Market Scorecard

The positive trade sentiment from Friday carried through to Monday. Phew, there were no late-night tweets to upset the apple cart! Adding to the positive mood is a move from China to make it cheaper for businesses to borrow money. Some stimulus to their economy normally has a positive ripple effect across the globe.

The main focus this week is the meeting of monetary policy leaders at Jackson Hole on Friday. The official name is the Jackson Hole Economic Symposium, which is run by the Federal Reserve Bank of Kansas City. The event attracts business leaders, academics and policymakers. It is followed very closely by the market. Particular focus will be given to what Jay Powell has to say about where he thinks the Fed will be heading.

Yesterday the

JSE All-share closed up 0.95%, the

S&P 500 closed up 1.21%, and the

Nasdaq closed up 1.35%.

Our 10c Worth

One thing, from Paul

One of my favourite web tools for checking the moves on the stock market is the heatmap on FinViz, a US-based financial information site.

US markets have been quite volatile in recent weeks, up or down more than 1% per day, so I find it interesting to see which parts are up and which are down. It shows the different sectors of the S&P 500, and the size of the boxes is determined by the market capitalisation of the individual stocks. The colour reflects the extent of their movement. The more intense the red and green, the more significant the rise or fall.

In the example below, the chart is set to reflect the stock performance in the eight months of the year to date, but the default view is the day move. At a glance you can see that technology, financial and consumer sectors have done well, but energy and healthcare sectors have lagged. The overall market has been strong, after a nasty slump at the end of 2018.

Check it out yourself here, and play around with the settings:

FinViz.

For the record, we built something similar (but more limited) for the local JSE market, which you can look at on our Vestact website once you are logged in to look at your account. It shows the daily moves of the major Alsi 40 stocks, grouped by sector. Login in and

navigate to this page.

Byron's Beats

Here's a bit of good news amongst the mess that is South Africa at the moment.

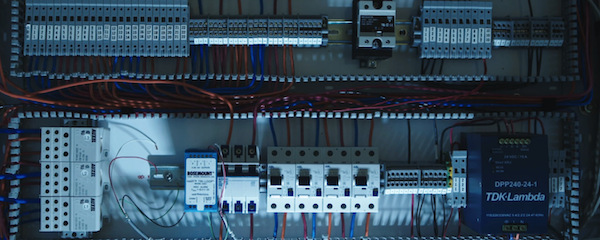

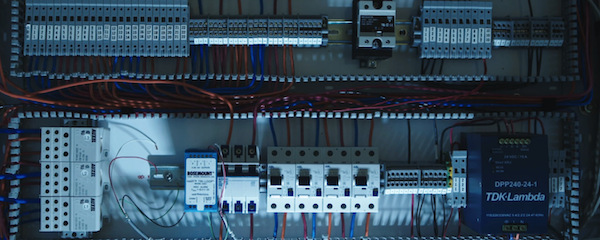

Little known tax incentives boost business case for renewable energy. Chris Yelland is a great person to follow if you are interested in all things energy related in South Africa.

The article talks about certain tax breaks which small businesses can utilise if they install their own solar energy generation. The tax break allows small businesses to depreciate the full cost of the grid in the first year of commissioning if they use less than 1 MW. That will create a large paper loss which can mitigate profits and therefore tax on those profits. If usage is higher than 1 MW the company can depreciate the cost over 3 years.

This is quite significant. Company tax sits at 28%. That implies a net 28% discount on the installation of the solar system. And then of course you save big on electricity costs.

I hope many small businesses who did not know about this incentive see this article and take advantage.

Michael's Musings

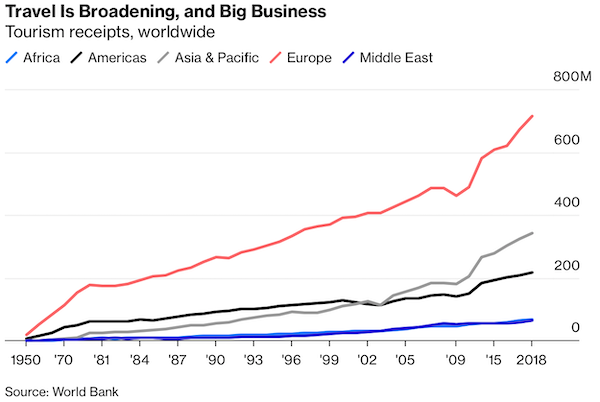

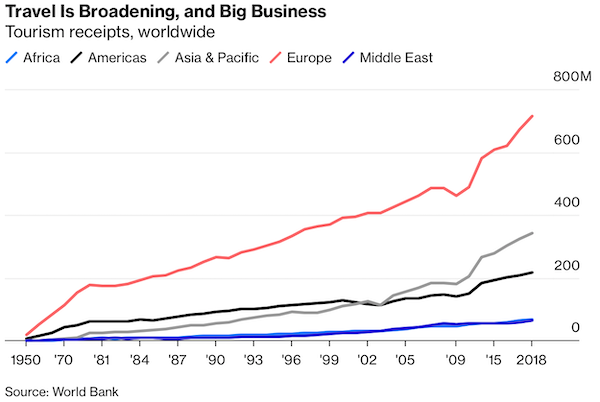

More and more people are travelling because global travel is getting easier, there is a growing global middle class and because of Instagram FOMO. There is also an increasing trend for people to buy experiences, instead of material things. The growing number of people traveling is making some cities think about implementing some form of crowd control tax. See what Bloomberg has to say about it -

Congestion taxes seem like the inevitable answer.

Thinking long term, we have around 7 billion people on the planet at the movement, which is expected to grow to between 10 and 12 billion over the coming decades.

How many more people will be visiting Eiffel Tower or the Colosseum in years to come? Have a look at the graph below showing tourism growth in numbers.

In our view, the number of people travelling is only going to increase. That is why Booking.com is one of our core holdings in our US portfolio.

The moral of the story is to visit those unique places now, while there is still space!

Linkfest, Lap it Up

Bill Gates writes about the hurdle of not having reliable access to internet. Having access to dependable electricity is one way that the poor can get out of poverty -

The hidden costs of unreliable electricity.

A big reason that Microsoft and Amazon are worth around $1 trillion

A big reason that Microsoft and Amazon are worth around $1 trillion is thanks to a booming cloud market.

You will find more infographics at

Statista

Vestact Out and About

Signing off

Signing off

There is very little economic data out today. BHP and Harmony released their numbers this morning, both showing strong gains in profits thanks to higher commodity prices. The JSE All-share is up this morning, but the Rand is on the back foot. Currently flirting with the $/R15.50 level.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista