Market Scorecard

US markets had another green day yesterday, meaning it is the first time since November that the Dow has been up for three days in a row. A client pointed out yesterday that those countries which still use the Julian calendar, only celebrated Christmas on Monday, so they at least had a Santa Clause rally.

For the first six months of this year, the main focus will be on The Game of Thrones, both the series and real-world politics. Who will win the South Africa election? Who will be in key ministerial positions? How will Brexit turnout? What will happen with US policies now that the Democrats control the house? Where will the chips fall in the China/US trade war? Equity markets will rise and fall as sentiment and predictions change. Remember though, buying equities is for the long-term. You will still own Naspers and Visa, long after The Trump is out of the White House.

Yesterday the

JSE All-share closed up 0.40%, the

S&P 500 closed up 0.97%, and the

Nasdaq closed up 1.08%.

Our 10c Worth

One thing, from Paul

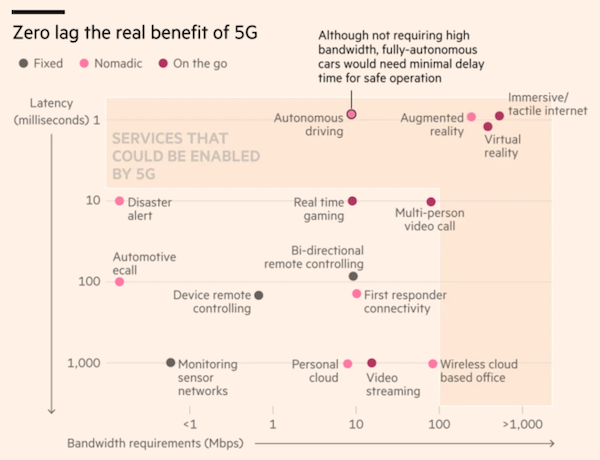

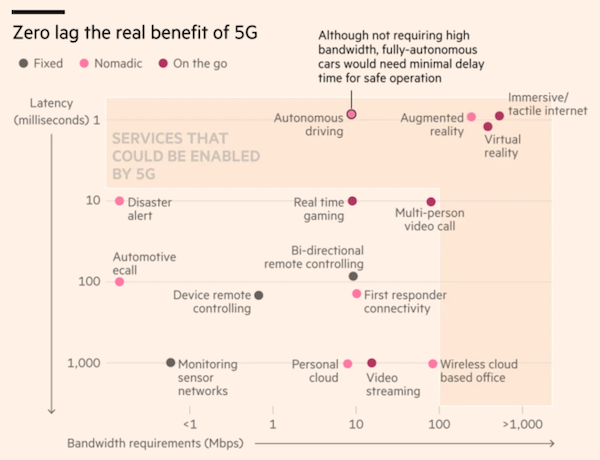

High-speed mobile communication networks are the infrastructure that underpins the connected way we now live. In that world,

the move from 4G/LTE networks to 5G is the next big thing.

Several countries have begun to trial 5G networks, though full international standards have not yet been agreed.

It will bring higher speeds, lower lag times, and a much larger capacity to transfer data. It also requires more base stations; the capital investment needed will be significant.

Chinese network equipment company

Huawei is the world leader in such switching equipment, but American officials have been pushing allied countries to ban Huawei from building their 5G networks, citing concerns over security and the company's unclear links to the Chinese state. The arrest of Meng Wanzhou (Huawei's chief financial officer and daughter to the company's founder) in Canada in December and her possible extradition to the USA, has deepened the spat.

Here in South Africa the uselessness of the industry regulator ICASA and the government Department of Communication has delayed even the testing phase of 5G networks.

Vodacom and MTN are pulling their hair out. We are buy rated on both stocks. There is a new minister in place, Stella Ndabeni-Abrahams. Perhaps she will get things going?

Take a look at the chart below, which shows the range of web services which are made possible by the low latency and high bandwidth that 5G provides.

More here, on the FT website (requires a subscription):

Huawei spat comes as China races ahead in 5G

Byron's Beats

The world of computer chips can be complicated and confusing. Even more so when you start delving into the details of Graphics Processing Chips (GPUs) and gaming. This Motley Fool article titled

Why Investors Should Love NVIDIA's Latest Announcement does a good job at explaining the Nvidia news over the weekend which spiked the share price by 5% on Monday.

In short, it means that Nvidia gaming chips which previously did not support certain computer monitors will now be able to support these cheaper monitors. Historically, gamers were forced to purchase specialised monitors along with high-end Nvidia chips to get the best gaming experience. For gaming pros, this is still encouraged, but for your average gamer,

Nvidia chips are now a lot more accessible.

Michael's Musings

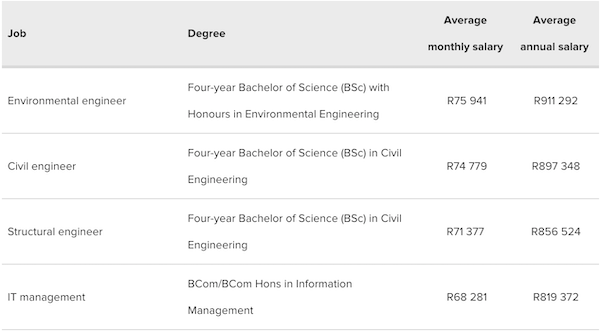

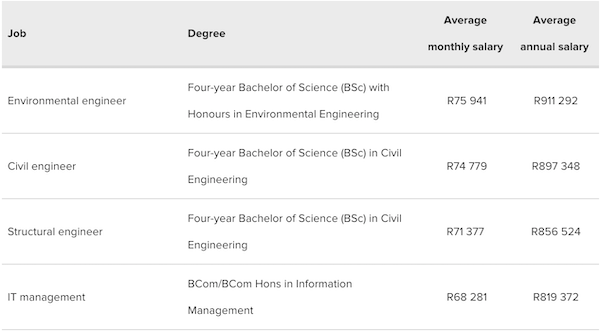

It is back to school for many people today. Following that theme, this article looks at what you should gear your future studies toward if money is the decisive factor -

What students should study to make the most money in South Africa. I'm not surprised to see problem solving type degrees at the top, I was surprised to not see anyone in the medical field mentioned.

The tough part for anyone considering what to study now is that technology is changing our world at a rapid pace. Some 'safe professions' like accounting and law are the most at risk of being replaced by computers. The flip side is that many jobs will be created that we haven't even thought of yet. What do you study today to take advantage of those jobs though?

Bright's Banter

I read a good article on Quartz this morning on how

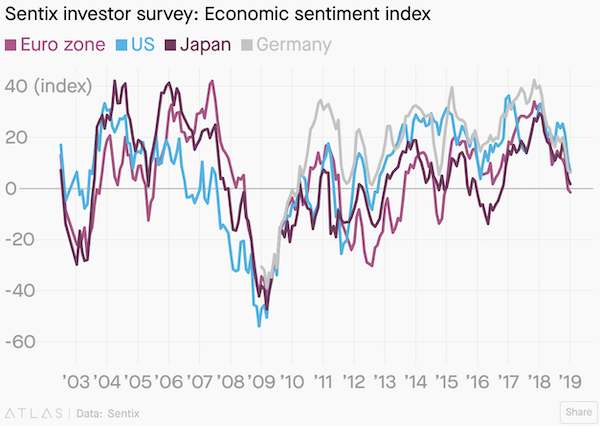

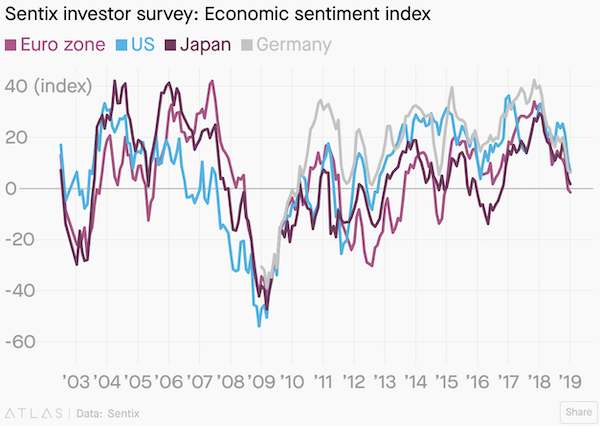

investors are predicting doom and gloom for just about every major economy.

The journalist makes the argument that investors are starting to get very nervous about this bull market and inevitably what goes up must come down. I tend to be very sceptical when reading investor sentiment indicators and here's why.

Most investor sentiment indicators such as the Sentix investor index or future economic expectations minus current conditions, means nothing at all in predicting future stock performance.

No investor or even a group of investors know for sure what is going to happen in the future, as Charlie Munger would put it, forecasting is a fools' errand.

These indexes that try to gauge fear in the markets are only right at extremes

These indexes that try to gauge fear in the markets are only right at extremes making them pretty useless as a forecasting mechanism and a market timing tool because you will only know after the fact. The Guardian reported that many economists are dead certain that we will see a global recession in 2020.

The gist of the article is still pretty much valid, which is the fact that the Eurozone, US, Japan, and Germany economies are slowing down and the rest of the world will probably follow. Misery likes company!

However, the conclusion to say at this exact time the markets will crash is totally invalid and absurd as it ignores all the other alternative probabilistic outcome. The best thing to do right now is probably to do nothing.

Spend less than you earn, save and invest the difference but most importantly don't forget to take your medicine and look at your investment statement with less frequency.

Linkfest, Lap it Up

Trevor Noah had a good Christmas -

Trevor Noah dumps $20 million on a Bel Air ultra-contemporary.

It was surprising to see the low projection for drone sales growth

It was surprising to see the low projection for drone sales growth. Equally surprising is the high growth for wireless earphones.

You will find more infographics at

Statista

Signing off

Talk of progress between the US and China means that Asian markets are flying this morning, and the the JSE is 1% higher for the day so far. The Rand is also slightly stronger, trading below that phycological $/R14 level. Later today, there is South African business confidence report and a manufacturing PMI number.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista