Market Scorecard

After a week of being closed, mainland China's stock exchanges are open today and are up over 1%. The positivity in mainland China spilt over to Hong Kong, where Tencent is currently up 1.3%. The push higher from Tencent means that it broke through the HKD 350 a share for the first time since August 2018. The stock still has some way to go until it reaches the HKD 470 a share highs reached in January 2018, but considering it was around HKD 260 in October, we can't complain about its current levels.

On Friday the

JSE All-share closed down 1.24%, the

S&P 500 closed up 0.07%, and the

Nasdaq closed up 0.14%.

Our 10c Worth

One thing, from Paul

I am very excited about the

forthcoming listing or initial public offering (IPO) of Uber. No date has been set, but rumours are that it will be in 2019 sometime. Uber was valued at around $76 billion when it last raised money in August 2018.

Everyone knows the business model of the ride-hailing giant, but it also has some other parts to its business.

Did you know how big Uber Eats has become? According to projections from CEO Dara Khosrowshahi,

Uber Eats is on track to deliver some $10 billion worth of food worldwide this year, up from an estimated $6 billion-plus last year.

Uber takes a 30% cut and a delivery fee, then pays drivers, suggesting that Uber Eats could generate at least $1 billion in revenue this year, or an estimated 7% to 10% of the total. That means Uber Eats is already among the planet's largest food-delivery services and ranks second in the US behind rival Grubhub (likely $1 billion in 2018 revenue).

Here's the article in full, it's written by

Biz Carson of Forbes Magazine.

Byron's Beats

Here is some fun for a Monday morning.

Visual Capitalist made a 5 minute clip explaining the history of Tesla. Many do not know that Elon Musk was not the original founder of the company. He was actually an early investor. When the company ran out of money and ideas to save itself, he stepped up and took the driver's seat. Over the years he has built up a nearly 20% stake in the business.

Considering that when he got involved, Tesla was just an idea, he deserves "founder" credit. Just like Howard Schultz from Starbucks and Ray Kroc from McDonalds.

Watch the clip

here.

Michael's Musings

With all the legal issues that MTN has been through over the last two years, we sometimes forget the scope of their operations. The MTN group has exposure to a number of tech businesses, for example they own a stake in Irans equivalent to Uber.

Another of their investments, this time from Nigeria, is looking to IPO in New York which could raise as much as $600 million for MTN -

MTN said to prepare share sale of African unicorn Jumia. At current exchange rates that is just over R8 billion which works out to 5% of the MTN market cap, so not insignificant.

Many of you probably haven't heard of

Jumia before but have you heard of Zando? The South African subsidiary is the online store Zando; I wonder if MTN employees get staff discounts?

Bright's Banter

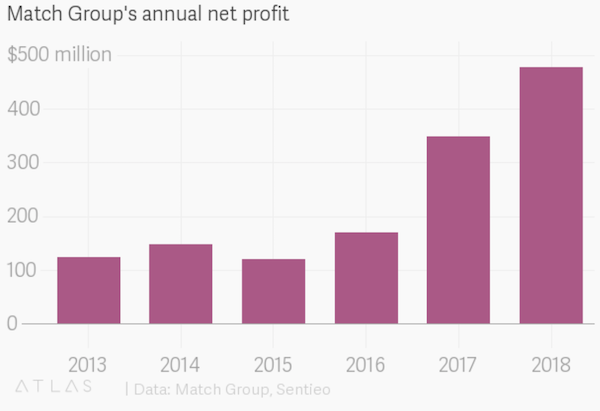

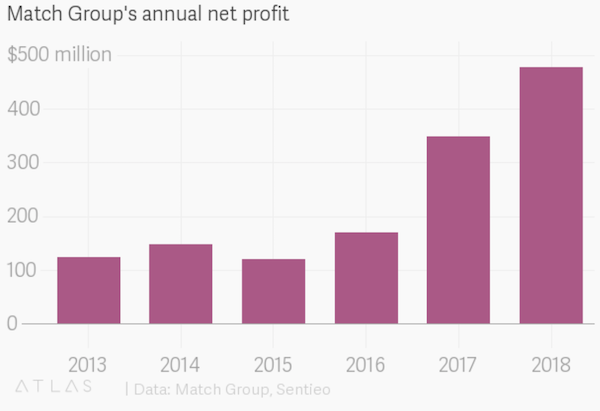

Match Group the owner of Tinder, OkCupid and plenty other dating sites

reported very strong results last week. The company reported profits of $115 million, as compared to a loss in the previous year. All thanks to monopolising dating sites and apps.

Match Group is buying all the cool dating apps

Match Group is buying all the cool dating apps and improving them as a strategy to keep competition at bay. They dominate the market to a point where 60% of all dates, relationships, and marriages that started out on a dating site or app in the US began on a Match Group product.

The biggest success for the group has been Tinder, as half of all the groups' revenues stem from this app. Tinder added 1.2million users last year and is expanding worldwide, including India, Japan, and South Korea. Tinder Plus and Tinder Gold give the user things like unlimited likes and better profile visibility at a fee, these have been minting money for Tinder.

The company developed an app called Ship where you can hook your friends up.

Match bought Hinge, a dating app that solely focuses on more mature, more serious people in the dating scene; this app rivals Bumble.

Linkfest, Lap it Up

Linkfest, Lap it Up

Um this is not meant to happen -

WorldFirst shuts down its US operations to enable a $900m sale to Ant Financial.

"WorldFirst, a British money transfer business in talks to be acquired by China's Ant Financial for $900m, shut down its whole American division so US regulators wouldn't put the kibosh on the deal."

There are millions of miles of unused fibre cables already in the ground. Why would there be so much unused cable? Anyway, science is coming up with ideas to use them -

'Dark' Fiber Optic Cables Can Measure Earthquakes .

Vestact Out and About

Vestact Out and About

Signing off

Signing off

The week ahead will be focused on US politics, sigh. Congress has until Friday to pass new legislation to keep the government open and funded. Over the weekend news surfaced that Democrats and Republicans stopped talking to each other, so who knows what will happen over the next few days. Then high level trade talks will take place again this week between China and the US; there is only three weeks until the 1 March deadline. The only significant piece of data out today is a UK GDP figure. Economists are expecting growth of 1.4%. The JSE All-share is higher this morning.

Sent to you by Team Vestact.