Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Cerner, the IT healthcare services business, reported numbers for the first quarter last week. Quarterly revenues rose 11 percent when compared to Q1 2016, it was at the top end of guidance given by the company. Earnings per share clocked 52 US cents, compared to 43 cents this time last year. Guidance for the coming quarter was at the top end of the range around 1.335 billion Dollars, with earnings per share likely to be in the region of 61 cents per share. For the full year, the company expects the mid point of the range to be 2.5 Dollars of earnings.

That means at the current share price of 64.28 Dollars a share, the stock trades forward at around 25 times earnings, relative to the growth prospects it looks a bit rich. The share price has been all over the show, at the depths of despair in December last year through to January this year. Since then however, the share price has been on an absolute tear, year to date the stock is up 35.7 percent. We like the space and the sector, the share price had reached an all time high of 75 Dollars a share back in April of 2015, around two years back.

Cerner has four decades worth of healthcare and information technology integration experience. They are one of the first to digitise medical healthcare records. The cofounders are very much still at the helm of the business, both Neal Patterson and Clifford Illig are in the Chair/CEO and Deputy-Chair roles respectively. Their solutions are smart, from devices connected, to feeding their cloud databases, to billing systems, to better help the business of hospitals, to focus on the important roles in providing quality healthcare.

Healthcare and hospitalisation is an emotive and complex affair, no two humans are the same, neither is their care. What the patients, the caregivers and the broader role players all want is continuity and world class care. Through advanced and specialised tools, time is saved and better care is given. Simply put, this business has loads of room to grow. They really do. The older and more technologically integrated the whole world gets, the more data there will be to put together for all our health records.

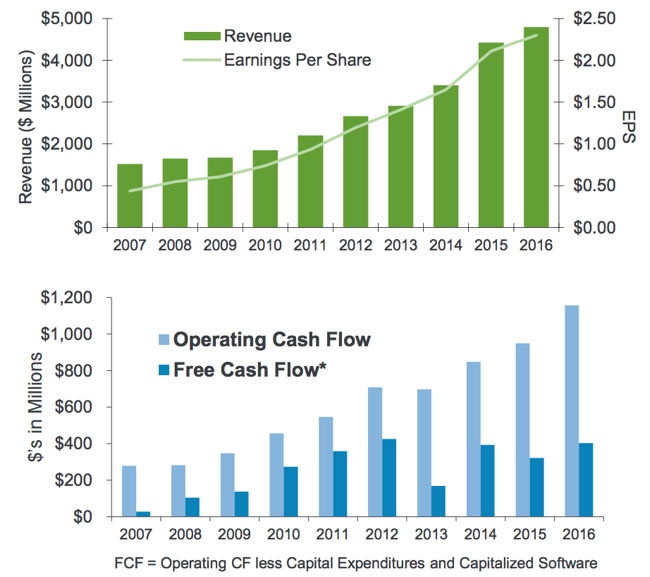

Revenues have seen astronomical growth, since the business went public in 1986 they have compounded by 21 percent per annum. And judging from their order books, there still is a lot of work to do. Retire paper and keep a data trail. This will help everyone. Not only will this business continue to steadily grow revenues and profits, it fulfils the role of being a humanity improving investment too.

When a share price underperforms, people naturally question whether the business is still good and whether the business is still attractive for investors. To answer that question, I have attached below from the last Cerner investor community report the important financial metrics over the last decade.

That certainly looks like a good company to own, one with rising revenues and earnings, right? Yet unfortunately we are hard wired to see that the price of a stock and link that to a company's "well-being". That is unfortunately the wrong way to go about investing. In large part we have resisted the selling of what is a good business. We will hold it through the (perhaps) Obamacare repeal, which now needs to go through the Senate - Senators Set to Write Their Own Version of the GOP Health Bill. All things being equal, this would be a minor setback for Cerner, the road ahead is plenty. Whilst we were actively accumulating at lower levels, we are likely to just hold at current levels, if you have them. A great company, a wonderful future.