Market Scorecard

Naspers is within a whisker of having a '3' in front of its price after closing 4.8% higher yesterday. The strong moves are thanks to a Tencent that is trending higher benefitting from the news that talks between the US and China are progressing well. Naspers hasn't been above R3 000 since early October last year. All this culminates in the JSE All-share now being green for the year. Long may it continue!

Yesterday the

JSE All-share closed up 2.03%, the

S&P 500 closed up 0.41%, and the

Nasdaq closed up 0.87%.

Our 10c Worth

One thing, from Paul

The

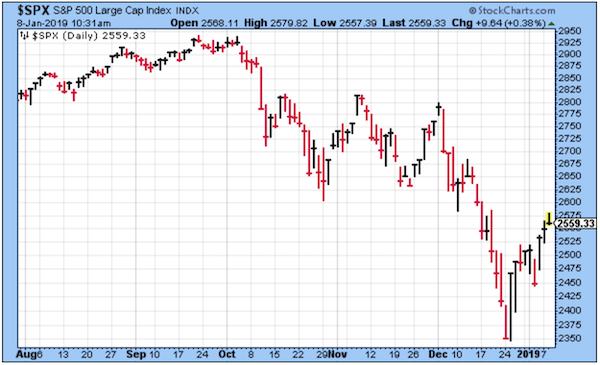

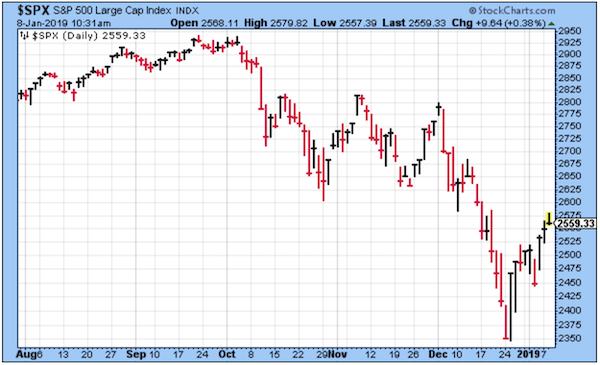

share price of Apple has pulled back sharply in recent months, so we are watching it closely. The all-time high was $232 per share on 3 October 2018. It got as low as $142 over the Christmas period, but has since rallied to last night's close of $153.31. As we mentioned earlier this week, sales of the new models of iPhones have been a little disappointing, especially in China.

Keep in mind that

Apple is the world's leading luxury consumer-goods company. It has wonderful profit margins, and regularly reports record sales and earnings. It dominates the high-end personal computer market, as well as those for smartphones and digital watches. It never discounts its products, and has raised prices in recent years. Its beautifully designed stores are tourist destinations.

It has hundreds of millions of rich, repeat customers who are largely price-insensitive. As a result it generates a mountain of cash every quarter.

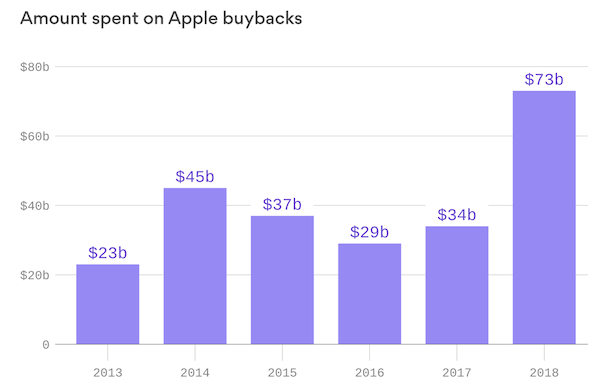

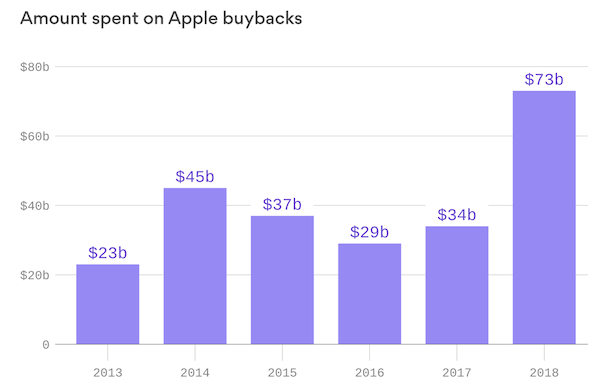

Apple has used a good deal of that cash in recent years to buy back its own shares, as you can see from the chart below. Remaining shareholders like us benefit directly, because it means that future profits are shared across a smaller base, and the earnings per-share keep rising. I'm not sure, but I would imagine that the team in charge of buybacks has been busy this last ten days?

Byron's Beats

Nike has taken Lululemon head on with a yoga clothing line. But they have done it in a somewhat sneaky way, calling yoga a "secret workout weapon" which prepares athletes for the usual Nike activities such as running and NFL.

I think it is very a smart move. The yoga movement is big and so is the clothing associated with yoga. You don't even have to do yoga to enjoy the slick looking clothing that the likes of Lululemon create. The apparel on its own has become very fashionable for day to day wear.

And Nike wants a piece of that gluten free pie. Namaste Nike, Namaste.

Michael's Musings

The market turbulence over the last 3-months has rocked some clients. One of the questions asked by clients is,

"Why don't we sell now and then buy back when the market recovers?" It is a very valid question, but it has

one massive assumption.

Selling now and buying back when the market recovers assumes that you know when the bottom is, or at the very least 'sort-of' where the bottom is. Eddy in a recent Crossing Wall Street blog post, asked

What If the Bear Market Is Already Over?.

The US market is already 10% higher than the recent December lows. What do you do now if you sold in December in anticipation of things going lower? Do you buy back in or do you wait and hope this bounce is temporary? Don't forget about all the costs and taxes involved with selling.

Bright's Banter

In a post titled "The Unstoppable Rise of Music Streaming", it showed some cool stats on how this industry is here to stay.

According to

Nielsen's 2018 Year-End Music Report , Americans came up top in the streaming race with a record of more than 900 billion (video and audio) songs streamed in the past year, an increase of 43%.

On-demand audio streams grew 49% in 2018, sitting at 611 billion streams, thanks to the likes of Spotify and Apple Music; both companies we admire here at Vestact.

Music streaming has increased more than eight times between the years 2013 and 2018. Streaming both on ad-supported (YouTube & Spotify) and subscription-based (Apple Music & Spotify) now accounts for 65% of US music revenues. Bye Bye CDs and downloads!

Four songs surpassed 1 billion on-demand streams last year including Drake's "God's Plan", Juice WRLD's "Lucid Dreams (Forget Me)", Drake's "In My Feelings", and the late XXXtentacion's "Sad". I must say I know all the lyrics to those songs in reverse!

You will find more infographics at

Statista

Linkfest, Lap it Up

Looking for a new book this year? Here are the books recommended by Bill Gates, it is an interesting list! (

5 books I loved in 2018)

One of the unintended consequences of Brexit is the potential time it will take to cross the border.

You will find more infographics at

Statista

Vestact Out and About

Michael gets a mention in this financial mail article, talking about Bitcoin and cryptocurrencies -

Is there life after bitcoin?

Signing off

Asian markets are slightly red this morning after Chinese data released was weaker than expected. The JSE All-share is also lower by 0.2% this morning. Local data out today is the manufacturing production number for November, and then in the US the Fed chairman, Jerome Powell, is speaking. The market is expecting very few rate hikes this year, with some analysts even calling for a drop in rates. We will have to see what sentiment Powell portrays this evening.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista