Market Scorecard

Yesterday was the second time in three days where the Dow Jones finished in the green but the Nasdaq closed in the red. Ted Weisberg, owner of Seaport Securities, our broker partner in the US, commented that the pendulum is swinging away from tech and back towards more traditional stocks. The top four weighted companies in the Dow are, United Health, Goldman Sachs, Home Depot and Boeing. You can see the complete list here -

Dow Jones Weightings. The Nasdaq is obviously all the tech titans.

Traders go through phases of preferring one sector over another.

When your sector is in favour, it's great, but it can be tough to watch when you fall out of favour. These sector rotations are all short term mood swings. In the long run, all that matters is the fundamentals of a company. Apple won't sell fewer iPhones just because tech stocks are out of favour. The same way that people will continue going back to Google regardless of Wall Street's 'sector of the month'.

Yesterday the

JSE All-share closed down 0.20%, the

S&P 500 closed up 0.60%, and the

Nasdaq closed down 0.04%.

Our 10c Worth

One Thing, From Paul

I'm doing something unusual tonight: taking part as a panellist on a webinar organised by the SA Jewish Report. The topic is "David vs Goliath: Manipulating the Markets - How Ordinary People are Taking on Wall Street". The promo says that Tesla, GameStop and Bitcoin will be discussed. Haha, that sounds hilarious!

The other speakers are Jonathan Hertz (former CEO of Peregrine Holdings), David Shapiro (Sasfin portfolio manager and top market commentator) Ran Neu-ner (founder of something called Cryptobanter) and Tumelo Ramaphosa (CEO of something called the Studex Group). It will probably be a bunfight, and I'll have to refrain from swearing?!

Anyone can register to watch. Go to this link to sign up beforehand:

Webinar Registration. I'll see you there!

Byron's Beats

Over the last year Prosus is up 60% and Naspers is up 44%. See the comparative graph below, Prosus is the blue line. Since the Prosus spinoff in September 2019 the outperformance has been about 14%. My calculations suggests that the spinoff has created around R400 billion extra value for shareholders.

Essentially that is what management had set out to achieve when they spun off Prosus and listed it on the Euronext. The idea was that because the Euronext was a bigger exchange, the size of Prosus would not be a problem. On the JSE, Naspers became such a large constituent of the index that many funds were forced sellers of the stock whenever the share price grew.

There is still a large discount to NAV for both holding structures.

Naspers has a 48% discount and Prosus has a 38% discount.

We like all the assets that these companies own and any discount unwind will be a good upside kicker. Many people think that the easiest way to solve the problem would be to spin out Tencent. That would mean that Tencent would need to be listed on the JSE.

Maybe the Chinese government don't want that? It would also make management a little less relevant because the holding companies they run will be a lot smaller.

In the interim, we are happy to hold Naspers and Prosus as the dominant positions in all JSE portfolios.

Michael's Musings

If you wanted to buy or sell a stock in the old day, you needed to go through a person, your broker. The broker would then send the order to the stock exchange floor and after a bit of shouting, the trade would be executed. The process was slow and expensive.

Also, it was very difficult to access information meaning retail traders didn't bother themselves with direct stocks.

Thanks to technology, the price, speed and access to information is infinitely better. The trading platform Robinhood, for example, allows their clients to trade for free and in partial shares. Helping retail traders access the stock market. These trading platforms also give access to huge amounts of debt, which means someone with only a few hundred dollars, can get stock market exposure in the thousands.

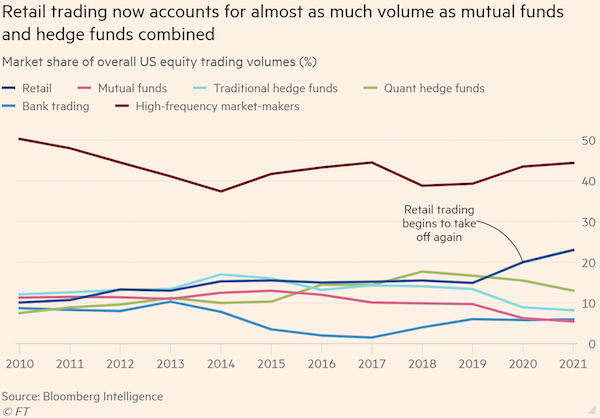

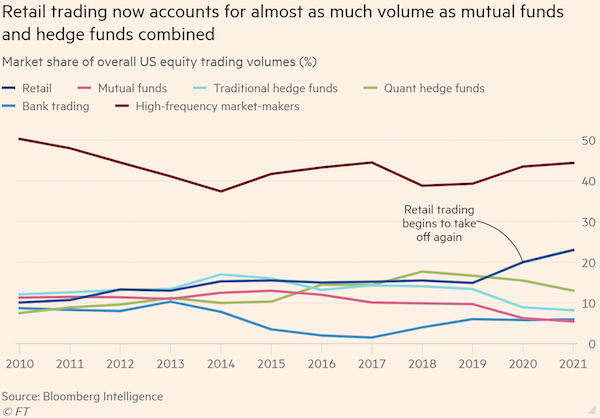

Due to this increased access, retail investors are a significant part of daily trading volume in the US. Share prices are determined by demand and supply, which is driven by volumes on either side of the order book. Effectively, as retail volumes grow, so too does their impact on short term stock market prices.

The FT article below points out that retail traders tend to get caught up in trending stocks/sectors, creating significant volatility. Think about travel sector share prices during Covid or the headline-grabbing GameStop, David vs Goliath, saga. I find it all very interesting to watch.

Read more here -

Rise of the retail army: the amateur traders transforming markets.

Bright's Banter

African payments company,

Flutterwave, announced that it closed a $170 million Series C funding round that valued the business at over $1 billion. This means Flutterwave joins a rare list of African unicorns, including Jumia and that's about it. That's the whole list!

Flutterwave has raised $225 million in total, making it one of the few African startups to have secured more than $200 million in funding. The fundraising was led by Avenir Growth Capital and Tiger Global.

The Nigerian payments company was founded in 2016 by Iyinoluwa Aboyeji and Olugbenga Agboola to connect merchants and consumers, intra-Africa and globally. Last year,

Flutterwave managed to process over 100 million transactions valued at over $5.4 billion across 11 African countries.

The west is taking notice of innovative African startups. We've seen the likes of

Stripe buying Nigerian fintech company Paystack for $200 million and

Visa buying a 20% stake in Nigerian business-to-business payments company Interswitch.

Linkfest, Lap It Up

Linkfest, Lap It Up

Don't waste a good crisis. Globally, there has been a spike in small businesses and side hustles thanks to lockdowns and state grants -

The Covid entrepreneurs: Americans start millions of new businesses.

Bill Ackman says he's working very hard not to disappoint his "Tontinites" as they hunt for clues about which company his Pershing Square Tontine Holdings SPAC will merge with -

Reddit is convinced it knows Bill Ackman's SPAC target. Ackman is paying attention

Signing Off

Last night the US Congress passed the $1.9 trillion stimulus package and Biden is expected to sign it into law on Friday. Asian markets are firmly in the green this morning and the Rand is looking healthier at $/R15.06.

Sent to you by Team Vestact.