Market Scorecard

US markets traded beautifully again on Thursday, rising strongly after better-than-expected fourth quarter US GDP data. Inflation is moderating and economic growth is good, what more could we ask for? Locally, the JSE All-share notched another record high at the close.

In company news, shares of media company Buzzfeed rose by a breath-taking 120% after reports came out that they plan to use artificial intelligence to create content. Elsewhere, perennial underperformer Intel tumbled 9.7% after the chip manufacturer griped about a slowdown in sales of personal computers.

In short, the

JSE All-share closed up 0.98%, the

S&P 500 gained 1.10%, and the

Nasdaq was 1.76% higher.

Our 10c Worth

One Thing, From Paul

Personal tips, that's what I write about on Fridays. You are welcome. I enjoyed this list from Ted Gioia, which has the headline

My 8 Best Techniques for Evaluating Character. The whole article is about how to assess the reliability of people you meet.

Here are the highlights. See how they treat service workers.

Can they listen? How do they handle unexpected problems?

Forget what they say - instead look at who they marry. Do they cheat at little things?

This one seems especially useful - when striking up a relationship with someone new, try to discover what experiences formed their character in early life.

Byron's Beats

Tesla is probably the world's most talked-about company, and they released fourth quarter results on Wednesday. This is always an exciting affair. Revenue for the quarter came in at $24 billion, up 33% year-on-year. This was 1% below the consensus view of analysts who cover the stock. Earnings per share came in at $1.19 which was 40% higher than last year, and 6c better than expectations.

There was, of course, a lot of focus on margins which are coming down due to vehicle price cuts. Tesla is not immune to the tough circumstances in the car market, where consumer demand has been hurt by higher interest rates. Automotive gross margins came in at 25.9%, the lowest figure in 5 quarters.

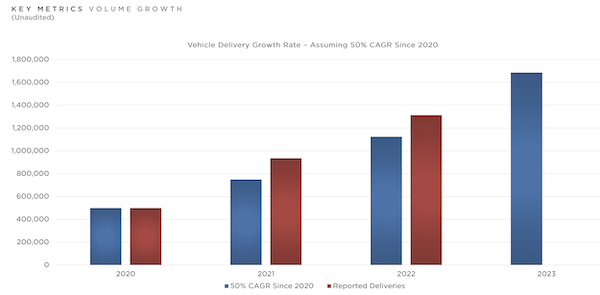

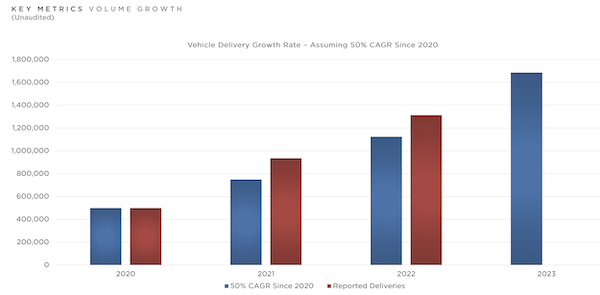

The market was pleased by the outlook for vehicle volumes, and Tesla stock closed up 11% on Thursday. The company commented that since they dropped prices they saw the strongest surge in orders in history. Elon Musk is obsessed with his stated goal of growing car production by 50% every year. Take a look at the image below, so far so good, but each year gets harder. To meet that target in 2023, they need to deliver over 1.6 million cars. Tesla forecasts they will push out 1.8 million, and some analysts have pencilled in an even higher number.

Earnings for next year are expected to come in at around $5 a share which puts them on a 29 times forward multiple.

Tesla is a profitable business with strong cash flows and a very exciting future. The EV market is still in its infancy and Tesla leads the pack with the newest and best production facilities. Self-driving cars, energy utilities, robots and transport solutions provide extra upside potential. Tesla is Elon Musk's ticket to eternal greatness, I am confident he'll move on from Twitter soon and give it all the attention it deserves.

Michael's Musings

The bad news is that the SARB increased interest rates by 25 basis points (bps) yesterday. The good news is that it wasn't 50bps, which was voted for by two of the five members present.

The prime interest rate is now 10.75%, the highest in over a decade. This hurts even more because interest rates were the lowest in our history just 18 months ago.

Looking back in history, things were much worse in the late 1990s when rates went from 18% to 25% almost overnight in reaction to an Asian currency crisis. Ouch! Paul says he remembers that time well, and the pain of having to make monthly bond payments that were skyrocketing.

The SARB has a tricky job keeping inflation at 4.5%. Our current predicament is mostly due to inflation in imported goods and electricity price hikes. The problem is, neither of those factors are responsive to local interest rate increases. The SARB now

assumes that inflation will dip into their target range in the second quarter of this year, and that we may even be able to cut interest rates later in the year.

So, it seems that we are at the peak of the current rate-rising cycle. Or perhaps just one more 25bps hike. The bigger question is if elevated interest rates will stick around, and become the long-term reality, or if there will be some relief over the next 18 months?

Bright's Banter

The Wall Street Journal reported that Elon Musk is seeking to raise up to $3 billion to pay off some of Twitter's high interest-bearing debt. Apparently, he is investigating issuing more Twitter shares. Musk has stated (on Twitter of course) that the story isn't true.

Following Musk's takeover of Twitter, the platform is been burning through approximately $4 million a day. This came to light in November and was due to a sudden drop in advertising revenues, caused in part by his erratic comments. Twitter has been a major distraction for Musk, I'm in the camp that wishes he had never done this deal.

Linkfest, Lap It Up

Linkfest, Lap It Up

What does it mean to be rich? Is it a certain salary? A specific amount of assets? It may be a particular lifestyle -

Being rich is a feeling.

This guy sold his business for $800 million and is trying to reverse the process of ageing Bryan Johnson is a guinea pig for a series of experiments -

Team of over 30 experts working on a 45 year old.

Signing Off

Asian markets have advanced for a sixth-straight day and the MSCI Asia-Pacific index is on course for a fifth week of gains, to its highest level since last April. The Shanghai Composite and the Seoul KOSPI index are in the green, while Hong Kong's Hang Seng and Japan's Topix were little changed.

US equity futures are lower in early trade. We have results out today from Chevron and American Express, amongst others.

The Rand is trading at around R17.25 to the US Dollar.

It's the weekend, be sure to get out and about in the lovely southern hemisphere weather.

Sent to you by Team Vestact.