Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Eli Lilly could be a useful addition to your New York portfolio. This drug company has a portfolio of existing blockbusters, and has treatments for weight-loss and Alzheimer's in its near-term pipeline.

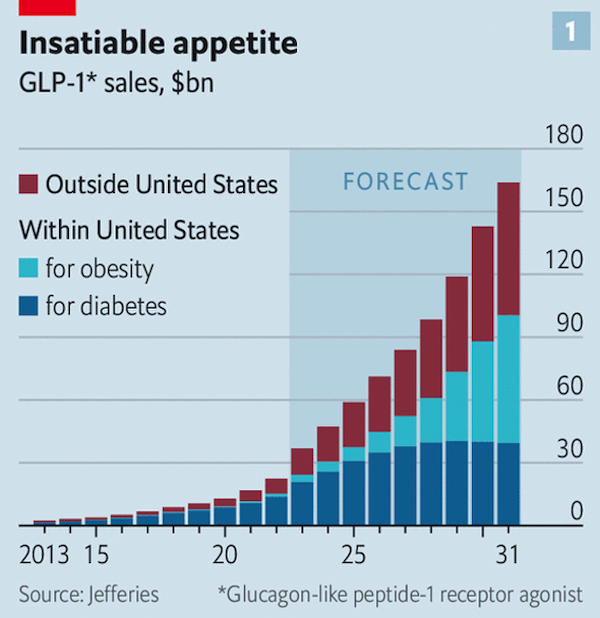

Obesity in America is very widespread, and the GLP-1 drugs sold by Eli Lilly, Novo Nordisk and (sometime later hopefully) Amgen, reduce people's appetite and slow their digestive systems. These drugs really work, allowing most people to lose 20% of their body weight in time, and they have negligible side effects. The chart below, from the Economist, shows that this could be a $160 billion sales opportunity by the end of the decade.

I made a Blunders video one year ago, suggesting Eli Lilly as an investment idea (warning, foul language). You can watch it here on YouTube.

The only problem with Eli Lilly is that the share price has already gone up a lot in the last few years. If something goes wrong, it has a long way to fall.

Lilly's GLP-1 formulation is called tirzepatide, and it will be marketed as Mounjaro for diabetes and Zepbound for weight loss. The company received FDA approval for the latter application last night, so it can finally go head-to-head with Novo's Ozempic and Wegovy.

Health insurers (what we call medical aids) in developed countries are on the brink of agreeing to pay for these drug prescriptions, because slimmer people have radically improved health outlooks.

These catalysts should push the Eli Lilly share price even higher. The market loves stocks with top-line growth potential.

Here's a link to their most recent results, which were released on the 2nd of November.

If you want to own Eli Lilly shares in your portfolio, send fresh funds to your New York account, and we'll buy you some.