Market Scorecard

US markets retreated yesterday after the Federal Reserve outlined plans to shrink its balance sheet by more than $1 trillion a year. This is on top of hiking interest rates, as they try to combat inflation. Bond yields hit their highest level in three years and technology stocks lost ground as investors digested the news.

In company developments, Rivian shares dropped 5% after the electric vehicle maker reported first-quarter production and deliveries that were in line with its own (rather modest) forecasts. Elsewhere, JetBlue Airways made a $3.6 billion all-cash offer for Spirit Airlines. There seems to be some consolidation underway amongst low-cost US airlines, as the bid comes less than two months after Spirit and Frontier agreed to merge.

At the closing bell, the

JSE All-share closed down 1.23%, the

S&P 500 fell 0.97%, and the

Nasdaq shed a painful 2.22%.

Our 10c Worth

Byron's Beats

Right, so the market took a beating yesterday as reported above. The fall in the Nasdaq of over 2.2% smacked a number of our portfolio holdings.

However, Johnson & Johnson rose by 2.6% to reach a new all-time high of $183 a share. So far this year J&J is up 6.5%, whereas the S&P is down 6% and the Nasdaq is down 11.2%. J&J has outperformed the Nasdaq by 17.7% in 3 months. Sometimes it pays to be boring!

Johnson & Johnson has underperformed our model portfolio over the last five years, but it's stood strong when times get tough. That's why it is in your portfolio.

Its 2.5% dividend yield is also very valuable. J&J deserves its solid reputation, so keep this one for the rainy days.

One Thing, From Paul

In general, people worry too much. It's not that the news is unimportant, it's that it always seems too important. So, we spend all day reading about the latest developments and wondering anxiously about the future of humanity. It's called doom scrolling, if you do it on your smartphone.

In fact,

most news headlines are designed to get you riled up, and it doesn't matter if you know about them or not. Bad things that happen are not your fault, and you can't do much to fix them either.

Humanity will survive and thrive, as it always has. It's best to keep a cheerful disposition. Tough times never last.

I liked the cartoon below, by Benjamin Schwartz in The New Yorker. I'm not sure if we're allowed to re-publish these images here, but I'm going to risk it.

Michael's Musings

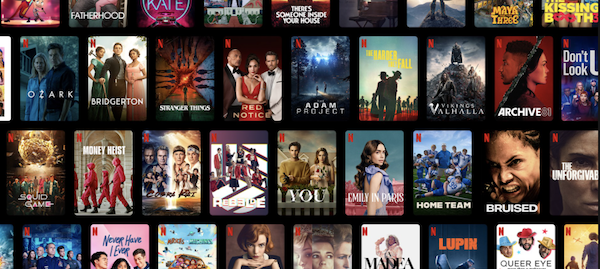

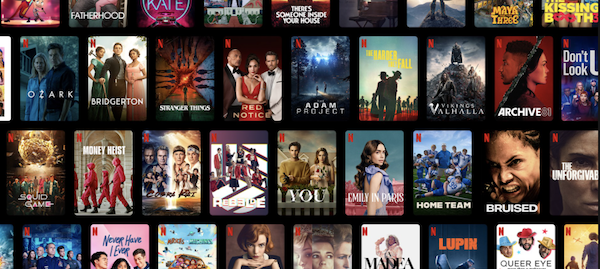

The streaming industry is entering a new growth phase. In the past, any company with a reliable platform and decent content would attract subscribers because people didn't have many options. We are now at the point where there is probably too much choice.

We think that most families will settle on three or four services, so this is not a case of a winner takes all. Here's what a recent Nielsen study found: "

24% of subscribers paid for two streaming services, compared to 23% who paid for three, 18% who paid for four, 18% who paid for one, 10% who paid for five and 7% who paid for six or more".

The report also found an 18% jump in the amount of time that people streamed weekly, and that almost 1 in 2 people felt there was now too much choice available. I know for me, the first tricky decision is picking a streaming service. Once you have found a platform, you still need to sort through all the titles to find something you feel like watching.

As the industry matures, the streaming experience will get better. As an aside, Netflix is apparently considering selling ads to create a cheaper streaming package.

Bright's Banter

A

report by

Piper Sandler showed that 87% of teens in the US own an iPhone. AirPod ownership also rose to 72% in that age group. Those are amazing numbers, that really demonstrate Apple's product reach.

Another interesting section in the report is about the usage of payment apps. Apple Pay managed to claim the top spot while Venmo (owned by PayPal) ranked second, followed by Cash App and PayPal.

Overall spending by teens was up 9% year-on-year with females leading the growth. They also continue to lead in the shift to digital, with 95% of upper-income females shopping online as compared to only 91% of males.

As far as social media platforms go, TikTok is the favourite for teens with a 33% market share, unseating Snapchat for the first time, now in second spot with 31% of the pie. Instagram is down to third with around 22% share. Social media is no longer a duopoly.

Linkfest, Lap It Up

Linkfest, Lap It Up

Some pandemic trends are unwinding. Thanks to a tight labour market and more work flexibility, more people are coming out of retirement -

Millions of Americans retired early. Now they want to work again.

Groups led by US billionaires Todd Boehly and Josh Harris are the frontrunners to buy Chelsea Football Club. Boehly owns the Los Angeles Dodgers baseball team and Josh Harris is the co-founder of private equity firm Apollo Global Management, which has stakes in the Pittsburgh Steelers (NFL), Philadelphia's 76ers (NBA), New Jersey Devils (NHL), and Crystal Palace FC (EPL) -

The fight to buy Chelsea continues.

Signing Off

Stocks in Asia are looking ropey. The MSCI Asia-Pacific index fell about 1%, sapped by Japanese markets. Losses were smaller in Hong Kong and China, where officials have once again signalled that they intend to loosen monetary policy amid a Covid outbreak.

The Rand is trading at R14.66 to the US Dollar. US Equity futures started out weak but have since returned to even par.

Let's wait and see how the day unfolds.

Sent to you by Team Vestact.