Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Naspers results this morning, for the first half. Before we jump into these numbers, remember through their stake in DST global that they have small indirect investments in Facebook and also in a business called Groupon. Last night Twitter was abuzz (well, the nerds I follow anyhow, it hardly is going to be a trending topic) with news that Google were looking to acquire Groupon. The Business Insider suggested that this was not going to be the case: No, Google Has Not Bought Groupon Yet. And then, DST was about to make a 100 million Dollar investment in Twitter and value the entity at 4 billion Dollars. That has traditionally been DST Global CEO's Yuri Milner's style. And Naspers style is let these alpha males run the businesses.

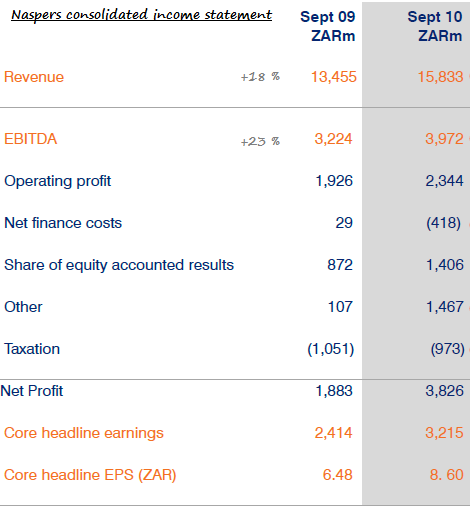

Naspers highlights column includes "consolidated revenues (up) by 18% and core headline earnings (increased) by 33%". "Major areas of growth were the internet and pay-television businesses. Our print media business has shown some recovery, whilst the technology business improved margins."

All good, and then the "new": "The group consolidated its internet interests in Russia, acquiring a 28,7% interest in Digital Sky Technologies ("DST") by contributing existing assets and cash. DST was subsequently renamed Mail.ru group. On 5 November 2010 Mail.ru group was listed on the London Stock Exchange and presently has a market capitalisation of some US$7,1bn. Our share is therefore worth approximately US$2bn." So, over 14 billion Rands. Just a little less than ten percent of the current market capitalisation. Astonishing.

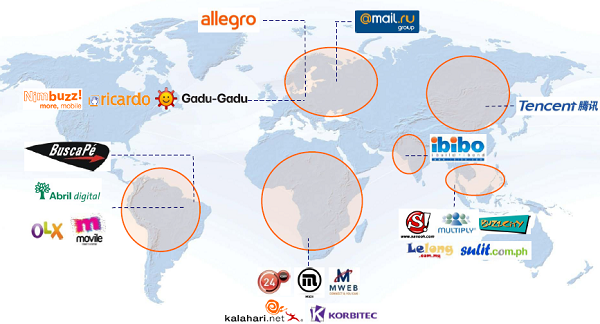

This is a great graphic (thanks IR at Naspers) of their internet businesses, across the globe, from TenCent in China through Easter Europe and onto Brazil, check it out:

OK, check their consolidated income statement out, I have hacked this along with the above graphic from their analyst presentation:

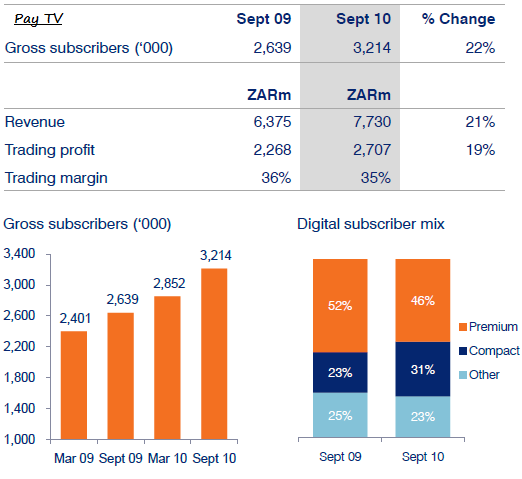

The old business (not the print, but rather TV) is still the major contributor:

OK, core earnings per share were 860 ZAR cents for the half, with no dividend. Gearing is low, there is a whole lot of cash here and just recently a Dollar bond has been floated. I think in Ireland of all places. EBITDA margins are increasing, thanks to bigger contributions from the internet businesses. The group is pretty cautious about the next half, saying that the satellite TV business should slow a bit, post world cup. And that there could be greater regulation. But all things considered I must admit we are pretty pleased with these results.