Market Scorecard

US markets surged higher on Tuesday, after a turbulent session that took its lead from an interview with Fed Chair Jerome Powell. He reiterated that US inflation is easing, but if the job market stays on fire, he might have to douse it with more rate hikes. No big deal, just the Fed doing their job, tapping on the accelerator and then the brakes.

The tech-heavy Nasdaq has outperformed the S&P 500 in recent weeks. This is where Vestact client portfolios are focused, so let's all grab a boerewors roll and enjoy the ride!

In company news, Enphase Energy shares jumped more than 8% in after-hours trade after the maker of solar inverters reported strong fourth-quarter earnings and upped its guidance. Elsewhere, Nissan and Renault have announced a major restructuring of their partnership, with Renault reducing its stake in Nissan to 15% and Nissan taking a 15% stake in Renault's electric vehicle unit, Ampere. They plan to list Ampere on the Paris Stock Exchange in the second half of the year.

In summary, the

JSE All-share closed down 0.06%, the

S&P 500 gained 1.29%, and the

Nasdaq was a healthy 1.90% higher.

Our 10c Worth

Bright's Banter

Last week,

Amazon reported its first unprofitable year since 2014, losing $2.7 billion despite good holiday-season sales. The company's share price dropped by 8.4% on the day.

Note that the primary cause of the loss was a write-down of Amazon's investment in the electric automaker Rivian, which faced challenges including pricing missteps and falling short of growth targets, resulting in an 82% drop in its share price.

Amazon's CFO, Brian Olsavsky, said

the company is expecting slower growth rates in the next few quarters due to uncertainty around consumer and corporate spending in the US and abroad. Although Amazon posted fourth-quarter revenue of $149.2 billion, up 9%, beating Wall Street expectations, its e-commerce segment saw a 2% decrease.

Web-hosting division AWS grew revenue by 20%, while its profit for the quarter came in 9% below expectations. Olsavsky also mentioned a potential slowdown in AWS spending as customers try to cut costs, which could lead to challenges in the next couple of quarters. AWS reported $5.2 billion of operating income in the quarter, almost double the profit of the whole company, but down 2% year-on-year.

Meanwhile, Amazon's advertising business recorded a 19% increase in revenue. That was a shining light in the numbers.

The company is currently going through a difficult period as it adjusts its business post the Covid boom, leading to higher operating expenses in the fourth quarter.

CEO Andy Jassy is cutting costs while still investing in long-term priorities, and has made some changes such as closing physical bookstores and specialty stores, slowing down new warehouse openings, and laying off over 18 000 corporate employees.

Even with all its challenges we still like Amazon, they are the outright e-commerce leader and they've done an incredible job with AWS. They will remain one of the world's leading companies. As margins recover, so will the share price.

One Thing, From Paul

Do you know how to say Nike? For the record, it's "nai-key" not "nayk".

Here are some other important ones for you to make a note of: Adidas is "addy-dass", Porsche is "por-sha", Huawei is "hwaa-way" and Hyundai is "hyun-day".

European luxury brands are often mispronounced. Moët & Chandon is "mow-et ey shon-don". Don't screw that one up, you'll sound like a yokel. Also Givenchy is "zhee-vahn-shee", Fjällräven is "fi-ell rair-ven", Hermès is "air-mess" and Hublot is "ooh-blow".

Haha, now you are all sorted!

Byron's Beats

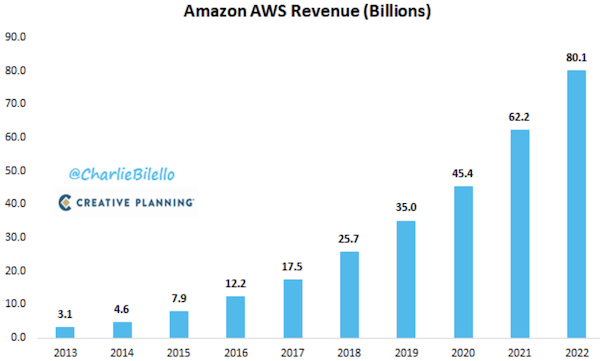

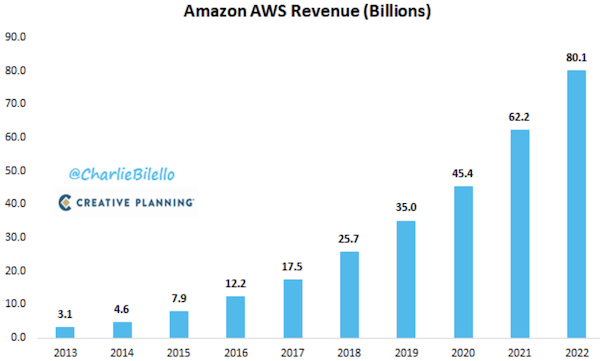

Last week my favourite chartist Charlie Bilello pointed out that

Amazon Web Services' 2022 revenue, although showing disappointing growth, was higher than 457 companies in the S&P 500. He also mentions that AWS has grown sales at 44% per annum for last 9 years, from $3 billion to $80 billion. That's just phenomenal.

Big tech businesses are taking some flack at the moment for their expensive side hustles. Conditions have changed quickly thanks to a fast rise in US interest rates. But that's how business cycles work, and these companies are now pulling in the reins.

If Amazon had not pursued their cloud side hustle, they would have missed out on one of the biggest growth stories of all time.

Michael's Musings

Yesterday I wrote that Google will launch a competitor to Microsoft's ChatGPT in the coming months. It turns out that the launch date is now.

Google's version is called 'Bard', and is only accessible to a select few trusted users, while it does some more testing. The plan is to release it to the public in the next few weeks.

We are getting to the point of AI fatigue, where every other article posted talks about how AI will change the world. Unlike other fads such as medical marijuana, fake meat, blockchain and Bitcoin, I think AI will materially change how we do things.

Time will tell, but I believe AI will be ranked alongside the internet in terms of its impact on humanity.

We think Microsoft, Google and Nvidia are the best ways to get exposure to AI. As the saying goes, during a gold rush it is best to be selling shovels. In this analogy, Nvidia is the company selling shovels. AI is an exciting trend that we will monitor closely.

Linkfest, Lap It Up

Linkfest, Lap It Up

Is self-control a superpower? Lindsay Baker explores the idea behind serenity -

Five ways to be calm.

Would you pay more for a better seat at the cinema? The airline industry already does it -

AMC Theatres to charge different movie ticket prices depending on the seat.

Signing Off

Asian markets are quiet this morning, despite the nice rally on Wall Street last night. Bourses in Hong Kong, Japan, mainland China and South Korea have trended lower in their afternoon sessions.

US equity futures are flat so far. The Rand is trading at around R17.56 to the greenback. Oil is still on the rise, but it's nothing to worry about yet, just a modest reaction to more demand from China.

Companies with quarterly results out today include Disney, Toyota, CVS Heath and Uber.

It's wet but warm in Joburg today. Have a good one!

Sent to you by Team Vestact.