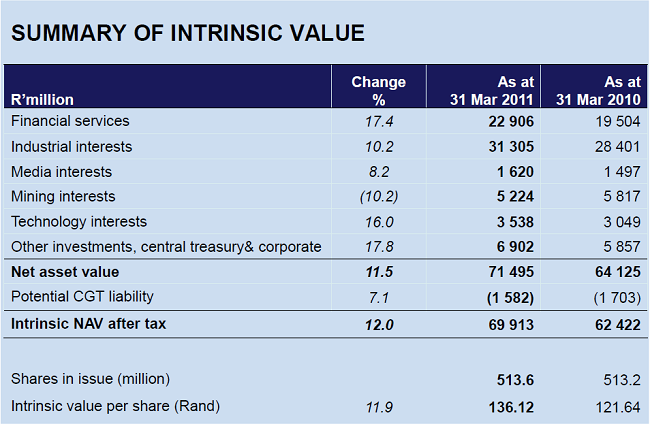

Anyhows, Remgro released results yesterday, this is for the full year to end March 2011. The headlines that I saw that grabbed me the most was, Remgro, still smoking without BAT. Quite, HEPS up over 17 percent to 811 cents per share. Remember that Remgro are in the middle of changing their year end and are expected to only pay their final dividend when they report for the 15 months to June, and that dividend payment is expected to be in November. Please do not patronise me and say that the intrinsic value is 136.12 ZAR per share when the stock trades at 110.59 ZAR a share. Are you telling me that the balance of the market are dumb to apply a 20 odd percent discount to your implied NAV? I guess that is what you are telling market participants.

My point is, if you have taken the time and effort to buy companies in the equities market, why buy a company that buys companies? You can diversify yourself, rather buy Exchange Traded Funds if you want diversification. Of course there are some interesting stakes in Remgro that you cannot buy in the open market, that could or could not be interesting like Total or Unilever SA, Tracker, SEACOM or even Air products. But those are really small compared to their value in Medi-Clinic, Distell and Rainbow Chickens. They have sold their 13 and a bit percent interest in Nampak at the end of last year, we have in the history of this business never wanted to own Nampak.

Other listed entity stakes include RMB Holdings, RMI Holdings (gained through the unbundling) and FirstRand. I could own those in the market if I wanted. Why entrust your market investing activities to the brains trust of someone else, that sounds like absolving yourself of the responsibilities of paying attention to individual stocks. My idea of a diversified business is BHP Billiton.

If you look at the Results Presentation for the twelve months ended 31 March 2011 on page 28, you get the following summary:

By my tally from earlier this suggests that 39 out of the 69 billion ZAR worth of the assets are listed. And to be honest, only the small media and tech interests are about all that excite me. No thanks, this might be an old favourite but industrial conglomerates in my mind should be more like General Electric.