Market Scorecard

US markets closed in the green yesterday, thanks to a rebound in technology counters. Markets have experienced big intra-day swings lately as traders digest fresh economic data.

US household spending rose by 1.3% month-on-month in October, while personal income increased by 0.5%. Weekly jobless claims fell sharply to the lowest level in that data series 52 year history, a big positive for the US economy. There's still a huge demand for labour in America.

In company news, bricks-and-mortar retailers Nordstrom and Gap saw their shares tumble by 29% and 24%, respectively, after reporting disappointing earnings amidst complaints about supply chain problems. I guess not even Kanye West could save Gap from this mess.

In summary, the

JSE All-share was down 0.64%, the

S&P 500 was up 0.23%, and the

Nasdaq rose by 0.44%.

Our 10c Worth

One Thing, From Paul

The stocks we own in US portfolios have done very well lately. They are mostly mega-cap global multinationals in the technology sector. That's fine, but will they stay on top for ever? Maybe, but maybe not!

Howard Marks's latest newsletter describes an earlier era, when

the "Nifty Fifty" stocks emerged in the 1960s. This group included office equipment manufacturers IBM and Xerox, photography titans Kodak and Polaroid, drug makers like Merck and Eli Lilly, tech companies including Hewlett Packard and Texas Instruments, and consumer goods outfits such as Coca-Cola and Avon.

Marks writes: "It was widely believed that nothing bad could happen to these companies and they could never be disrupted. Of course, those investors were riding for a fall. If you bought the stocks of "the greatest companies in America" in 1969, and held them steadfastly for five years, you lost almost all your money. At least half of these supposedly impregnable companies have either gone out of business or been acquired by others."

This is why you pay Vestact 1% of your portfolio value per annum: to worry about what the future holds, and to propose changes when the time is right. For now, we advise you to hold tight.

Byron's Beats

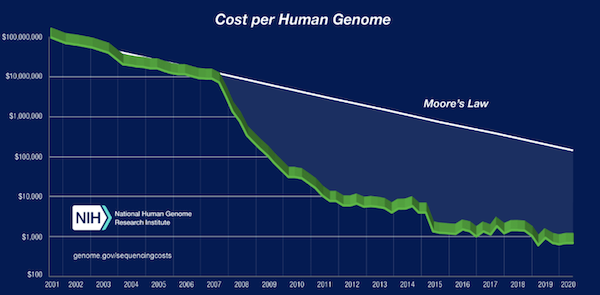

The first genome sequence cost $1 billion. The project to map the entire three-billion letter human genome was launched in 1990 and cost the US government more than $3.8 billion.

Today it costs just $1 000 to sequence a person's genome; that's one of the fastest learning curves in history. There are currently innovations in the sector that look to bring the cost down to $100.

How do you invest in this marvel of human ingenuity? Through Illumina of course. They are the world's leader in genome sequencing equipment and services. Their share price performance has been disappointing lately but we are confident that this will be a huge part of healthcare services in the future.

You can read more about the history of The Human Genome Project here on

HumanProgress.

Michael's Musings

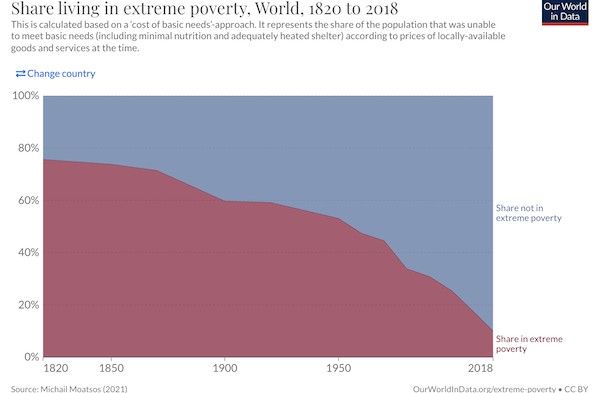

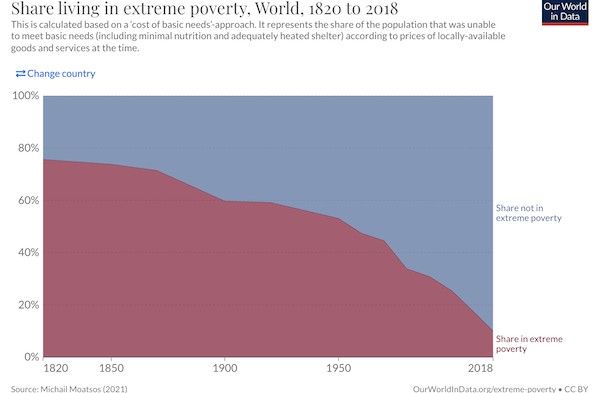

This may not be a popular opinion, but I think all the attention on wealth inequality is overdone . The idea that the rich are too rich is misplaced, we should rather be asking how we can improve the prospects of the most vulnerable in society. Having fewer rich people is not going to change the plight of the poor.

The graph below shows how well humanity has done over the last 200 years. Thanks to market liberalisation, increased trade and massive technological advances, society is unimaginably better off today than 200 years ago.

Economic growth is the key to reducing poverty.

The bulk of people still living in extreme poverty are in Africa. A lack of opportunity is a contributing factor to poverty. In an ideal world, all would have access to opportunities, and then their work ethic would determine how high they climb the economic ladder. For many that is not the case. Try to be aware of how you can create opportunities for others, particularly in situations where it will cost you very little but the opportunity is life-changing for someone else.

As an aside,

do you think Jeff Bezos wants a richer society or a poorer one? Some think that rich people rig the world to keep the poor down.

As the wealth of Amazon's customers increases, so do their profits. Bezos definitely wants to live in a world where there's no poverty and people spend a lot more on Amazon. In a wealthier world, robots will take over low-paying warehouse jobs, which is better for everyone.

The focus needs to be on making the economic pie bigger, which will be better for everyone.

The graph is from this Our World in Data article -

Extreme poverty: how far have we come, how far do we still have to go?

Bright's Banter

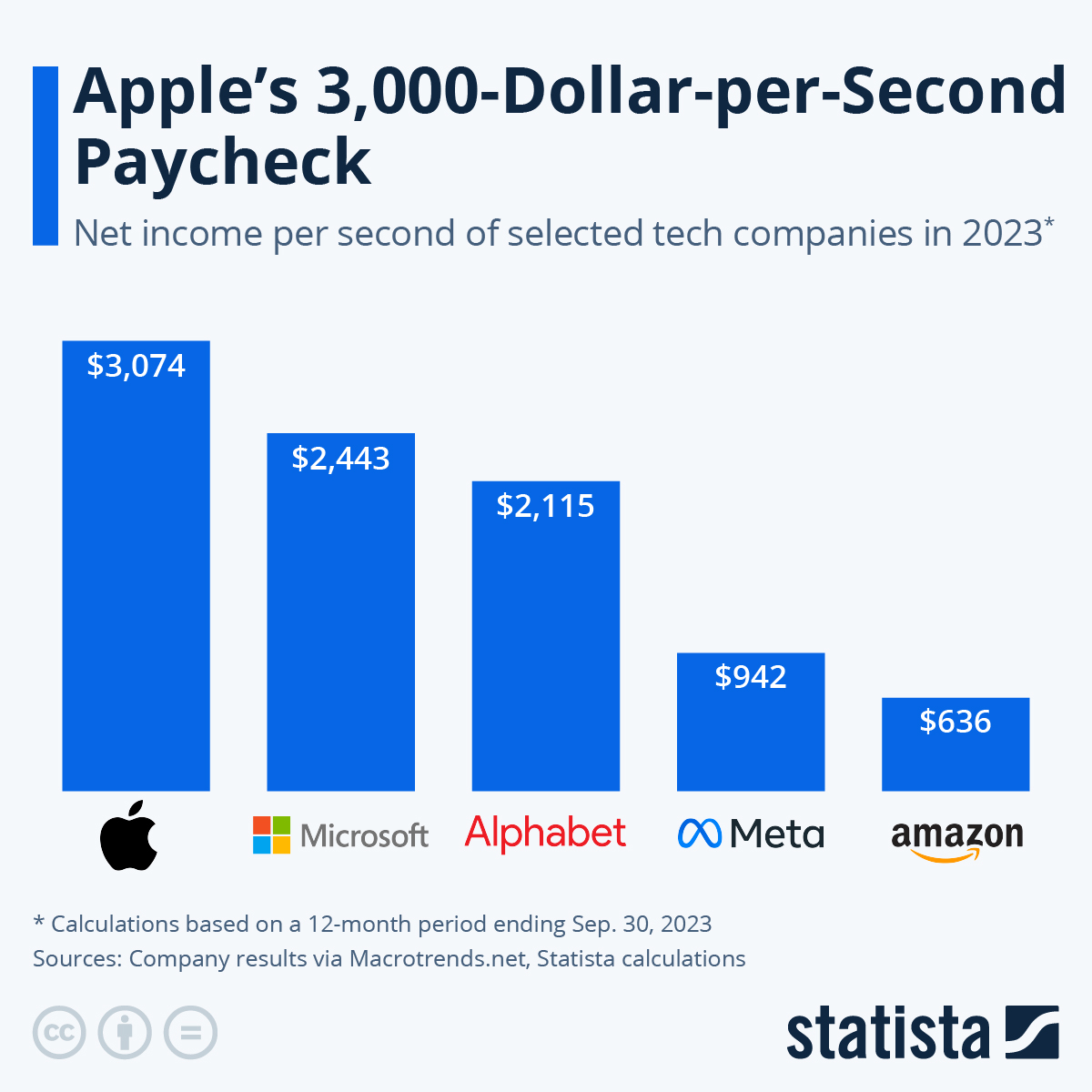

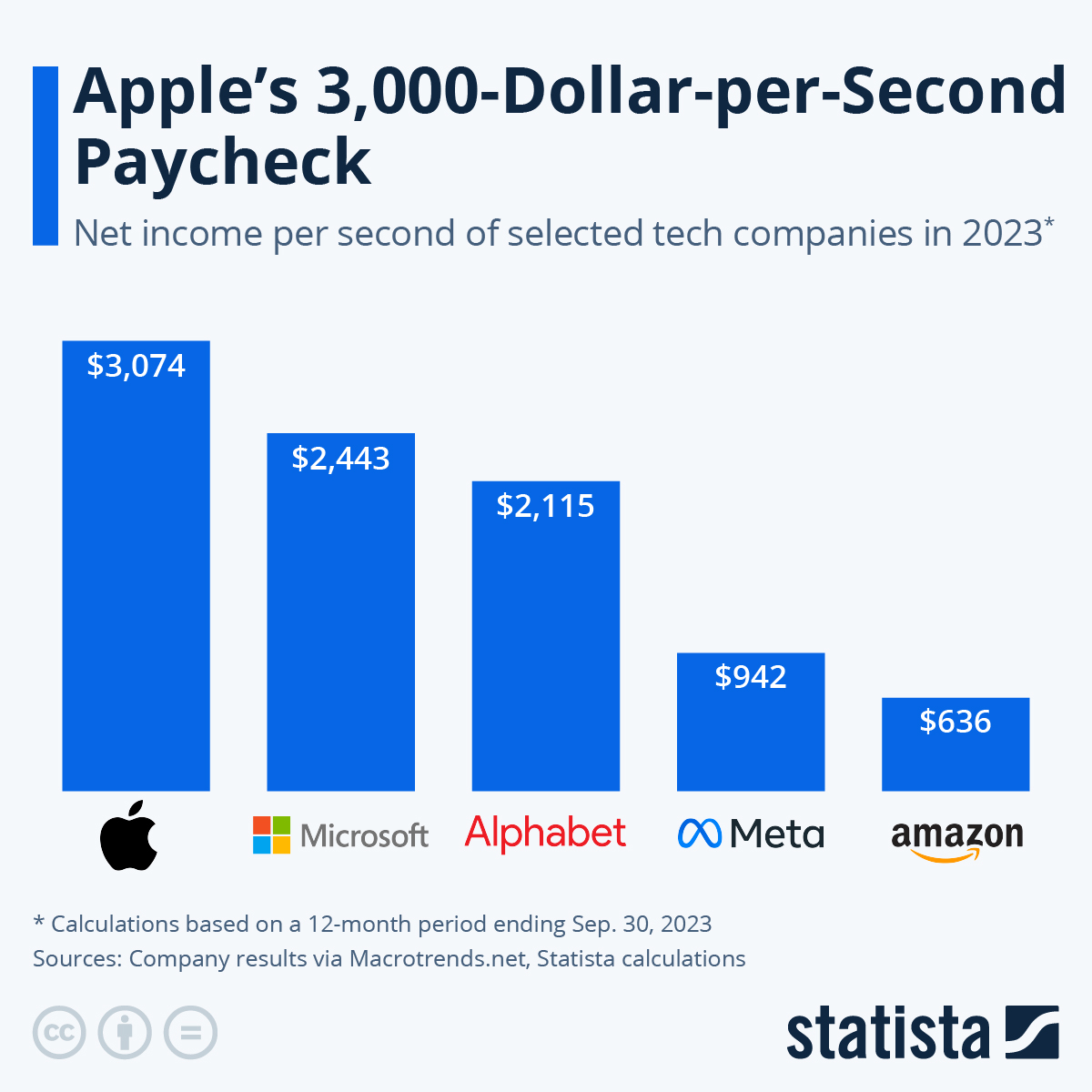

Ever wondered how much the companies you own earn every second? Speculate no further because our friends at Statista have answered the question for us.

The FAMGA group of companies made $300 billion in net profits from $1 350 billion of revenues over the past year. This is thanks to an increase in profits of 59% for Meta Platforms (Facebook), 51% for Amazon, 43% for Microsoft, 98% for Google, and 65% for Apple. Absolutely incredible!

The infographic below shows how much net profits are generated per second by these selected tech companies in 2021. For comparison purposes, the biggest winners of Covid-19, the

vaccine makers Pfizer, BioNTech, and Moderna combined, only made $1 000 in profits per second.

You will find more infographics at

Statista

Linkfest, Lap It Up

Being frugal is a good thing, being cheap is not. This short blog post takes a quick look at some of the differences -

Frugal versus Cheap.

Steve Kaczynski and Scott Duke have an excellent explanation of how NFTs create value. Good advice for people and organisations interested in creating digital art -

How NFTs create value.

Signing Off

Asian markets are steady this morning and the MSCI Asia-Pacific index snapped a three-day slump. The Chinese government has urged local governments there to spend more to fight the economic growth slump.

US markets are closed today for the Thanksgiving Day. We hate days when there is no US market trade! However, investors still need to show up for Black Friday tomorrow.

The Rand has weakened to R15.90. The US Dollar continues to hit those 52-week highs. Have a good one!

Sent to you by Team Vestact

You will find more infographics at Statista

You will find more infographics at Statista