Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Nike reported its latest quarterly earnings on Thursday night. Revenues were a little soft, up only 2.0% compared to last year, at $12.9 billion. Profits were much better than expected and inventories of unsold athletic gear declined nicely. As reported above, the stock price rose sharply on Friday.

Phew, what a relief! You may have noticed that Nike has had bad run this year, and the share price is down a lot from its all-time high back in November 2021.

The run-up in 2021 was caused by extraordinarily high sales of athleisure gear and running shoes during the work- and jog-from-home Covid period. The slump since then came from stock management problems, inflation worries, slowing sneaker sales in the US, and general concerns about the popularity of American brands in China.

What needs to happen for the price to return to all-time highs?

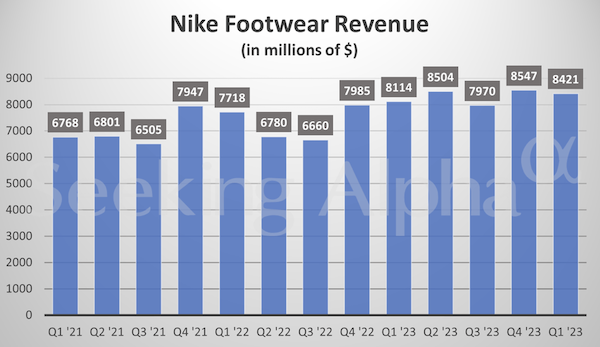

Sales of shoes need to re-accelerate. That category includes running shoes, soccer boots, basketball shoes, walking shoes, and casual sneakers. Look at the chart below, for the past three years. It's been a bit bumpy, but is rising over time, and needs to continue to do so.

We foresee ongoing demand for casual wear and exercise gear. Trendy youngsters need to buy themselves a new pair of Air Max sneakers. Heavy seniors need a new pair of Nike Air Monarch IVs. Serious runners need to replace their Alphaflys often.

Nike's designers need to keep coming up with technically sound, fashionable, premium-priced products that are better than those available from competitors. The upcoming Paris Olympics are a good opportunity to showcase their latest wares.

Nike's sales in greater China need to hold up. They are around 15% of total revenue and 20% of total profits. That will require a stronger economy there (above 5% GDP growth) and a defusing of the tensions between the US and China.

Finally, operating margins need to get back up to 15% (they were 12.5% this quarter). To do that Nike needs to sell more items via their iPhone app. Investments in new distribution centres and logistics management systems should help.

We've held Nike shares in Vestact portfolios for a very long time. We started buying them for clients in March 2011 and they've delivered an average gain of 12.5% per year since then. That's not too bad, but we're hoping for a better run in the next decade.