Market Scorecard

Yesterday was a decent day for US markets. The Dow Jones index closed in the red, but more importantly for Vestact clients,

the tech-heavy Nasdaq had a strong session. On the JSE, over 20 companies hit 12-month highs, and none reached a new 12-month low. Many of our previously-unloved, smaller companies are starting to attract investor attention. Thinly-traded, focused businesses can rally hard under these circumstances, justifying the risks in buying their shares.

In company news,

Apple had a very successful product announcement event last night. The new MacBook Pros look amazing, and Byron reports on those in more detail below. They also unveiled new AirPods, updates to their HomePro Mini smart-speaker line-up and tweaks to the Apple Music offering, which will be more integrated with voice-assistant Siri.

Elsewhere,

Tesla is back near its all-time high, just ahead of its earnings release tomorrow. This means Elon Musk is now worth a quarter of a trillion dollars, and is right on top of the world's richest list. Well done to him.

In summary, the

JSE All-share closed up 0.83%, the

S&P 500 closed up 0.34%, and the

Nasdaq closed up 0.84%.

Our 10c Worth

One Thing, From Paul

John Lim writes on finance website HumbleDollar that

the cardinal investment sin is selling your winners too soon. Here's a link to the whole post:

The Cardinal Sin, which expands on this topic. I'm just going to post chunks of it here.

"From 1926 to 2016, more than half of all US stocks returned less than one-month Treasury bills. In other words, you were better off putting your money into risk-free T-bills. In fact,

more than half of common stocks delivered negative total returns.

These stats come from an academic paper by finance professor Hendrik Bessembinder. He found that the best-performing shares, a mere 4% of all stocks, were responsible for the stock market's entire gain over and above T-bills.

If just 4% of stocks account for the lion's share of stock market returns, you had better own them or you're doomed to underperform the market.

You must hold on to your winners and not sell them prematurely. Unfortunately, this is easier said than done. Most investors display a strong tendency to sell their winners and ride their losers."

This explains why at

Vestact, we have held our portfolio winners for decades, and hope to continue to do so for a very long time.

Byron's Beats

When you're a $2 trillion market cap business, making over $100 billion in profit a year, how do you get bigger? One answer is to move away from outsourcing. That's exactly what Apple is doing by creating its own chips. These chips are streets ahead of the competition, and making them in-house improves profit margins.

Yesterday Apple launched their new MacBook Pro line-up, which use the significantly more powerful M1Pro and M1 Max chips. The chips have more powerful GPUs using high-performance graphic memory. This is the biggest upgrade to the MacBook range since 2016. Their impressive specifications could make them very attractive to the gaming community, who have historically not favoured Macs. It will be a big win for Apple if they manage to lock in these big spenders.

Initial feedback from tech reviewers and financial analysts has been very positive. I know that a few members of the Vestact team have been patiently waiting for this upgrade, and will rush to the Sandton iStore as soon as these beasts arrive in South Africa. We all exclusively work on MacBooks, naturally.

It's crucial for Apple to keep moving forward like this. Not only does it improve their margins, but it keeps their hardware business relevant and locks more and more users into their ecosystem.

Michael's Musings

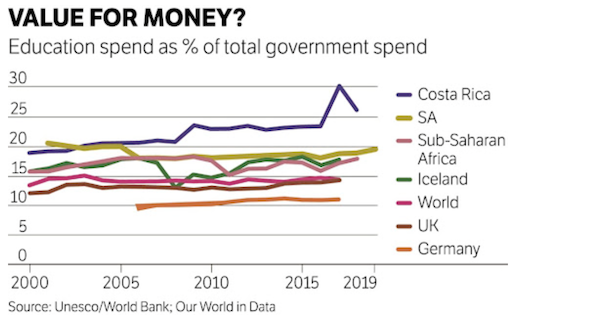

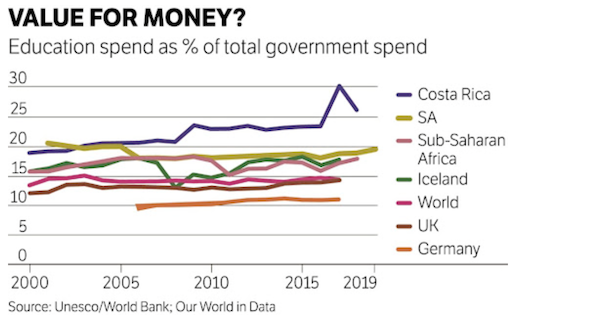

Over the last few weeks, there's been an interesting debate going back-and-forth in the South African business media about how to stimulate growth in this economy. On the one side is Colin Coleman, the ex-CEO of Goldman Sachs for Sub-Saharan Africa. On the other is Thabi Leoka, an economist with a PhD in economics from the University of London.

Coleman seems to be in the Modern Monetary Theory (MMT) camp, saying that the South African government should forget about our debt levels and spend as much money as they can. His view is that aggressive state spending will create an economic boom to propel South Africa out of the doldrums. He says it's the silver bullet we've all been waiting for.

Leoka disagrees, noting that South Africa doesn't have an austerity problem, but that we spend money badly. I agreed with her on Twitter - "Saying that our solution is for the gov to spend more is like telling an alcoholic that they need to drink more to solve their ills." Perhaps we feel South Africa is in an era of austerity because we are spending billions bailing out defunct state-owned entities, leaving less money for things that really matter.

We live in a world with limited resources. Wealth is created when we use the resources at our disposal in a more efficient manner. The MMT crowd seem to forget this. They assume that unlimited government spending, regardless of how inefficient it is, won't have any negative consequences.

Unfortunately, we can't just spend our way to prosperity.

This piece from Bruce Whitfield highlights how education is a government priority spending item, but the results are absolutely abysmal.

We don't need more money, we need better implementation. It's a subscription only article, but I would encourage you to sign up for BusinessDay access at only R120 a month -

Inside SA's education apocalypse.

Linkfest, Lap It Up

Linkfest, Lap It Up

After a failed IPO in 2019, WeWork is making a comeback. The company is expected to list through a SPAC this week with a valuation of around $9 billion, a far cry from the previous value of $50 billion -

WeWork to finally get stock market listing.

Toyota has launched a $3 100 electric scooter called the C+ Walk, designed for those with limited mobility. It goes for 14km on a single charge and has a top speed of 10 km/hour -

Toyota's three-wheel electric scooter.

Signing Off

Asian markets have bounced back from yesterday and are green across the board. US equity futures were flat for hours, but are now moving slightly higher. Our JSE has opened in positive territory and the Rand is trading at 14.61 to the US Dollar.

We will be looking forward to results later today from

Johnson & Johnson (before the bell) and

Netflix (after the close). Let the good times roll.

Sent to you by Team Vestact.