Last week Visa reported another pleasing set of quarterly numbers. Visa is a mainstay in the Vestact-recommended portfolio, the one that our clients have owned for the longest time. We started buying it when it listed in March 2008 at around (a split-adjusted) $13 a share. It now trades at $225 a share, a 1 655% return over that period.

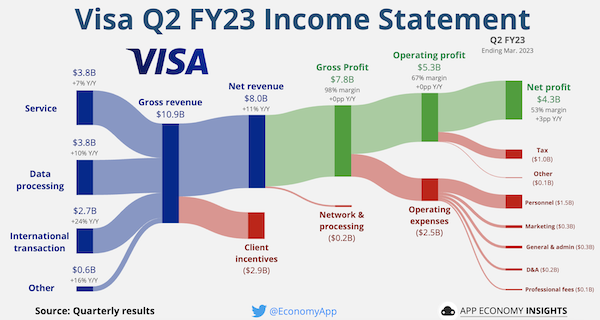

Sales and profits in Q1 2023 both beat estimates. Visa is a natural hedge against inflation because higher prices mean higher value card transactions, despite consumers feeling the pinch. The company processed $2.95 trillion dollars in payments for the three months. That's a lot of money!

The high-margin cross-border business continues to thrive post-Covid. Those transactions often include a juicy currency switch and grew 24% thanks to a revival in Asia as well as better numbers from Europe.

Visa must have one of the best net margins of any company on the US stock exchange. Take a look at that chunky green line in the image below. Just wonderful.

The stock trades at 22 times next year's earnings, which is in line with its average multiple since 2008. We still see plenty of upside for this fantastic business and suggest that every client own Visa shares.