Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Visa reported after hours. Been through a tough time lately as government look to crimp their margins in the US, with a cap on what they can charge. Our simple thesis on these electronic payment processing folk like Visa is that as we switch to everything from internet transactions, more debit cards with less notes and checks (cheques) transactions, it is the fellows processing that will make money. And this is not just in the developed world, moving away from traditional payment systems. As listed entities, both Visa and MasterCard are relatively new. Visa listed in May 2008, MasterCard in May 2006.

OK, but into the Visa numbers post market last night. These are some pretty impressive lines:

"Payments volume growth, on a constant dollar basis, for the three months ended December 31, 2010, was a positive 15% over the prior year at $897 billion.

Cross border volume growth, on a constant dollar basis, was a positive 15% for the three months ended December 31, 2010.

Total processed transactions, which represent transactions processed by VisaNet, for the three months ended December 31, 2010, were 13 billion, a positive 15% increase over the prior year."

A whole lot of 15 percent increases. So basically that means that each human being every quarter transacts twice through the Visa payment systems. Is that less or more than you thought? In the USA, according to this page ---> Credit card statistics, industry facts, debt statistics from CreditCards.com there are nearly 610 million credit cards. And the average credit card carrier (ten year olds don't have such things) has around 3.5 cards each. So each household I guess should have 7 cards. And average outstanding debt per household is around 15800 US Dollars. Around 112 thousand ZAR. Now I guess that is a lot, but not unmanageable in the USA.

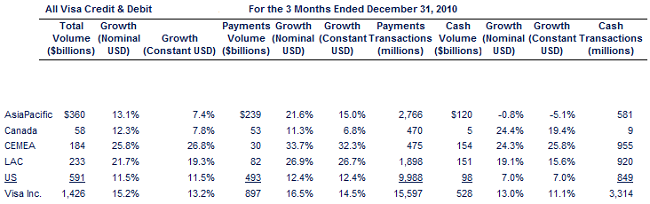

Net income was 884 million Dollars which translated to earnings per share of 1.23 Dollars for the quarter. Revenue of only 2.238 billion Dollars. Amazing, an extremely profitable business, but quite quickly you can work out what the payments fee is. The company does indicate that they are growing strongly across all segments, US debit and credit card, and international credit and debit cards growing strongly. Check out the global Visa debit and credit card revenue:

From this graphic you can tell that it is still pretty much an American revenue company, but growing strongly across all segments.

And the outlook looks good, the company themselves suggest as much:

"Visa Inc. affirms its financial outlook for the following metrics through 2011:

Annual net revenue growth: 11% to 15% range;

Client incentives as a percent of gross revenues: 16% to 16.5% range;

Marketing expenses: Less than $900 million;

Annual operating margin: About 60%;

GAAP tax rate: 36.5% to 37% range;

Annual diluted class A common stock earnings per share growth of greater than 20%;

Capital expenditures: Between $250-$275 million; and

Annual free cash flow in excess of $3 billion."

We like the company for the reasons initially mentioned. There is US government legislation that limits the fees of Visa and MasterCard. That is putting the cap on, but the stock looks cheap and is hugely cash generative. Who do you think will be the payments gateway for the mobile payments systems? Same people. We like it.