Market Scorecard

US markets surged again yesterday, after another day of financial sector drama. San Francisco-based First Republic Bank announced that it would receive a deposit of $30 billion from a consortium of 11 of America's largest banks. This appeared to ease some liquidity and contagion worries, but also lessens the likelihood of (m)any more rate hikes from the Fed. Growth stocks in the communication services and information technology zoomed higher. Suits us, thank you very much.

In company news, Google, Nvidia and Microsoft all rose over 4% on good vibes and enthusiasm about new AI tools. Snap and Meta closed up 7.3% and 3.6%, respectively, after the Biden administration threatened to ban TikTok in the US. Finally, Transaction Capital closed down another 40% on the JSE, now trading at a dismal R8.78. Their share price collapsed following a vague trading statement; the market is assuming the worst while we wait for official numbers.

In short, the

JSE All-share closed up 0.01%, the

S&P 500 rose 1.76%, and the

Nasdaq was a splendid 2.48% higher.

Our 10c Worth

One Thing, From Paul

Here's my Friday advice for the week:

try to live for as many years as possible.

We all know older persons who have physical or cognitive problems, and have watched them battle in their last years, with a poor quality of life. In reaction to cases like these, some middle-aged people (in other words, those in their 50s and 60s) say they'd like to be exterminated when they reach a milestone, like 80 years. That's ridiculous, in my view.

If you do the right things and are fairly lucky, you can be healthy, happy and make it to 100.

Over the past decade, scientists have learned a great deal about maintaining vitality into our later years. We now know the basic requirements for long-term health and well-being.

Here are the key points: (1) get a lot of exercise; (2) maintain deep social ties; (3) stay lean by eating clean; (4) travel and de-stress regularly; and (5) live with passion and purpose.

No excuses, just get on it.

Byron's Beats

I really like the idea of carbon credits because I believe that the profit incentive is the biggest driver for action and efficiencies. In case you do not know what carbon credits are, here's a quick explainer. A carbon credit is a permit that allows the owner to release a certain amount of carbon into the atmosphere. That permit gets a monetary value and is freely traded. Basically, a company who is a heavy polluter can buy carbon credits from another company that specialises in removing carbon from the atmosphere, by planting many trees for example, a net positive for the environment.

A great example of this working well is Tesla. Tesla was able to finance a huge parts of their business in the early days through carbon credits. Without being able to sell carbon credits to dirty companies they may have gone under before achieving large scale EV production.

Nick Hedley recently wrote a good

article for News 24 about how carbon credits could really benefit South Africa.

Our country as well as the rest Africa has vast tracts of wilderness which could potentially sell carbon credits.

The management of the Kruger Park spend a lot of time, money and effort looking after natural resources and biodiversity, making the world a better place.

They should be able to make extra money from that. Nick gives a few other examples of how this system can benefit the country through farming and land reform, give it a read (may need a sign-up or subscription).

Michael's Musings

South Africa already has an advanced banking system but it's good to see that the sector is still innovating. Earlier this week, a new instant payment platform for low-value amounts was launched, called PayShap. The idea is to make sending amounts less than R3 000 between different banks easier and quicker.

To make use of this instant payment platform, you either need the recipient's bank account number or their cellphone number. Then you hit send.

A payment will take less than 60 seconds to reflect on the other side. I had a look on my FNB app, the payment option is there already.

The only restriction is that you need a bank account to use the system. Even if you pay using a recipient's cellphone number, the money will go to their linked bank account. There are many people in South Africa who are unbanked because they don't have an ID or proof of residence. PayShap says this is only the first iteration of the service, so maybe a future version has a way to include unbanked people.

Read more here -

Reserve Bank and BankServAfrica launch new instant payment service - PayShap.

Bright's Banter

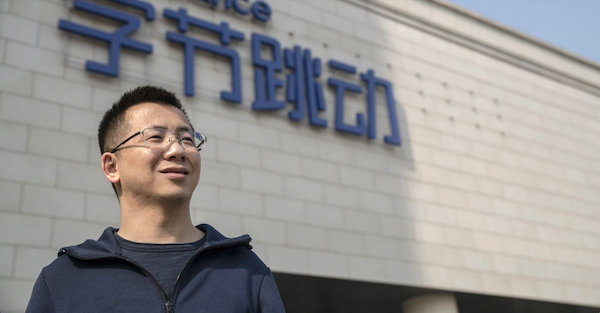

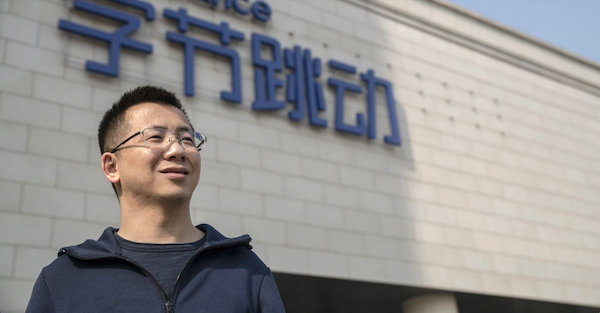

ByteDance, the owner of TikTok, was valued at around $220 billion in a recent private-market investment by Abu Dhabi AI firm G42. This was much lower than the $300 billion valuation that ByteDance set during a recent share buyback program.

G42 acquired a $100 million-plus stake from existing investors through its 42XFund. ByteDance isn't in urgent need of cash after TikTok made around $12 billion in revenue in 2022.

ByteDance's valuation reflects the uncertainty surrounding the company since Washington signalled it is considering outlawing TikTok, which they consider to be a potential national security threat. Washington has already ordered all government workers to delete TikTok.

ByteDance's leadership is reportedly discussing the possibility of separating TikTok from its Chinese parent to help address these concerns. I can't see how they can operate without the link to the Chinese-owned algorithm and servers. I have my doubts.

Sheikh Tahnoon bin Zayed Al Nahyan, the owner of G42, has built a portfolio of holdings in everything from cloud computing to vaccines and driverless cars.

Last year, his AI firm set up the $10 billion 42XFund, which has additional financial backers, to invest in technology companies across emerging markets.

Linkfest, Lap It Up

Linkfest, Lap It Up

After a Covid-related surge, LEGO continues to grow. This company has become the largest toymaker in the world -

The interlocking bricks that built an empire.

Things are tough in South Africa, but at least our government is financially conservative. Populist policies and a bad drought have wrecked Argentina's economy again -

Inflation in Argentina surges past 100 percent.

Signing Off

Asian markets are up this morning. Indices rose in Hong Kong, Japan, mainland China, and South Korea amid a rebound in banking shares. Baidu added to the positive sentiment after brokerages gave its ChatGPT-like bot called Ernie the thumbs up.

Today we have something called "quarterly triple witching," where contracts for index futures, equity index options, and stock options all expire on the same day. Trading volumes will be high, which could add to the market swings.

US equity futures are mixed this morning. The Rand is at R18.35 to the US Dollar.

The Gold price is having another run at the $2 000 per ounce level. Bitcoin rose to near the highest level since June amid a broad rally in crypto. Other tokens such as Ether, Solana, and Polkadot moved higher as well.

It is Green Beer Day in the southern states of America, where university students enjoy a day-long party and down beers that are dyed green with artificial colouring. This is of course to celebrate Saint Patrick's Day.

Have a good weekend, but make sure you do a full day's work on Monday. It's a matter of principle. Then you can take Human Rights Day off, on Tuesday.

Sent to you by Team Vestact.