Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

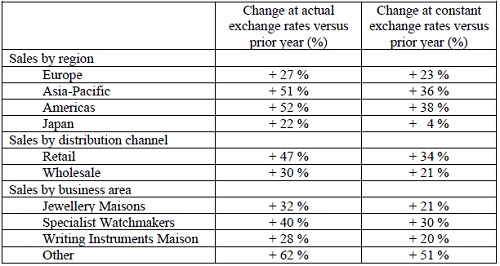

Richemont released a sales update for the five months to the end of August this morning. I must say that it looks more than a little impressive. As they point out though: "The strong growth in sales reflects, in part, the low comparative figures reported in the prior period." A picture tells a thousand words (even if it is a table), check out the sales updates for their various geographies and through the different business segments.

Looks phenomenal not so? They do say off a relatively low base, but still, growth in Asia-Pacific is awesome. And a monster bounce back in the America's region, Japan is still as exciting as Sudoku. For me, my mother in law loves it, please don't tell her.

However, and this is almost always the case, Johann Rupert says to be cautious. He always does, but take a read and let me know what you think:

"The improved trading environment is certainly welcomed. However, it is far too soon to draw any conclusions about the sustainability of the economic recovery or whether the recession is truly behind us. This time last year we were still seeing falling sales. This year, with double-digit sales growth already in hand, Richemont will report significantly higher first half profit. However, the rest of the year is less straightforward. In the second half of last year, we saw some recovery in sales, setting higher comparative figures against which sales in the six months from October to March will be measured. Relative to the present conditions, those comparative figures were achieved with a weaker euro against the dollar and yen. Compared to the second half of last year, the current strength of the Swiss franc will be negative for the cost of sales."