Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Its been a while since one of our Vestact recommended stocks got involved in a mega-deal. Medical device maker Stryker hit the news wires last night. We have often spoken about Stryker as a potential consolidator in the fragmented medical devices industry. They are debt free and have been buying up small, innovative companies and integrating them into the Stryker supply chain. Yesterday, however, they went big, $50bn big.

The Wall Street Journal reported that Stryker has approached rival Boston Scientific with a takeover bid. Stryker fell 5% on the news, and Boston Scientific rallied 7.4% to close the day with a market cap of $47bn. Stryker is currently valued at $64bn.

Here are the opening paragraphs of Boston Scientific's Wikipedia page:

"Boston Scientific Corporation is a manufacturer of medical devices used in interventional medical specialties, including interventional radiology, interventional cardiology, peripheral interventions, neuromodulation, neurovascular intervention, electrophysiology, cardiac surgery, vascular surgery, endoscopy, oncology, urology and gynecology.

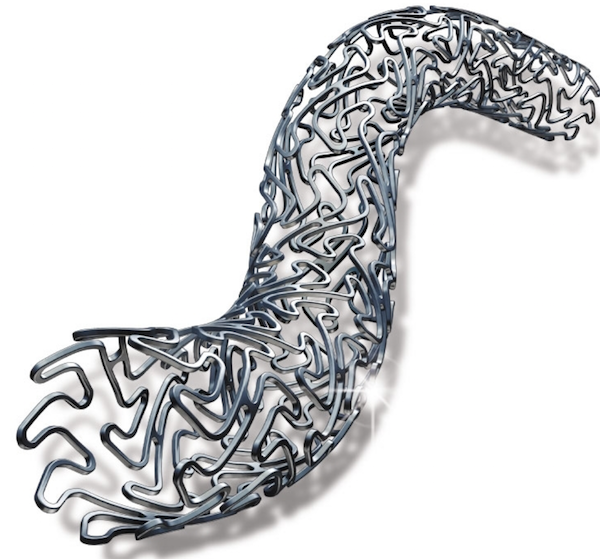

It is primarily known for the development of the Taxus Stent, a drug-eluting stent which is used to open clogged arteries. With the full acquisition of Cameron Health in June 2012, the company also became notable for offering a minimally invasive implantable cardioverter-defibrillator (ICD) which they call the EMBLEM Subcutaneous Implantable Defibrillator (S-ICD)."

The image below is what a Taxus Stent looks like.

I have read various opinion pieces suggesting that this will be a good fit as the medical devices industry seeks scale to take on the health insurers, who have also been consolidating. The health insurers decide what they will and won't pay for. This makes suppliers in the world of healthcare very reliant on the insurers. Having this sort of scale will give them more bargaining power. There could also be lots of synergies in management, logistics and distribution.

This does all make sense to me but I am also slightly sceptical of the deal. I have seen quite a few large deals go wrong in recent years. Both companies have refused to release anything official. We will monitor the story closely.