Companies that make weight-loss drugs are attracting a lot of attention on Wall Street at the moment, and for good reason. Goldman Sachs estimates that these products will have sales of $100 billion by 2030.

Currently, only two companies are competing in the market, Eli Lilly and Novo Nordisk. If Goldman Sachs estimates are correct, both these companies have huge growth ahead. Amgen is planning to have its own drug available in 2027, assuming it passes all the regulatory tests and is effective.

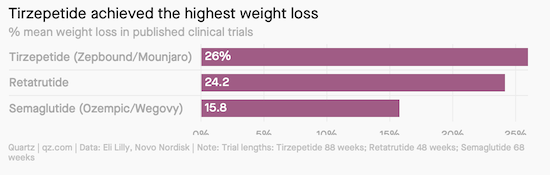

Vestact has chosen to back Eli Lilly for a few reasons. (1) It is an American company, so it should have an easier time selling to a US audience (patients, doctors and funders). (2) Its drugs are currently cheaper. (3) Early trials point to their drug being more effective, 26% mean weight loss compared to Novo Nordisk's 16%. (4) Eli Lilly has a second horse in the race with retatrutide, a drug still in trials but also proving effective.

Eli Lilly currently has an annual revenue of just under $33 billion. If it can capture only a third of the weight loss market, its revenue will double. We think Eli Lilly will capture more than 50%, which means its revenue will most likely triple over the next 7 years.

The market is also pricing in some steep growth, with Eli Lilly currently trading on a PE of 100. Profit growth will push that PE lower in time, but it will probably be a wild ride along the way.

Read more here - How Ozempic, Wegovy, and Mounjaro compare on weight loss effectiveness.