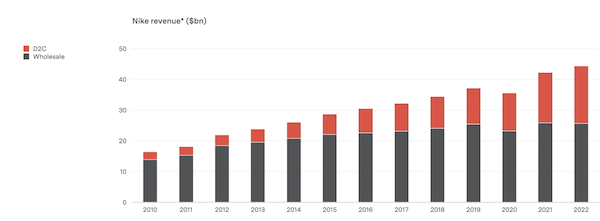

Yesterday I referred you to Ben Evans' annual tech presentation. There was a slide there about one of our core holdings that I want to discuss today. The graph below looks at Nike's sales mix. The grey portion reflects sales to third parties like Foot Locker or Sportsmans Warehouse. The red portion reflects their direct-to-consumer (D2C) sales through their website and Nike stores.

Around ten years ago the market punished Nike because they spent all their profits building out that D2C network. An online sales website needs to be backed up by distribution and delivery systems and those are expensive to build. Now that D2C sales are over 40% of the total, Nike's profits have grown because they take the money that would have gone to a middleman.

It's a cliche to say that you need to look at the long term when a company ploughs away their free cash into a new idea. But sometimes management actually does know what they are doing.