Market Scorecard

US markets raced higher on Friday, thanks to a slew of earnings announcements and economic data that boosted optimism among investors. The S&P 500 notched its best week since November 2020, breaking a seven-week losing streak. All three major indexes jumped at least 6% last week, marvellous!

In company news, Dell Technologies rose 13% after reporting a strong rise in profits. Michael Dell had an amazing week, first the announcement of the takeover of VMware where he's the majority shareholder, and now this! Elsewhere, Workday dropped 5.6% after the human resources cloud-software specialist reported earnings that came short of expectations.

On Friday, the

JSE All-share gained 1.44%, the

S&P 500 climbed 2.47%, and the

Nasdaq blossomed by 3.33%.

Our 10c Worth

One Thing, From Paul

High-end chipmaker

Nvidia had very good quarterly numbers out last week, with revenue up 46% since last year and profits up by 55% to a record high.

It should be noted that

their business of making graphics processors for video-gamers, which is about half their overall operation, is slowing a bit. That division has averaged over 50% year-over-year growth over the last eight quarters, but is being hampered by supply-chain challenges, and sales may even fall sequentially in the current quarter.

However,

Nvidia's business of making chips for data centres is really doing very well. Revenue there surged 83% year-over-year to nearly $3.8 billion in the latest quarter. They sell these chips to cloud computing companies like Amazon, Meta Platforms, Microsoft and Google. We expect the data centre business to be their largest, in time.

This is all good and well, but

why has Nvidia's share price fallen by 40% from its highs in December 2021? That has been really painful for shareholders!

To be honest,

I think that it's mostly just a general tech stock sell-off, and the merits of Nvidia's growth story will win out in the end. The share price picked up by nearly 15% last week. As ever, with companies this good, just buy them and hold. Accumulate and sock them away.

Byron's Beats

Last week there were 2.2 million US airline travellers a day through TSA checkpoints, on average. That's the highest level since the pandemic started, and the summer travel season hasn't even started yet. This is positive! I assume that business travel will never quite be the same now that people realise how effective video calls can be. But travel for leisure must be cooking.

We are living in very interesting times. On the one hand, the world is opening up, travellers are out there spending and people are enjoying life. On the other hand, we have high inflation, increasing interest rates, war and unrest in many regions of the world.

These forces pushing and pulling the global economy will have an impact on your investments. In truth there are always countervailing forces at play, and they are always changing.

Don't chop and change your investments based on these short-term trends, the market will always be one step ahead of you.

Michael's Musings

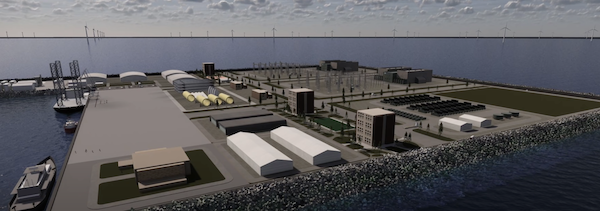

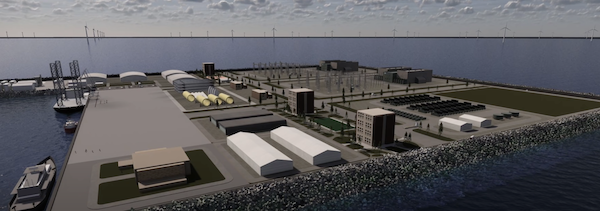

The North Sea is a significant oil and gas producing region, and it's also emerging as a renewable energy powerhouse. Last year the Danish government announced the creation of a $34 billion 'power island' in the North Sea off the coast of Denmark. Given the urgent need to stop buying Russian hydrocarbons, a second island was announced this month.

The idea is to build giant wind farms in the sea, with all the power being routed to a power island. The island will then store and distribute the electricity to neighbouring European countries. Denmark already gets over 50% of its power from wind, and is building an undersea cable to distribute some of that power to the UK. The project is called 'Viking Link' and is expected to be operational next year. This follows a similar link already in place between the UK and Belgium, called the Nemo Link.

The world is rapidly moving away from fossil fuels, and these power island projects will speed up the change. We learn new skills from these large scale projects, advancing new technology and lowering the cost of production, which in turn leads to more renewable energy projects.

Here is an interesting video about the project -

Denmark's $34B Energy Islands Could Solve Europe's Power Problem.

Bright's Banter

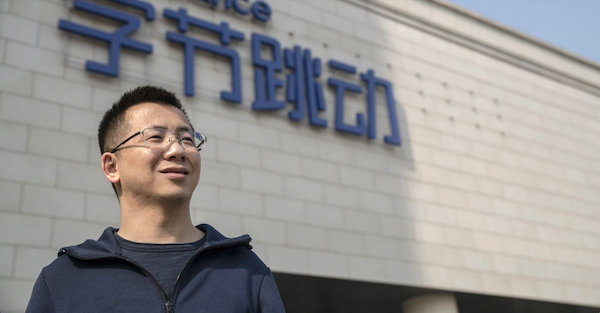

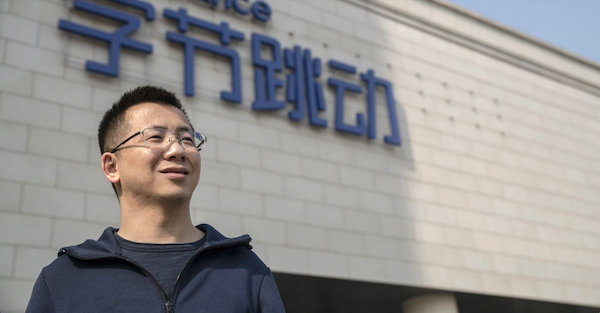

ByteDance, TikTok's parent company is now said to be worth over $357 billion, based on trades in secondary markets. At this valuation, the Chinese social media company is larger than PayPal, Netflix, Snap Inc., Spotify, Pinterest, Twitter, Etsy, and Uber combined!

TikTok has amassed more than 1 billion active users despite many regulatory snags in both the US and China. Its main client base spends an average of 80 minutes a day on the app, the highest of any social media company. Its advertising business is booming.

Linkfest, Lap It Up

Linkfest, Lap It Up

Huge demand for Rolex watches and lack of supply is driving interest in other luxury timepieces. It's almost impossible to get your hands on a Cartier Dos Santos or a Tudor Black Bay -

Global luxury watch shortage spreads to Cartier and Tudor models.

Last week, historians announced that they had successfully sequenced the DNA of a person who died in Pompeii in 79 AD. His family origins were pinpointed, and they can tell he had a bone disease -

From the Ancient Ashes of Vesuvius, Human DNA.

Signing Off

Asian markets are up this morning after the Chinese government eased Covid restrictions because the number of cases in Beijing and Shanghai are declining. Japanese and Hong Kong equities led gains.

The US equity futures market is closed, because

Wall Street will be closed today for the Memorial Day public holiday. The Rand is currently trading at around R15.56 to the US Dollar.

Enjoy the quiet start to the week.

Sent to you by Team Vestact.