Market Scorecard

How did you survive the first week of the lockdown? One down, two to go. US initial jobless claims came in at a massive 6.6 million people yesterday, meaning over the last two weeks, around 10 million people have lost their jobs. The figure pushed US futures into the red. Shortly after the market opened though, Trump tweeted saying that he spoke to the Saudi Crown Prince. He expects Russia and Saudi Arabia to cut back their oil production by 10 million barrels - maybe substantially more.

On the tweet, the price of Brent Crude launched 47% higher and US stocks moved into the green.

As people ran the figures, the price of oil prices started returning to its previous price. Between Russia and Saudi Arabia, they produce 23 million barrels a day. To cut 10 million barrels would be a 43% cut from the two nations, probably too high. Not helping is that both Russia and Saudi Arabia have distanced themselves from the production cut claim. As it stands, the oil price is still 10% higher than it was before the tweet yesterday. Given how volatile asset prices have been recently, it almost feels like we are watching a Hollywood movie. The key is to keep calm and carry on with our long term plan.

Yesterday the

JSE All-share closed up 3.04%, the

S&P 500 closed up 2.28%, and the

Nasdaq closed up 1.72%.

Our 10c Worth

One thing, from Paul

Former banker, now venture capitalist

Michael Jordaan wrote a good piece in the Daily Maverick today, about steps that business owners and entrepreneurs need to take now. The headline was

Simple, timeless priorities for business people during Covid-19.

The whole thing is worth a read as it includes a useful analysis of our macroeconomic challenges and some good personal advice. The part that really stood out for me was his comment that

business owners must take immediate steps to keep their companies profitable.

For all but the luckiest, most digital outfits, staying profitable will require immediate operational shifts, and drastic cost cutting. Business models must be changed overnight to fit in with the requirements of stay-at-home rules and social distancing.

In many cases, companies will have to lay off staff and (perhaps) employ others.

Job losses in 2020 are going to be eye-wateringly large. As our Michael Treherne pointed out above, 10 million workers in the US were let go in the last two weeks. Here in South Africa we already had horribly high levels of unemployment, and the joblessness numbers are going to get worse, much worse in the months to come. This is no time for lame excuses or wishful thinking. Zombie companies like SAA or Edcon will not survive.

US workers live in a rich society that can afford generous unemployment benefits, but here in South Africa there is a very small safety net.

As a matter of interest, US markets rose strongly on both days that those brutally high job losses were announced. Tough as it may sound, that is probably a reflection of the fact that the pain is being taken early, as it needs to be.

Byron's Beats

Netflix was trading at $380 a share before the COVID crash. Today it sits at $370. Basically flat. That is a big outperformance of the Nasdaq which is down 18%. Netflix is providing a lot of entertainment for people on lockdown. What will happen to the company after lockdown ends? I suspect most new subscribers will remain happy clients after a good experience (getting addicted to series).

Disney however has dropped 30%

Disney however has dropped 30%. All their parks have closed which had a big impact. To try and counter that, they are pushing ahead with their launch in India which takes place today. They were originally planning to launch with the IPL, but that will most certainly be delayed. Let's see how it goes.

Michael's Musings

The silver lining to the current lockdown is that we are using much less electricity. This means Eskom is in a position to increase the amount of maintenance they are doing. I tried to get the link to the press release but the Eskom webpage is also under maintenance.

The statements said that Eskom had increased planned maintenance from 4 250 MW to 9 000MW.

Having better maintained power stations will mean fewer breakdowns later. It also means that Eskom will have lower planned maintenance when things go back to normal, which translates into being able to absorb unexpected breakdowns.

In summary, we will have less loadshedding when the lockdown ends, giving our economy the best possible chance to rebound.

Bright's Banter

International luxury wannabe brand Shandong Ruyi is making headlines for all the wrong reasons.

Two years ago the company agreed to buy Swiss luxury fashion house Bally from JAB Holdings for $600 million. Shandong Ruyi is now failing to find the financing for the deal. Very awkward if you ask me!

Shandong Ruyi, like all good Chinese companies,

has a very large and complicated debt structure, which now has come under question as it looks shakier by the day. Shandong Ruyi also

owns high-end luxury house Trinity Group which has brands like Cerruti1881, Gives & Hawkes, Kent & Curwen, and my personal favourite, the Japanese brand D'urban.

The faux luxury conglomerate wannabe acquired Trinity Group in April 2018, and managed to turn it from a loss-making business to a profit machine. Ruyi did this by cutting what doesn't work and supporting supply chain capabilities to brands loved by loyal customers through its massive network of resources.

The good news here is that Trinity Group released its end of 2019 year results showing revenues increased by 13.9% to HKD 1.962 billion, with core operating profits of HKD 161 million. This is the first set of full numbers that Trinity has produced since being acquired by Shandong Ruyi. However,

there's still a big question mark on Ruyi's debt structure which compromises the whole thing.

Linkfest, Lap it Up

Linkfest, Lap it Up

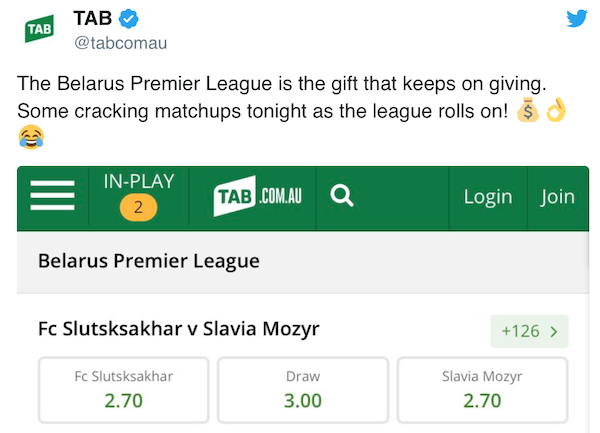

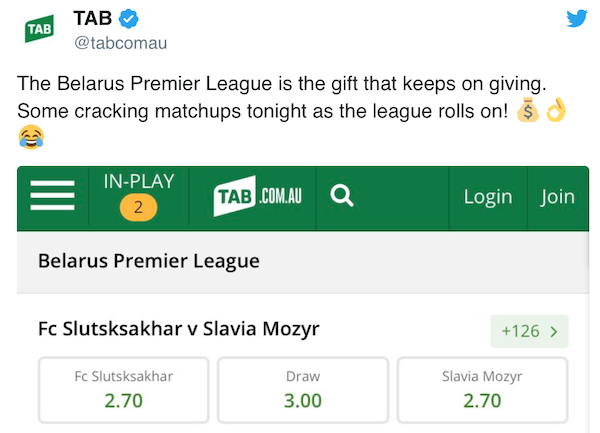

With many sporting events now canceled, betting companies got creative -

From basketball in Tajikistan to the weather: how gambling companies are riding out Covid-19

Computers will take over the world

Computers will take over the world one game at a time. Developers like to test artificial intelligence using games because of the variability that comes with each game and the ability to test scores against humans-

DeepMind's AI learned how to play every Atari game.

Signing off

Signing off

The Rand took another hiding yesterday. It is currently at $/R 18.56 as money flows into the Dollar. Data out today includes manufacturing data from South Africa and the EU, and then US labour statistics for March, which includes their unemployment rate. The JSE All-share is lower this morning.

Sent to you by Team Vestact.