Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Illumina is a global leader in DNA sequencing and array-based technologies. They make the machines and consumables that are used to investigate genetic material to fight disease, especially cancer. It's headquartered in San Diego.

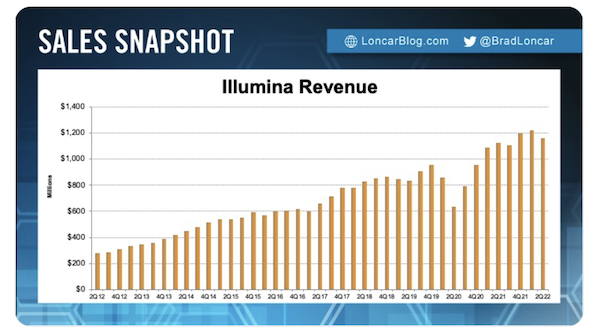

The company is growing fast. Consider the chart below, which reflects the trend in their quarterly sales over the last decade. Unfortunately, the very last data point on the far right was lower than the two before it, which prompted a selloff in the company's shares last week. In fact, the share price of Illumina has fallen from a high of $526 a share in August 2021 to $208 a share now. Ugly!

Illumina CEO Francis deSouza said, "Our second quarter results did not meet our expectations". He pointed to the ongoing negative impact of foreign exchange rates, and delays in customer laboratory expansions.

The company also made two hefty provisions which knocked profits. The first is an accrual of $453 million for the potential fine that the European Commission may impose on them for going ahead with the acquisition of another company GRAIL, prior to obtaining full approval. The second was for $156 million, related to the settlement of an intellectual property fight with a Chinese company called BGI.

We still believe that Illumina has a place in your portfolio, with an eye to the future of genomics as a business sector. There is no doubt that genetic oncology, drug development using DNA sequencing and preventative studies using population genomics have a big future. We encourage you to be patient with this underperforming holding.