Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

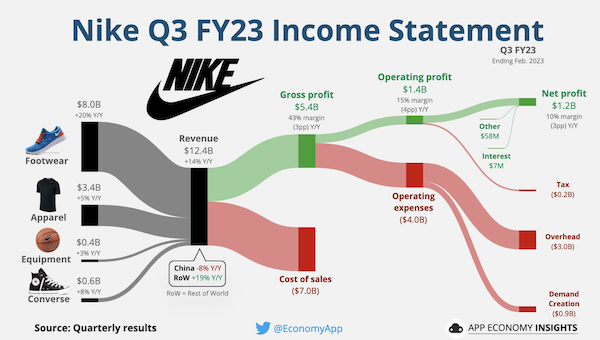

We always write up the results of our recommended companies in detail. Nike reported quarterly numbers this week that came in well ahead of expectations. Sales rose by 14% to $12.39 billion for the three months. They also raised their revenue growth target which bodes well for the year ahead.

Inventory went up by 16% due to soft sales in China, but Nike remains confident it will get those unsold shoes moved, and normalise stocks in the future. Higher markdowns have reduced profit margins slightly, and Nike's profit for the quarter was 11% lower to $1.24 billion.

Nike has put a great deal of effort into building its direct-to-consumer (DTC) channel in recent years, and that's paying off. During this quarter, direct sales went up by 17%, reaching $5.3 billion. Web and app (digital) sales went up by 20%, which is pretty impressive. In fact, digital sales now make up 27% of Nike's total revenues, which is a big increase from just 9% at the end of 2019.

Consumer spending has been affected by war, banking sector unrest, inflation, and rising interest rates, but demand for Nike products remains strong. The company has been able to increase prices across its portfolio and forecasts high mid-single-digit percentage revenue growth for the year ending in May. In China, the company is seeing an improvement in sales already, with a rebound in traffic at its stores.

Nike has taken steps to address supply-chain challenges, moving its production base around, reducing dependence of single suppliers and diversifying its wholesale partners. They put a lot of work into managing logistics costs and procuring well, to ensure profitability.

Nike is one of Vestact's core portfolio stocks, and we expect it to remain so. As Paul likes to tell all his running friends, go and buy yourself a pair of Nikes, that share price isn't going to go up by itself!