Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week, the maker of DNA sequencing machines Illumina reported underwhelming numbers. Revenue was slightly better than expectations, but profits were a miss. The bigger issue is the forecast growth of only 7 to 10% for the year ahead. For the leader in an emerging industry, we'd expect to see significantly faster top line growth.

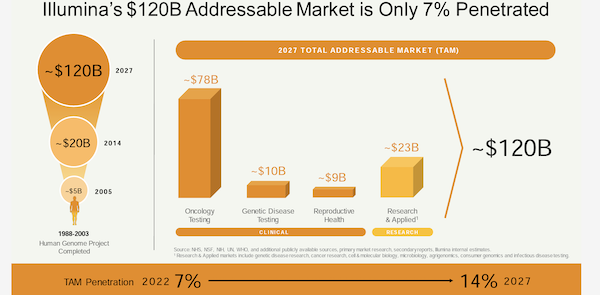

The company estimates that its industry will be worth at least $120 billion in 2027, and the management team aims to have a 14% market share. The demand for genetic testing remains very strong. If all goes according to plan Illumina would have revenue of $17 billion, a big jump from the current $4.6 billion.

There are short-term challenges though, particularly with their purchase of early cancer detection company Grail. Illumina paid $7.1 billion for the start-up, which only had revenue of $55 million, up from $12 million the year before. Since then, Illumina has taken a $3.9 billion value write-down on Grail, suggesting that it vastly overpaid.

To make matters worse, Illumina pushed ahead with the merger without getting all the required approvals, and the EU is aiming for the merger to now be undone. Regardless of how the regulators rule, there are going to be expensive legal bills and probably fines ahead, not to mention the massive distraction of this uncertainty hanging over the company.

Illumina is one of our "future hero" stocks, given all the potential in the sector. These ambitious investments are high risk because we don't know how things will play out. If 7% growth is all they can muster and competition from other players increases, the share price will battle. If growth rises to the plan described above, Illumina's share price should triple over the next four years.

It's tough to know what will happen next. As a smaller position in a balanced portfolio, the damage caused by underperformance is not too dire, and the chance of a high reward is enticing.