Market Scorecard

US stocks managed to eke out a gain last night, after a volatile day. Traders seem to have mixed feelings about Powell's recent inflation comments, and be more inclined to wait to see how the economy performs.

The next big data points are the US unemployment rate tomorrow, and the all-important inflation read next week.

Locally, it was a bad hair day, with a growing number of companies trading at 12-month lows. Unfortunately, our mining companies which did well last year, are struggling now that commodity prices are sliding.

In company news, Occidental Petroleum was up 2% on news that Warren Buffett's Berkshire Hathaway had bought another big chunk of the company. Campbell Soup was also up 2% on better-than-expected results. Finally, the biggest loser in the S&P 500 was Norwegian Cruise Line, falling 4.3%. Despite its name, it's incorporated in Bermuda and headquartered in Miami.

In summary the

JSE All-share closed down 1.04%, the

S&P 500 closed up 0.14%, and the

Nasdaq closed up 0.40%.

Our 10c Worth

Michael's Musings

On Tuesday night, CrowdStrike, one of our 'Future Hero' holdings, reported strong results. The cybersecurity company posted a top and bottom line beat, and the share price gained 3% yesterday. It's nice to see positive pops, given recent pressure on stock prices.

There are three key reasons we like CrowdStrike: 1) Protecting a growing trove of digital information is going to become increasingly important to all kinds of organisations.

2) CrowdStrike grew revenue by 48% last quarter and expects to grow by 39% next quarter. Having strong revenue growth is very important if the company has a chance of becoming a 10 bagger investment.

3) Most of CrowdStrike's revenue is from recurring subscriptions, meaning once they lock in a customer, that revenue will hang around for years.

In addition, CrowdStrike is developing new bolt-on security products.

Once they have customers locked into their ecosystem, they're able to upsell them extra packages. Given the importance of securing new clients before another company does, they spend around 40% of their revenue on sales and marketing. That's massive!

This investment is not without its risks. In the previous quarter, they made a profit of $111 million. If you factor in the stock-based compensation of $152 million, then the company is still loss-making. We are not the only people who see big potential in the company. Crowdstrike trades on a steep premium, meaning that it will need to continue growing like gangbusters to justify the current share price.

This 'Future Hero' falls into the high risk category, but could lead to big returns.

One Thing, From Paul

We like to remind our clients that they own actual businesses, not just listed-shares. In other words, if you have a holding in Apple with Vestact in your New York portfolio, you literally own a slice of that fabulous company, and you are entitled to a share in their profits, and to the cash dividends that they pay out every quarter.

You don't just have an interest in an abstract financial instrument that goes up and down every day. You are a part-owner of a real enterprise that employs an army of people who work hard to make you money.

You can support your company by buying their products. I'm sure that you need a new iPhone already? Or what about an upgraded MacBook? Get on it!

The stock market is a yo-yo, but businesses aren't. Warren Buffett wrote about this in his recent shareholders letter: "we own publicly-traded stocks based on our expectations about their long-term business performance, not because we view them as vehicles for adroit purchases and sales. Charlie Munger, [Buffett's partner] and I are not stock-pickers; we are business-pickers".

Byron's Beats

Yesterday I referred you to Ben Evans' annual tech presentation. There was a slide there about one of our core holdings that I want to discuss today.

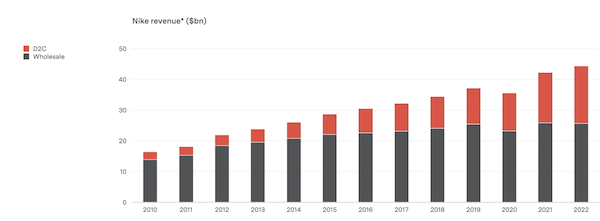

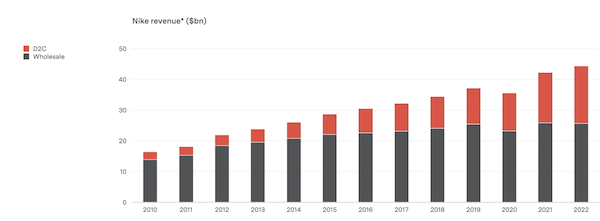

The graph below looks at Nike's sales mix. The grey portion reflects sales to third parties like Foot Locker or Sportsmans Warehouse. The red portion reflects their direct-to-consumer (D2C) sales through their website and Nike stores.

Around ten years ago the market punished Nike because they spent all their profits building out that D2C network. An online sales website needs to be backed up by distribution and delivery systems and those are expensive to build. Now that D2C sales are over 40% of the total, Nike's profits have grown because they take the money that would have gone to a middleman.

It's a cliche to say that you need to look at the long term when a company ploughs away their free cash into a new idea.

But sometimes management actually does know what they are doing.

Linkfest, Lap It Up

Linkfest, Lap It Up

If you're so smart, why aren't you rich? New research suggests personality has a larger effect on success than IQ -

Dorks and nerds find it harder to get ahead.

Your car may drive off if you fall behind on your payments. New "repossess" feature on self-driving cars -

Cheerio owner, you are in arrears.

Signing Off

Asian markets are mixed this morning, reflecting the volatility we saw in the US last night. It seems that the markets will bob around until the US jobs data out tomorrow gives more clarity on what we can expect from the Fed.

The price of oil is higher, copper is down and iron ore slid yesterday amid uncertainty around potential moves by Chinese authorities to implement price controls.

The Rand is currently trading at R18.61 to the US Dollar after a volatile 24 hours, fluctuating between $/R18.50 and $/R18.70. Loadshedding mixed with higher interest rate expectations in the US haven't been kind to the Rand.

All the best for the day ahead.

Sent to you by Team Vestact.