Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

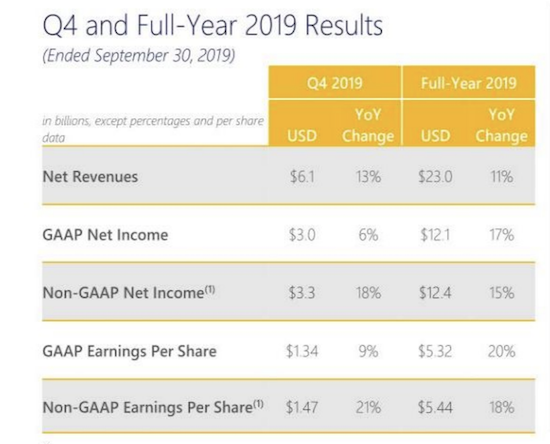

Our biggest and most widely held stock in our client base, Visa, reported Q4 and full year numbers last night. Here is what Chairman and CEO Alfred Kelly had to say.

"The fourth quarter capped a strong fiscal 2019 with net revenue and adjusted EPS growth of 13% and 21%, respectively. During the year, we extended and expanded partnerships with a significant number of our largest clients globally while also establishing new partnerships with emerging companies across the payments ecosystem. These partnerships, combined with four acquisitions and substantial organic investment, greatly expand our reach and capabilities to fuel future growth."

The more I follow Visa the more I realise that this business is about establishing good long term partnerships and maintaining them with world class service. As a consumer, you cannot choose who issues your card or who switches your transaction. I doubt many consumers or merchants even care. As long as it is done efficiently. From the above quote from the CEO, you can see that is a priority for the company and something they have been able to do very successfully over the years.

Here are the financial highlights.

Lets focus on the full year numbers for a change. Earnings growth of 20% off revenue growth of 11% is good going for a company with a market cap of $400bn. But you have to pay up for that quality. There is no such thing as cheap quality on the US market. With full year earnings of $5.44, the stock trades on 32 times earnings.

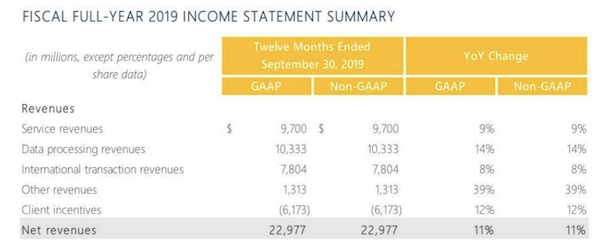

Here is how they make that money.

See the client incentives? That is the partnership costs I was explaining earlier.

This team has a great track record and continues to grow within a thriving sector. As we have seen with cryptos coming online, governments want to regulate money movements. And so they should if they ever want a decent chance of collecting taxes. Visa is their ally in this. We are long and strong this company with a holding period of forever.