Market Scorecard

On Friday, social media companies were under pressure after some underwhelming quarterly numbers released by Snap Inc, the parent company of Snapchat.

Snap lost over a quarter of its value in one day, dropping by 27%. In sympathy, Facebook shares were down by 5% and Google was off by 3%.

Snap management said that some advertisers cut spending because they didn't have enough stock to sell, due to supply chain problems. The company also complained that Apple iOS changes hurt their business. Apple now requires users on iPhones to opt in to app tracking, which makes it harder for social media companies to measure the effectiveness of ad campaigns. Marketing managers can't get granular information on campaign performance and can't pinpoint customers as easily. Facebook will report their quarterly numbers after the market close tonight, so we will see if they have experienced similar problems.

On Friday the

JSE All-share closed up 1.50%, the

S&P 500 closed down 0.11%, and the

Nasdaq closed down 0.82%.

Our 10c Worth

Byron's Beats

Since the rumour started that PayPal is looking to buy Pinterest for $45 billion, the PayPal share price is down by 12%. It's not unusual for the share price of the buyer in a large acquisition to drop when the news comes out. Academic studies show that most acquisitions don't work, so the market will sell off first and ask questions later.

If this deal goes through, it will be the biggest tech acquisition of the year. PayPal currently has a market cap of $285 billion, making Pinterest 16% the size of PayPal. That seems like a manageable deal, to me.

As a PayPal shareholder, we need to ask if Pinterest will be a good fit? Pinterest has a very engaged audience of 380 million monthly users. The content is image-based and mostly focused on creativity, design and sharing beautiful things. That sounds like an advertiser's dream. Pinterest has been pivoting into direct sales, which certainly makes sense.

If the deal goes through, I get the sense that Pinterest will maintain its identity while PayPal will get exclusive rights to manage ecommerce transactions arising from the site. Eventually, the Pinterest and PayPal apps will integrate seamlessly as they take on the likes of Amazon in online retail.

PayPal has ambitions to become a super app, much like WeChat in China. I think this deal is a step in the right direction for PayPal.

The acquisition is far from done, I wouldn't be surprised to see Pinterest reject the offer. After all they traded 15% higher than the $45 billion valuation in February this year. Either way, the drop in the PayPal price feels like a good time to accumulate more of their shares.

One Thing, From Paul

We have a local government election coming up next week. Municipal service levels in this country are very poor, with the exception of some cities and towns, mostly in the Western Cape. We live with potholes in the roads, irregular electricity supply, trash and weeds in the streets, compromised rivers and drinking water, inadequate policing, erratic town planning and worse. Ratepayers get a raw deal.

This country needs more competition for public office. Municipal councillors are paid a decent salary, and some of the people who get elected are just not up to the job. Corruption is rife.

How should we strengthen our democracy? Here are three suggestions. (1)

We should all vote, and get involved in local party politics. (2) We should build our residential communities by

participating in local level community structures such as neighbourhood watches, park clean-up initiatives and social clubs. (3) We should

read widely and subscribe (pay for) local and international publications which explore political issues. Vibrant investigative journalism is the best defence against corruption and ignorance.

Michael's Musings

Intuitively, I know that buying an expensive car is bad for wealth creation.

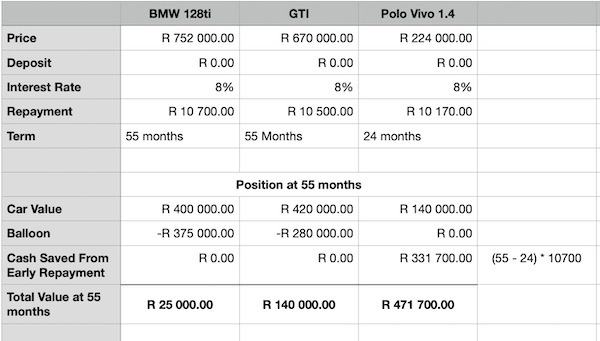

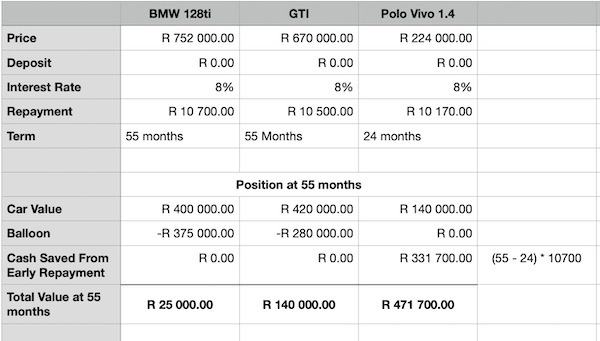

Last week I decided to run the numbers, by putting a value on the opportunity cost of buying an expensive sports car. You can see the results below.

When I graduated with a BCom degree many years ago, the first cars that people bought when they started getting a decent paycheque was a usually a VW Polo or a GTI.

To simplify my calculation, I assume we start with R0 in all cases. I based my calculations on the actual deals offered on car company websites. I was shocked to see that some offer deals with a 50% residual (balloon) payment. In my experience, people care more about the monthly payment that they'll need to make, and less about the car's sticker price. The car values at the end of 55 months are very subjective, so make mental changes as you see fit, and you can roughly see how it changes the final wealth figure. I chose payment periods where the monthly cash flow would be similar.

On luxury cars, there isn't much value left at the end, once you settle the balloon payment. If you don't have the cash available to cover the final requirement, you'd need to trade-in the car, effectively only renting it for 55 months.

If you go for a less expensive car, the Vivo route, you have a fully paid-off vehicle at the end of 55 months, plus all the extra cash you saved once the car was paid off in only two years.

I think we often underestimate the amount of depreciation on a new car. As soon as you drive a new vehicle out of the dealership it drops 15% in value just due to lost VAT.

As you can see, opting for a more modest car creates significantly more wealth. In reality, the value will probably be even higher because the BMW and GTI would have more expensive insurance, fuel costs and tyre replacement costs. I also haven't assumed any growth on the cash you put aside once the Vivo has been paid off.

I have nothing against driving a nice car, but I think people don't know the opportunity cost of the high-end purchase.

Personally I'd rather drive an old car and use the money saved to go on nice holidays and invest in exciting companies.

Linkfest, Lap It Up

Linkfest, Lap It Up

Altos Labs, a Jeff Bezos-backed anti-aging company recently raised $270 million for research. The company hopes to create rejuvenation treatments by reprogramming our cells -

Meet Altos Labs, Silicon Valley's latest wild bet on living forever.

Doctors successfully transplanted a pig kidney into a human being. The genetically-modified kidney was put into a recently-deceased person and observed for two days, and the body didn't reject the organ as was expected -

In a major scientific advance, a pig kidney is successfully transplanted into a human.

Signing Off

Earnings season in the US continues this week. We are anticipating quarterly numbers from Facebook tonight; Microsoft, Google and Visa tomorrow; and Apple, Amazon and Starbucks on Thursday.

Markets are in the red in Japan this morning, in the green in China but mixed in Hong Kong. US equity futures are pointing towards a positive open this afternoon. The Rand is currently trading at $/R14.80.

Have a good week. If you live in Johannesburg, enjoy the summer rains and the Jacaranda-lined streets.

Sent to you by Team Vestact.