Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

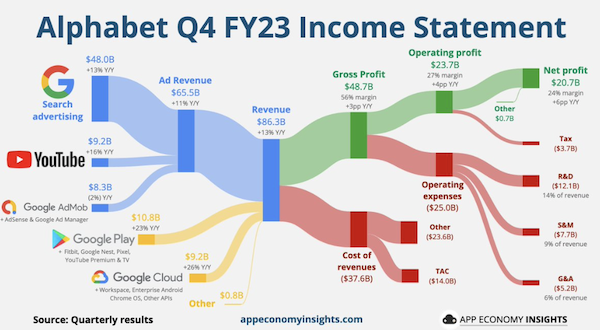

On Tuesday night Google released Q4 earnings. Revenues were up by 13%, its fastest sales growth since early 2022. Earnings also came in ahead of consensus due to better margins, while shares in issue declined by 2.5% year over year thanks to share buybacks. This business is in fantastic financial shape. They have net cash of $100bn and quarterly free cash flow of around $18bn. Lovely.

Sadly the share price took a hit after the release. It coincided with a day the Nasdaq was down 2%, thanks to the Fed, but underperformed badly by dropping 7.5%. The general consensus is that they missed slightly on advertising spend. Nothing to lose sleep about.

Naturally, there was a lot of AI speak. Unlike Microsoft, they are not charging customers immediately for AI services which means the upside is not yet tangible. Instead, Google is using AI to enhance the search and advertising experience for both customers and advertisers.

Their technologies are creating more targeted and relevant advertising which has been shown to raise conversion for advertisers by 18%. With image discovery campaigns they expect the conversions to rise by another 6%. A more effective product for clients means more money for Google.

The cloud business is still growing fast at 25.5%, but not quite as quick as their competitors Microsoft and Amazon. We still see a lot of potential for this division which will also see big AI improvements over time.

Google's subscription roster now brings in $15 billion a year. This includes YouTube Premium and Google One. Google One does not get talked about enough. It is the main competitor to Apple's IOS. Android (owned by Google) phone users buying apps, storage, music, etc is a huge profit driver.

Based on fundamentals Google remains one of the cheapest tech stocks, trading at 20 times 2024 earnings. It goes as low as 17 times on 2025 projections. This stock ticks all the boxes and remains one of our favourite. The image below shows you where all the money is being made.