Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Vestact customers have been invested in Woolworths in their local portfolios since the middle of 2011. At the time, we felt that the clothing and food retailer was perfectly positioned to benefit from a growing middle class in South Africa, who were aspiring to shop at its upmarket stores. At the time, it traded at about R30 a share.

We don't really favour cyclical stocks with unpredictable earnings swings, but we hoped that Woolworths' high-end customer would weather the economic storms better than low-end operators. The stock did well at first, trebling to over R100 per share.

Along the way it expanded significantly, buying its way into the Australian market with the acquisition of David Jones, a department store operator, for R21.4 billion. That was added to other clothing chains there like Country Road, Mimco and Politix. The idea was to create a leading southern hemisphere retailer. CEO Ian Moir said at the time: "This transaction provides us with the scale and opportunity to deliver significant benefits to our shareholders, and our customers in South Africa and Australia".

Since the end of 2015, Woolworths has underperformed relative to our expectations. Consumer confidence in both South Africa and Australia has been weak. The Woolworths share price has halved, back to R50 per share.

The South African clothing business has struggled, amidst fierce competition from both traditional local competitors like Foschini and Truworths, and new international arrivals like Zara and H&M. The Australian business has been even more disappointing. Despite heavy restructuring, it has not delivered on its supposed promise. The past few years.

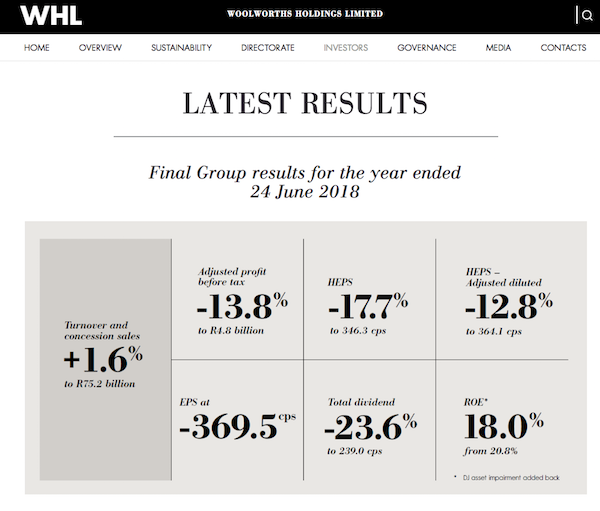

The company had its full-year results out yesterday, and they stunk. They showed a 14% decline in profits, and an outright loss after taking a big write-down of the holding value of the David Jones asset. The dividend was cut by 24%.

Group wide turnover was up 2%. Clothing sales in South Africa were disappointing, again. The sub-brand Edition for younger shoppers was "way too fashionable, way too young" according to management.

The South African food business, which targets rich people in urban areas, enjoyed solid sales and profits again.

In Australia, Country Road did fine, but David Jones' numbers were disrupted by the head-office move and significant in-store changes. The board decided to reduce the carrying value of David Jones by A$712.5 million.

Group strategy remains the same, and the management team mostly unchanged. Moir said to Business Day yesterday: "The board are clear that they want me to continue with the business. I've signed an extension of my contract, I'm not going anywhere. I'm actually feeling more energised than I have done for a long time. I think myself and my team are the right people to effect a turnaround of the business. So, I'm here to stay, I'm afraid."

The plan is to fix the fashion offer, again. Go back to "beautiful, simple, well-made basics" and hope for the best.

At David Jones, they hope that the new systems, a new online platform, a repositioned food business and a re-located head office will bear fruit. With their high-end brand partners like Gucci and Louis Vuitton, their Elizabeth Street store in Sydney will be refurbished at a cost of A$400 million.

So, what are we shareholders to do? Many are tempted to call it quits. Clothing is tough, and online retailers like Amazon are humbling store-based chains. However, the consumer environment here and in Australia will improve eventually, as it always does. The Woolworths share price has come down to the point where all the bad news is baked into the price. It's on a price to earnings ratio of 14.6. Even after the the reduced dividend it trades at a yield of 4.7%. My sense is that we should all simply hang in there and wait for better days.