Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday MTN released interim results for the first half of the year. Revenues grew to R84.1bn from R72.5bn and operating profit jumped to R23.3bn from R15.4bn. This resulted in earnings per share more than doubling to R4.30 from R1.95 last year.

The market was already told about these great numbers a few weeks back in a trading statement. It jumped 8% on that day. Yesterday when the full details came out the share price dropped 1.4%.

The share now trades at R60. If it makes R4.30 every 6 months, you get your money back in 7 years assuming all things remain the same. That is very cheap for a listed business!

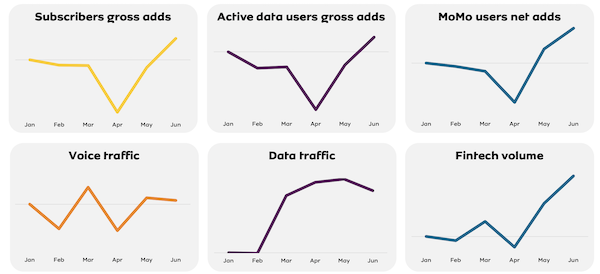

Data revenue jumped 32.7% to R22.7bn and fintech (mobile banking) jumped 18% to R6.1bn. At face value these numbers look outstanding. Not just that, they are operating in growing sectors with exciting prospects. Take a look at the graphs below showing the trends of their businesses during and after lockdown.

Why is the share so cheap? The geographies MTN operate in would be the clear cut answer in my opinion. They cannot be an acquisition target for a western firm because of their operations in Syria and Iran. They are sensitive to the oil price because they operate in oil rich nations. They are constantly targeted by bankrupt and corrupt governments and they struggle to repatriate profits.

That is why they have announced their intention to exit their Middle Eastern businesses in the next 3 to 5 years. They will keep their focus exclusively on Africa now.

At these levels MTN has a lot of upside potential. But because of the risks mentioned above there are always potential disappointments around the corner. If you own them, keep hold of them. If you are looking for a deep value buy and have a strong stomach, I would add a few at these levels.