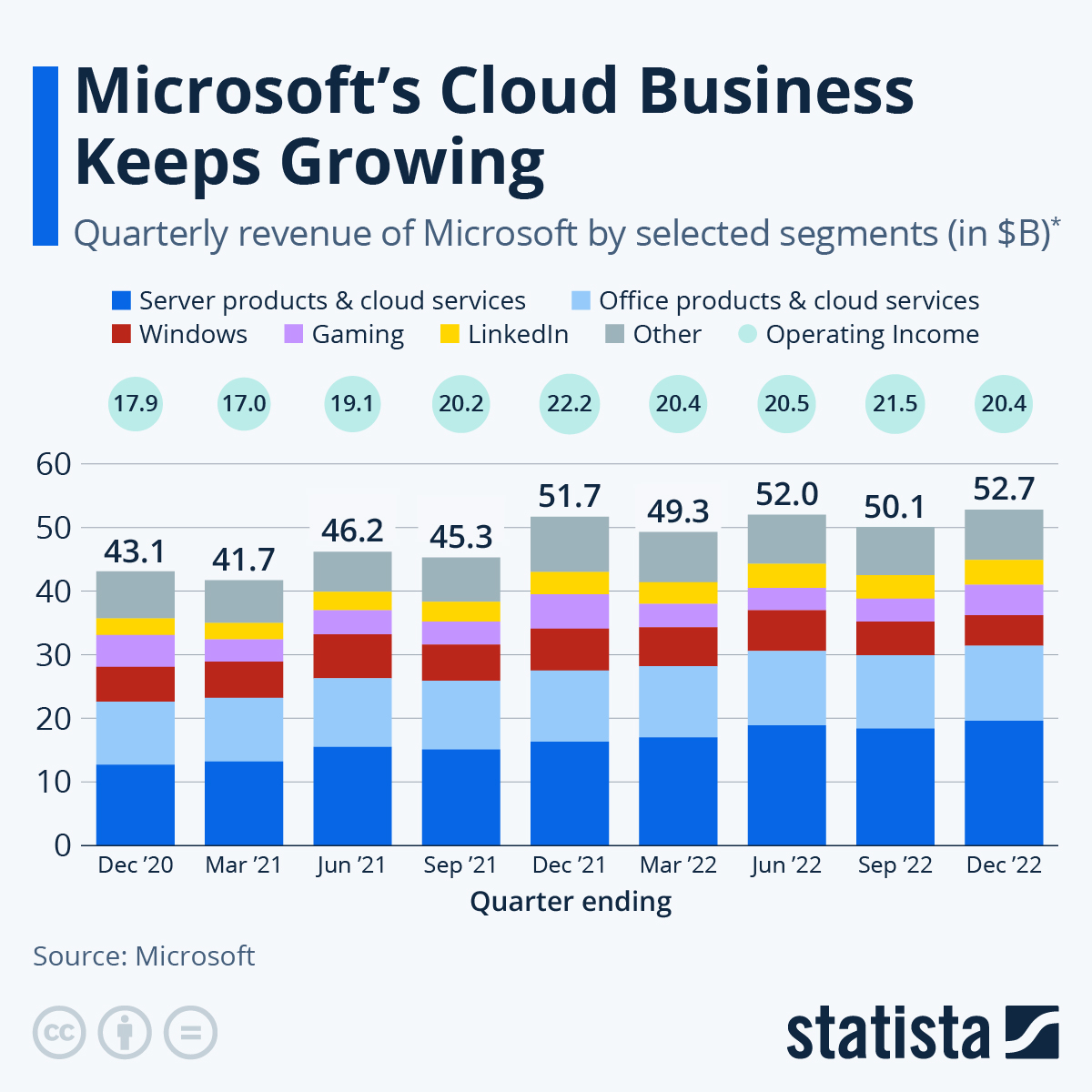

On Tuesday night Microsoft released its strongest set of numbers since the start of the pandemic. This was thanks to an increase in demand for server products and cloud-connected services. For the quarter from January to March, the company saw revenues rise 18% to $49.4 billion, and its net income climb 8% to $16.7 billion.

The Server and Office segments made up roughly 57% of revenue, 4% more than in the previous quarter. Cloud-hosting segment Azure is still the fastest-growing part of the business with a revenue increase of 46%, and is showing no signs of slowing down post-pandemic.

The Gaming division also saw record numbers of subscriptions due to the continued growth of Xbox Game Pass and console sales. If the $75 billion offer for Activision Blizzard acquisition goes through, the gaming division will become the third-largest revenue generator for Microsoft.

The company expects its sales for the current quarter to be between $52.4 billion and $53.2 billion. This is a strong outlook and the market seems to like it, since Microsoft shares closed up 5% in trading on Wednesday. The company is looking relatively cheap compared to its tech peers.

Microsoft should be an anchor position in your portfolio, and the current weakness in the share price is a great opportunity to accumulate more.

You will find more infographics at Statista

You will find more infographics at Statista